Weekly Energy Industry Summary

Commodity Fundamentals

Week of April 15, 2024

By The Numbers:

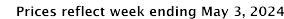

- NG '24 prompt-month NYMEX settled at $1.69/MMbtu, down $.08/MMbtu, on Monday, April 15.

- WTI '24 prompt-month crude oil settled at $85.41/bbl., down $.25/bbl., on Monday, April 15.

Natural Gas Fundamentals - Neutral

- The weather forecasts relative to natural gas demand are largely neutral this week.

- Natural gas bears are getting help from flagging LNG exports as the Freeport LNG terminal has been down for the past five days.

- LNG exports have dropped to 9.5 Bcf per day. So far for April, LNG exports have averaged 12 Bcf per day, down from the same period last year when they averaged 14 Bcf per day. Near term, LNG is favoring bearish pricing action as gas supply is bottled up in the U.S. that would be going out if the Freeport terminal were operating.

- Production continues to move downward hitting 97.4 Bcf yesterday. April 2024 production averaged 99.8 Bcf per day, down 1.3 Bcf per day from the same period last year.

- Air conditioning load is relatively low and heating demand is low.

- Storage inventories are high and will act as a barrier to seemingly out-of-control upward pricing action seen during the summer of 2022.

- Summer is coming. The forecast is for a top-five hot event. That means air-conditioning load moving into the picture in May and that means increasing amounts of excess gas get mopped up and placed into combined-cycle gas-fired electric power generation, the single largest source of demand for natural gas.

- The 2025-29 NYMEX strips have been gaining over the past several weeks despite the collapse of pricing in the prompt and nearer months of the futures' contract. NYMEX strips 2025-29 are $3.50, $3.97, $4.06, $3.99, and $3.96 respectively.

Crude Oil - Bullish

- War and rumor of war makes for a potentially volatile crude oil market and there is plenty of this to go around.

- Iran attacked Israel directly for the first time signaling a new chapter in the Israeli/Iran/Hamas/Hezbollah conflict.

- The effect of Iran's attack may well be a solidification of a broader economic and defense pact between the Saudis, Bahrain, UAE, Egypt, and Jordan.

- An Israeli strike on Iran's oil refining capacity would likely be a very bullish event.

- WTI is hovering around $85 per barrel waiting on events in the Middle East.

- Iran is also threatening shipping in the vital Strait of Hormuz -- another source of potential extreme upside in crude oil pricing.

- Meanwhile, Russia's oil exports hit an 11 month high the week of April 14.

- OPEC+ has some large fissures developing as a result of Iran's attack on Israel.

Economy - Neutral

- March inflation came in hotter than expected with the Consumer Price Index up 3.5%.

- Interest rate cuts are becoming more a matter of "if" than when as inflation amps up yet again.

- Employment rose by 303,000 jobs in March according to the Labor Department, well ahead of expectations.

- Growth in hourly earnings in March slowed to 4.1%, the lowest since June of 2021.

- Mortgage rates are back up, now near 7%, thwarting many home buyers and keeping older homeowners in place, unwilling to trade down in size as the return on such is very negative.

- Home ownership affordability has fallen to the lowest level since the 1980s, The Wall Street Journal reports.

- The University of Michigan's consumer sentiment index fell to 77.9, down from the March figure of 79.4.

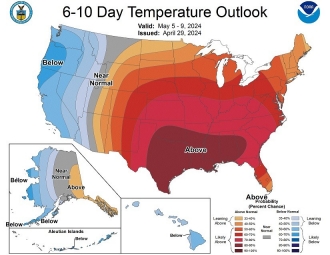

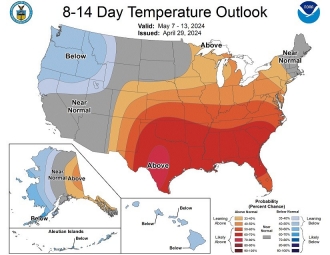

Weather - Neutral

- A general warm up is in motion in the eastern two thirds of the country.

- The West is largely below normal.

- The summer forecast is hot, portending a potentially great tomato-growing season.

Weekly Natural Gas Report:

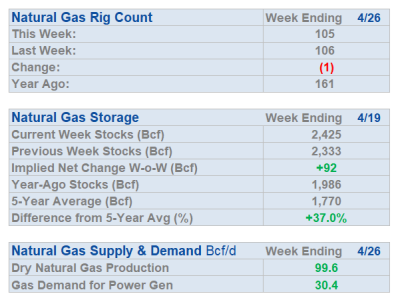

- Inventories of natural gas in underground storage for the week ending April 5, 2024 are 2,283 Bcf; an injection of 24 Bcf was reported for the week ending April 5 2024.

- Gas inventories are 633 Bcf greater than the five-year average and 435 Bcf greater than the same time last year.

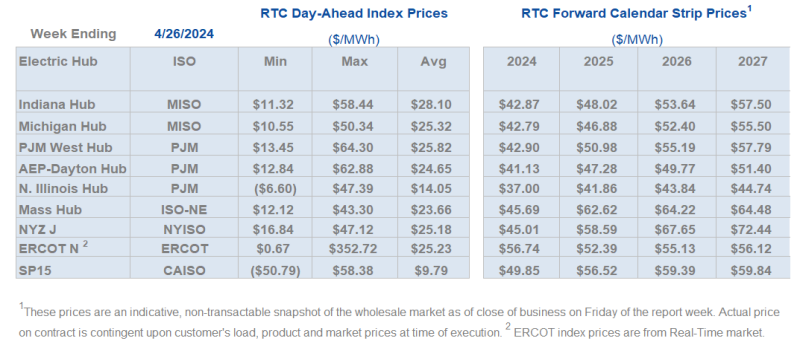

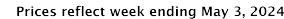

Weekly Power Report:

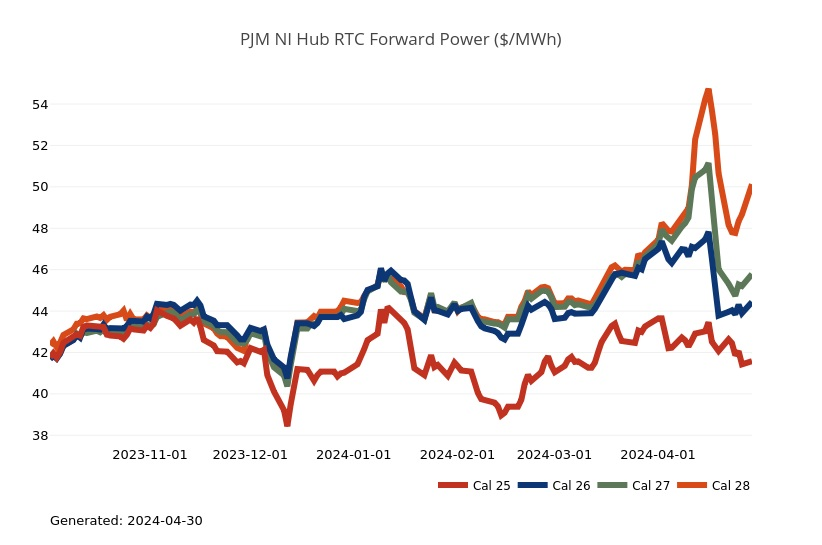

Mid-Atlantic Electric Summary

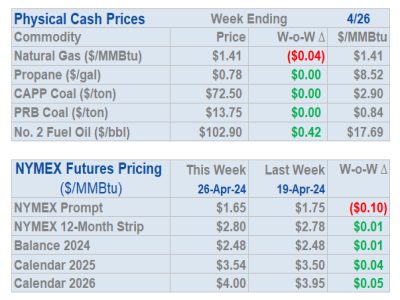

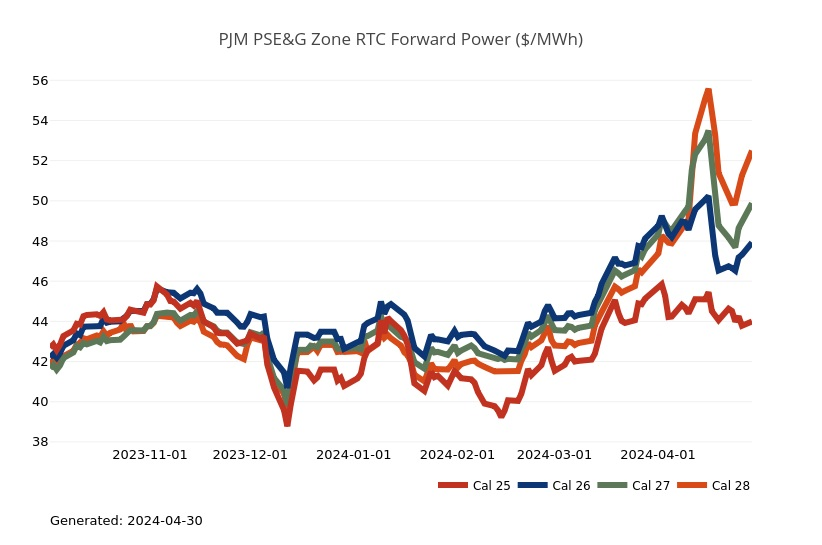

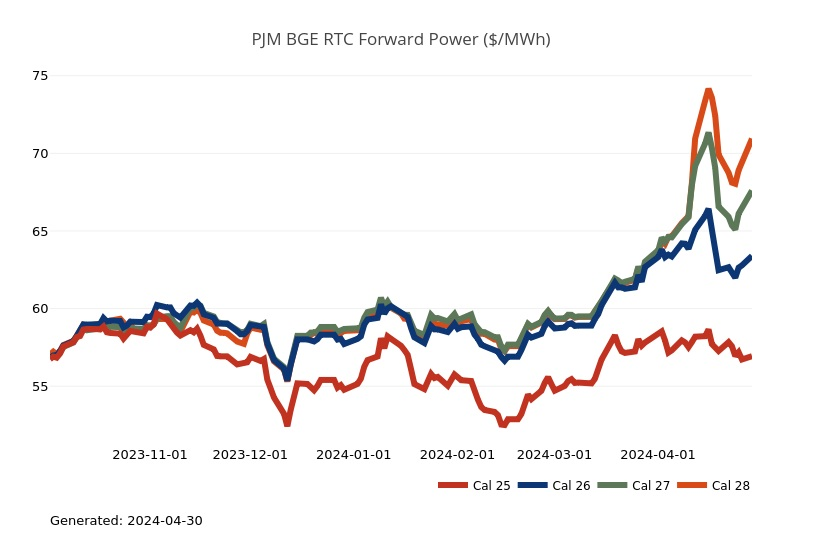

- The Mid-Atlantic Region’s forward power prices continue to press upwards, particularly further-out on the price curve, being driven by long-term reliability concerns in the market. New projections around data center load growth and the system’s ability to meet that demand are causing the market to price in added risk premiums that continue to widen most of the heat rates throughout the region. Power forward prices from 2025-2029 are +7% higher, on average, over the past week and 15% over the past month. The nearer term 2025-2026 were up only +3%, while the 2027-2029 outer terms were up +9%. Over the past month those percentage increases were +9% and +19% respectively. While power forward pricing continues to be supported for the longer-term pricing, index prices remain weak, driven by soft spot natural gas prices in the current bearish market. The month-to-date, day-ahead average settlement price for April in West Hub is $28.91/MWh, which is +21% higher than March’s settlement price average and -47% lower than a year ago.

- Legislature Passes Retail Bill After Removing Controversial Amendment Targeting Data Center Colocation - On the final day of the 2024 legislative session, both the House and Senate passed the final version of Senate Bill 1, as agreed to by a conference committee established after the Senate rejected the House-passed version of the bill due to a utility-backed amendment in the House version that would have prevented an electric supplier from entering into a contract for direct supply of electricity to commercial customers in a way that bypasses interconnection with the transmission distribution system or distribution services of an electric company. The conference committee replaced the amendment with a provision directing the Public Services Commission (PSC) to conduct a study evaluating the impact of collocated loads on wholesale energy dynamics, PJM transmission planning, and Maryland consumers. The PSC is directed to provide findings and recommendations on how to mitigate any impacts identified before the end of the year. SB 1 will now move to Governor Moore’s desk. The legislature has 21 days from the end of session to present SB 1 to the Governor, and the Governor will have 30 days after presentment to either sign or veto. If the Governor takes no action after 30 days, SB 1 will go into effect by operation of law.

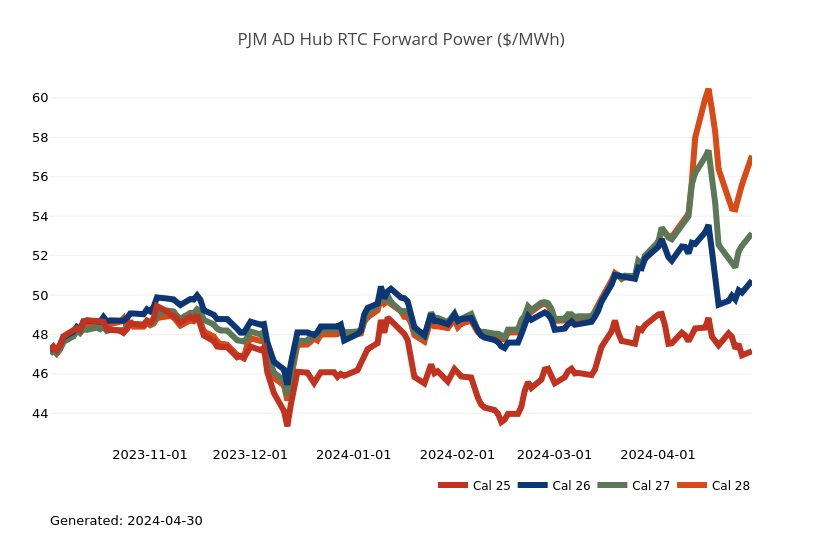

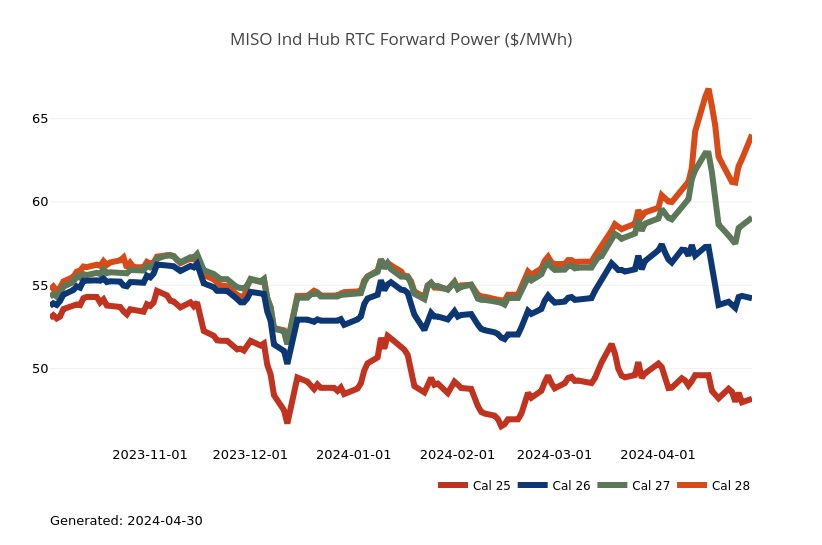

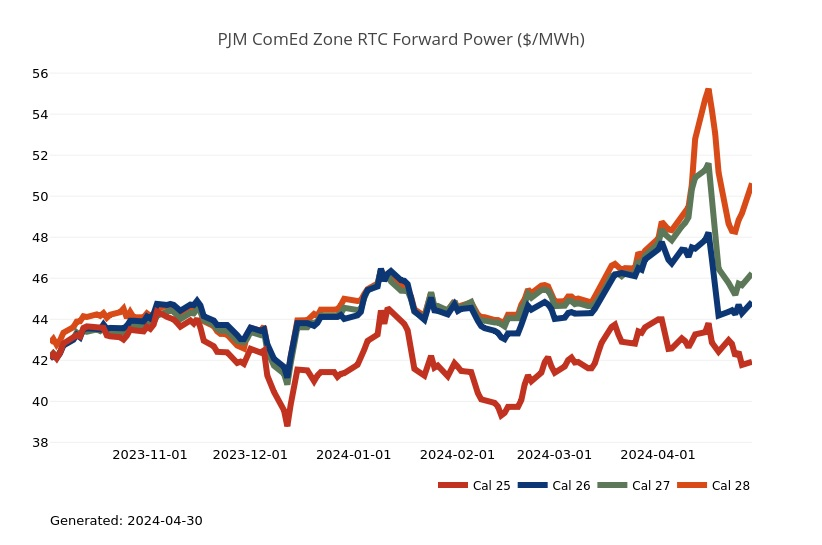

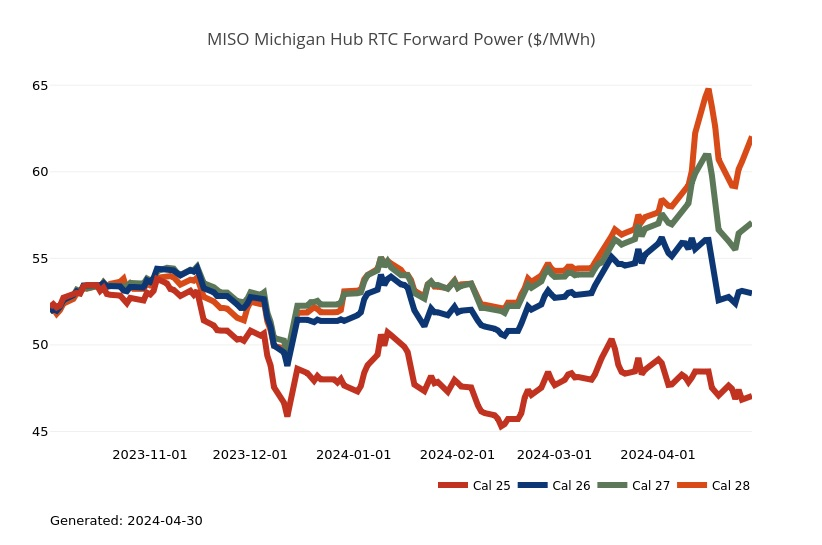

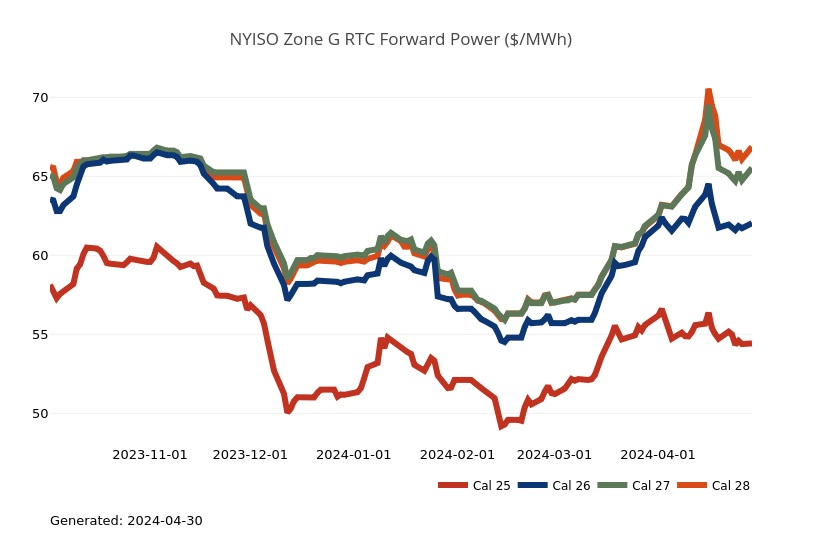

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices continue to press upwards, particularly further-out on the price curve, being driven by long-term reliability concerns in the market. New projections around data center load growth and the system’s ability to meet that demand are causing the market to price in added risk premiums that continue to widen most of the heat rates throughout the region. Power forward prices for the 2025-2029 terms are +6% higher, on average, over the past week and +12% higher over the past month. The near terms 2025-2026 were up only +2% week-over-week, while the 2027-2029 terms were up +9%. Over the past month those percentage increases were +7% and +16% respectively. While power forward pricing continues to be supported for the longer-term pricing, index prices remain weak, driven by soft spot natural gas prices in the current bearish market. The April month-to-date, day-ahead average settlement price in Adhub is currently $26.16/MWh or +19% higher than last month, but -47% lower than last year at this time, while in COMED, that index price is $18.58/MWh or +13% higher month-over-month, but -41% lower than last year. In Michigan, the month-to-date, day-ahead average settlement price is currently $24.04/MWh or +8% higher month-over-month, but -19% lower than last year, while in Ameren, that index price is $22.88/MWh thus far or +9% higher than last month, but -9% lower than last year.

- PJM Posts Indicative Results for 2024/25 DPL-S Capacity Prices - Following the 3/12 Third Circuit Court of Appeals ruling to vacate the FERC orders allowing PJM to change capacity market rules for Delivery Year 2024/25, PJM filed a petition on 3/29 with FERC requesting an order by 5/6 confirming the applicable Tariff provisions governing the conduct of the Base Residual Auction (BRA) for the 2024/2025 Delivery Year are those in effect prior to the FERC Orders in this proceeding. PJM further requested, to the extent FERC makes such confirmation, that it authorize PJM to re-run the Third Incremental Auction for the 2024/2025 Delivery Year. PJM released indicative results for the 2024/25 BRA with the original planning parameters on 4/4. The Resource Clearing Price for DPL-S increased from $90.64/MW-day to $426.17/MW-day due to an increase in the reliability requirement of 361 MWs. Resource Clearing Prices for three other LDAs (PS, EMAAC, and PSNORTH) decreased by $1.35/MW-day. The results for other LDAs did not change. PJM includes a disclaimer with the posting that the information may change and “is not intended to be a substitute for the final auction results that may be updated and posted upon FERC directive.”

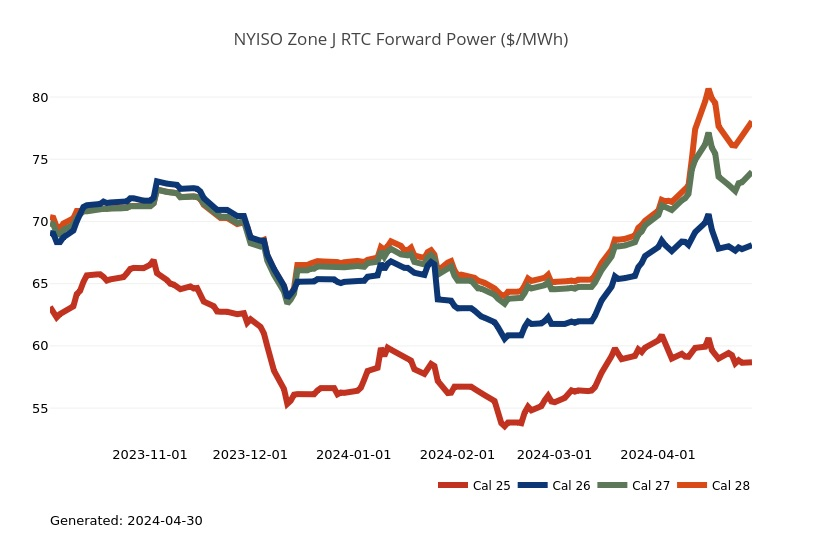

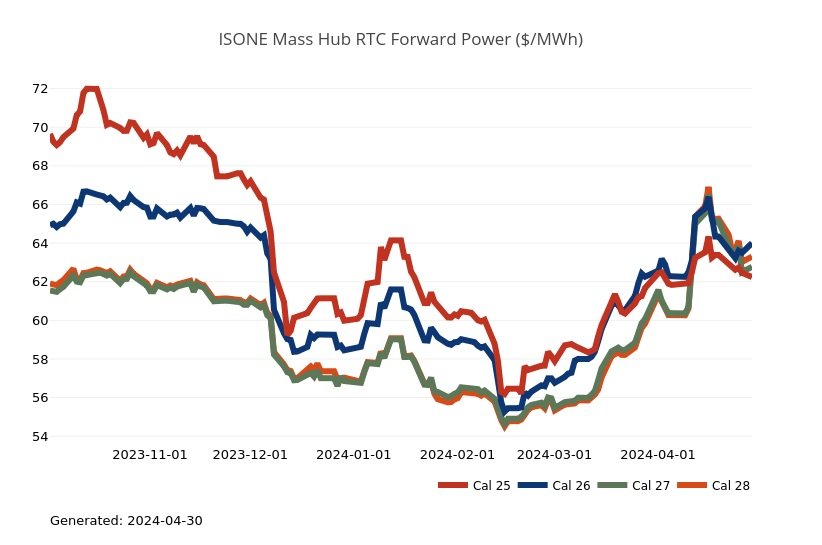

Northeast Energy Summary

- On March 29, the New Hampshire Department of Energy (DOE) issued a final report on its Investigative Proceeding Relative to Energy Service Procurement. The report provides 35 recommendations regarding default service in the state, some for and others against a series of potential market changes. The recommended changes include: introducing an independent advisor to assist the assessment and approval of bids, adopting monthly, variable price contracts for large customers, developing contingency plans in case of failed bids, and certain restrictions on laddering bids should the state value rate stability over market-reflective rates. Any changes to the way the state procures its energy will require either legislation or a Public Utilities Commission order.

- Last year, the Massachusetts Department of Public Utilities (DPU) started a docket to establish guidelines for municipal aggregation to help streamline the review process for municipalities filing aggregation plans. As part of the docket, the DPU established a working group consisting of the Department of Energy Resources and aggregation consultants to draft an example municipal aggregation plan. On March 18, the DPU released a draft example municipal aggregation plan and an accompanying memorandum based on changes in the guidelines proposed by the municipal aggregation consultants last month. The DPU is continuing to work on the Municipal Aggregation Plan template with further working group sessions.

- On April 12th, Bassil Seggos ended his tenure as Commissioner of the New York Department of Environmental Conservation (DEC). Seggos held the position for nine years and announced his departure in February. Sean Mahar, the current executive deputy commissioner, will step in on an interim basis as the state continues a national search. Seggos’ exit comes at a pivotal time for the agency and New York, with department staff working to finalize its economywide cap-and-invest proposal to raise billions in revenue for climate action. The departure also creates an additional vacancy within Governor Hochul’s energy and environment cabinet currently operating with an interim president and CEO at the Long Island Power Authority, and an open seat on the Public Service Commission - all to be appointed by Hochul and confirmed by the state senate.

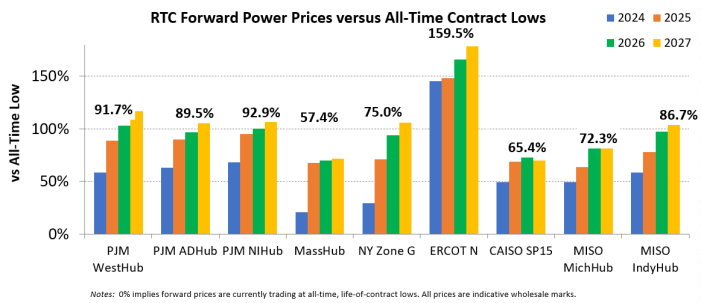

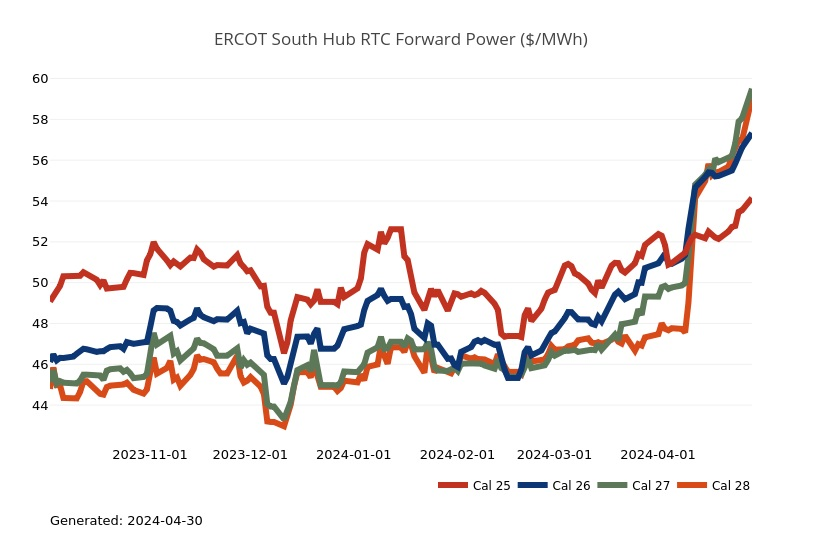

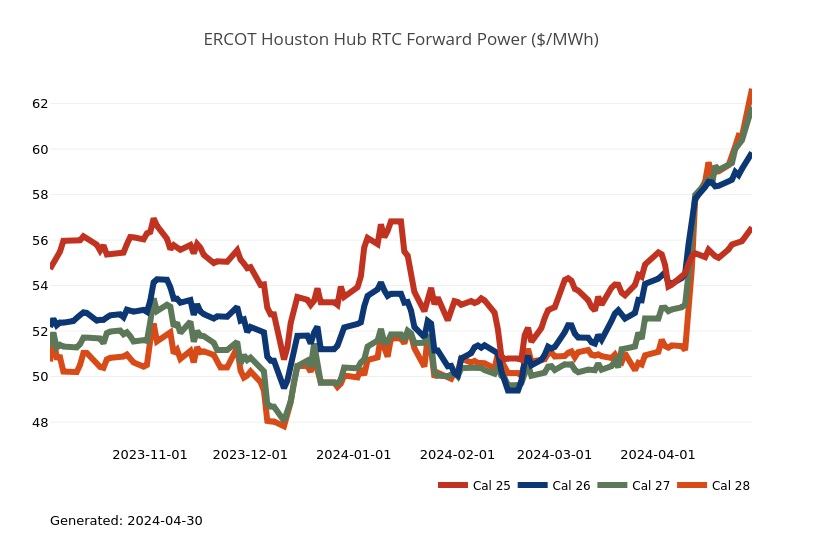

ERCOT Energy Summary

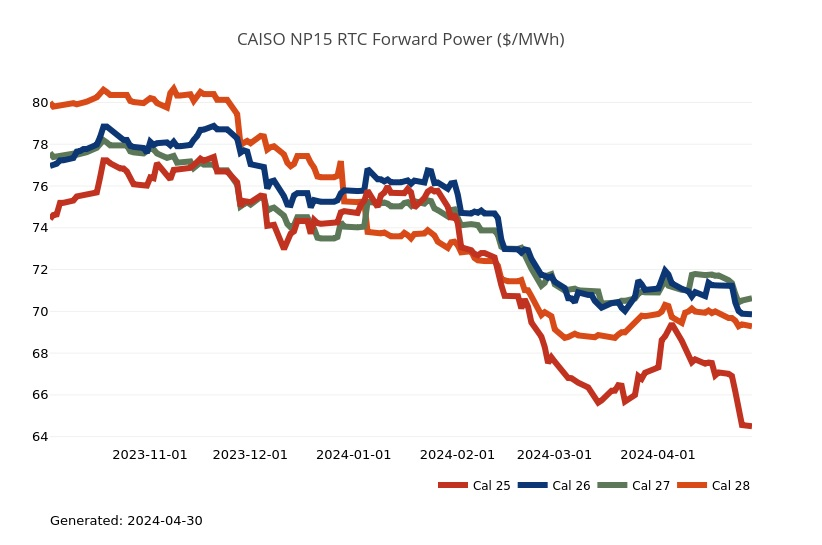

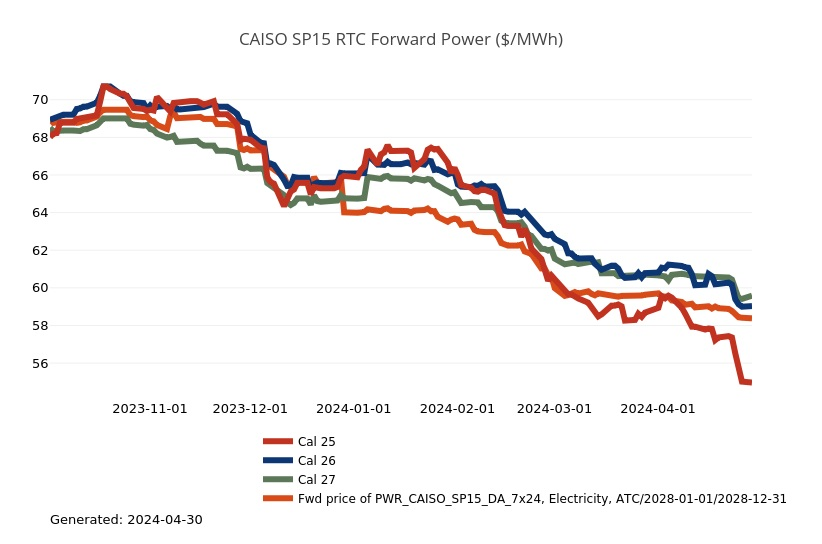

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- The trend in the West came in a bit cooler to start the week, but from a demand standpoint there will not be much of change. It’s going to be a fairly quiet week in terms of storminess as the jet stream shifts north. Temperatures in California and the PNW will be warmest today then shift cooler for the back half of the week. The DSW will be mostly sunny and seasonably warm with cooling demand ramping up in the late afternoons. After last week where we saw daytime lows in the 40s and 50s, California will see 60s and 70s this week. Not only will that wipe out the last of the heating demand for the season, but it will keep the snowmelt process moving along. At the moment we see the runoff developing gradually as the temps remains moderate and there are no warm rain events in the near term forecast. Snow cover is mostly restricted to the Mountain West, with just 8.3% of the U.S. covered in snow. California’s snowpack is at 105% of normal, reflecting the slow drift lower so far this season. The water storage between reservoirs and the snowpack remains favorable for the state. Elsewhere, the snowpack is well above normal in areas of the Southwest and Great Basin while the Northwest remains mixed—Oregon is at 123% of normal but Washington is only at 76% of normal. The latest April-September NWS streamflow forecast for The Dalles is just 81% of normal, which will have potentially upward pricing impacts this summer due to the limits it places on hydro generation.

- As average temperatures for the LA Basin climb to the upper 60s by midweek, sendouts on the SoCalGas system will drop from 2.4 to 2.1 Bcf per day. City gate prices are likely to remain subdued not only due to the drop in demand but because of upcoming maintenance outages on the import lines. Work just began at the Needles import point that runs through July 12th and will limit flows into the Northern Zone to only 0.9 Bcf which keeps BTS limited to 2.4 Bcf. That is still enough to generate surplus for storage injections at least until the Aliso Canyon outage starts on the 22nd, after which the facility will have no ability to move gas in or out of the cavern through May 8th. Capacity at Redwood should return this week in PG&E territory, but operators up north appear to be managing imports on the pipes to that of a drinking straw in order to preserve system flexibility for this summer.

- In the most entertaining energy news of the week, engineers and researchers are exploring "cloud brightening," a technology that would use large aerosol sprayers to change the composition of clouds to make them more reflective, such that they bounce more of the sun's rays back into space in an effort to cool the planet's surface. As the goal of keeping planetary warming to 1.5o C relative to pre-industrial temps looks increasingly unachievable, some scientists are becoming more open to the concept of direct intervention in shaping the climate, so the private sector has begun directing money to efforts where governments are willing to foot the bill, like vacuuming carbon dioxide out of the atmosphere, adding iron to the ocean to facilitate carbon storage on the seabed and cloud brightening. We’ll leave it as the research we’ve seen on this cloud intervention seems a little fluffy at best and could have unpredictable consequences at worst.

Stay up-to-date on the latest energy news and information:

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, May 8 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for more information on our next Fortunato & Friends webcast featuring Constellation's Chief Economist, Ed Fortunato and special guest to be announced soon!

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.