Weekly Energy Industry Summary

Commodity Fundamentals

Week of April 19, 2024

By The Numbers:

- NG '24 prompt-month NYMEX settled at $1.79/MMbtu, down $.04/MMbtu, on Monday, April 22.

- WTI '24 prompt-month crude oil settled at $82.85/bbl., down $.29/bbl., on Monday, April 22.

Natural Gas Fundamentals - Neutral

- Natural Gas Intelligence reports that volumes of LNG are beginning to "ramp up" at the Freeport, Texas LNG export terminal. Volumes are now at 17% of total capacity and electric power output to the facility has risen for the first time since a reported outage at Train 3 on April 11. If Freeport resumes full opertions near-term, an additional 2 Bcf per day of gas supply will be drawn from the domestic U.S. market, and all other things being equal, would be supportive of the natural gas market relative to pricing action.

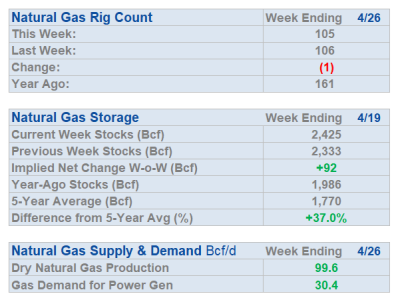

- Natural gas production for the month of April has declined year-over-year for the same period. This April, production averaged 99.6 Bcf per day, a 1.7 Bcf per day decline relative to April of 2023.

- Natural gas power-generation demand averaged 31.9 Bcf per day year-to-date, up 1.4 Bcf per day over the same period last year signalling a robust demand signal for the coming summer air-conditioning season.

- Natural gas storage remains robust.

- The weather is largely neutral for the remainder of April.

- European LNG prices are $9.17 per MMbtu this morning while Asian the Asian index price is $10.53.

- Natural gas strip prices 2025-2029 are: $3.53, $3.97, $4.05, $4.00, $3.98 per MMbtu respectively.

Crude Oil - Bullish

- The events and geopolitcal tensions remain in this market providing the potential for upside in crude oil despite recent very near-term softness in crude. For this reason, the headline on the market condition of crude oil remains "Bullish" until further notice.

- Crude oil has been trading downward for the past week as near-term tensions regarding Israel and Iran have tempered after Iran launched a major attack directed at Israel and Israel responded.

- The U.S. Senate will take up debate on a measure to sanction Iranain oil exports.

- Russia's seaborne crude oil exports maintained at a multi-month high through April, averaging 3.66 million barrels per day.

- Year-to-date, crude oi prices are up 11% this year.

- Commercial crude oil inventories surged by 12 million barrels, giving some modest downside to near-term crude.

- Shipping giant Maersk is advising its customers that disruptions to shipping in the Red Sea could continue through this year, adding additional cost to crude oil shipments.

Economy - Neutral

- Activity in the U.S. private sector slowed in April amid signs of a pickup in other leading economies.

- A recent jump in U.S. government bond-yields has left investors pondering whether the 10-year Treasury yield could reach 5% as expectations for interest-rate cuts continue to be scaled back.

- Existing home sales fell 4.3% in March.

- Mortgage rates have surged past 7%.

- President Biden announced plans to ask trade officials to rasie tariffs on Chinese aluminum and steel from 7.5% to 25%.

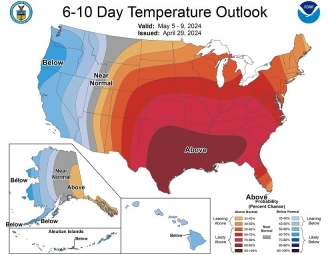

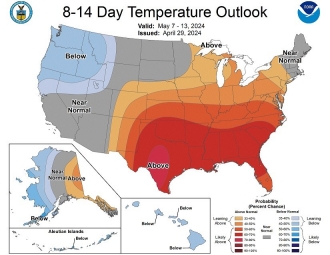

Weather - Neutral

- A chilly pattern will prevail in the northern tier and the northeast for the remainder of this week.

- Next week a general warming pattern, centered in the midcontinent will prevail.

- Over the 11-15 day period, the west and the northeast will be largely seasonal.

- Some heat is building in the southwest and south.

Weekly Natural Gas Report:

- Inventories of natural gas in underground storage for the week ending April 19, 2024 are 2,333 Bcf; an injection of 50 Bcf was reported for the week ending April 19, 2024.

- Gas inventories are 622 Bcf greater than the five-year average and 424 Bcf greater than the same time last year.

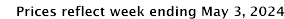

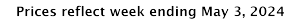

Weekly Power Report:

Mid-Atlantic Electric Summary

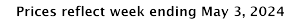

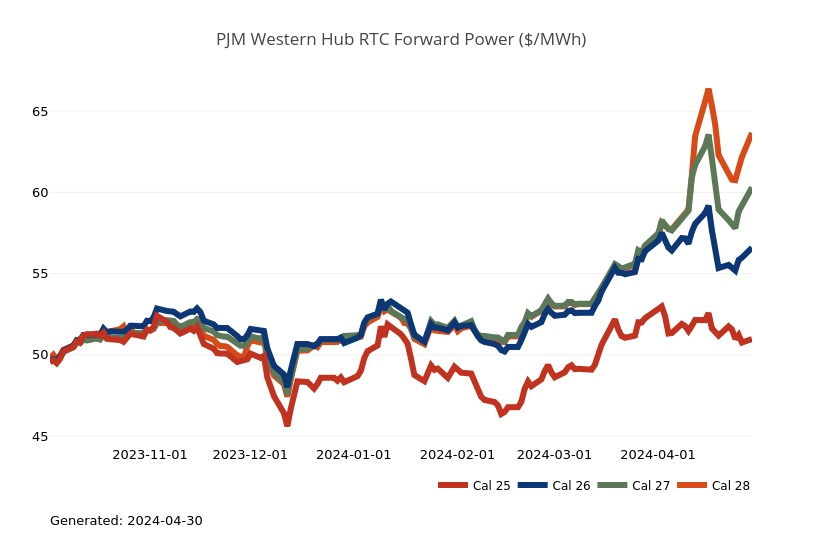

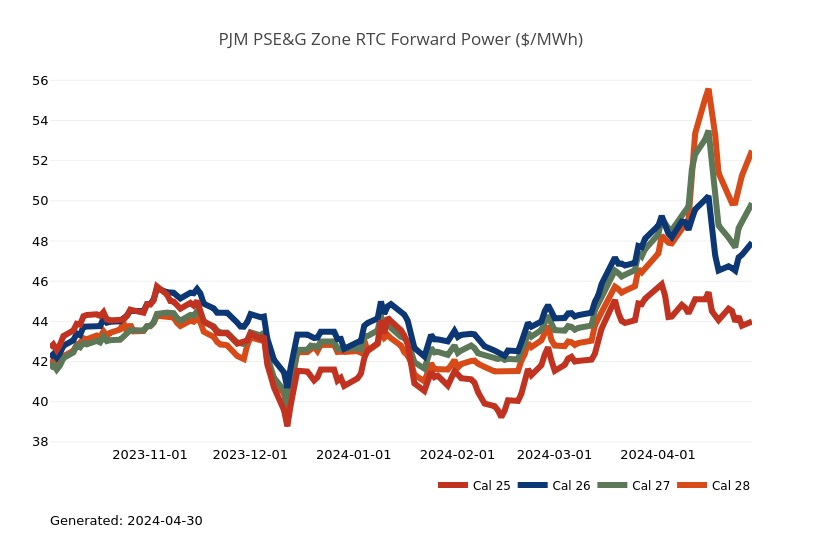

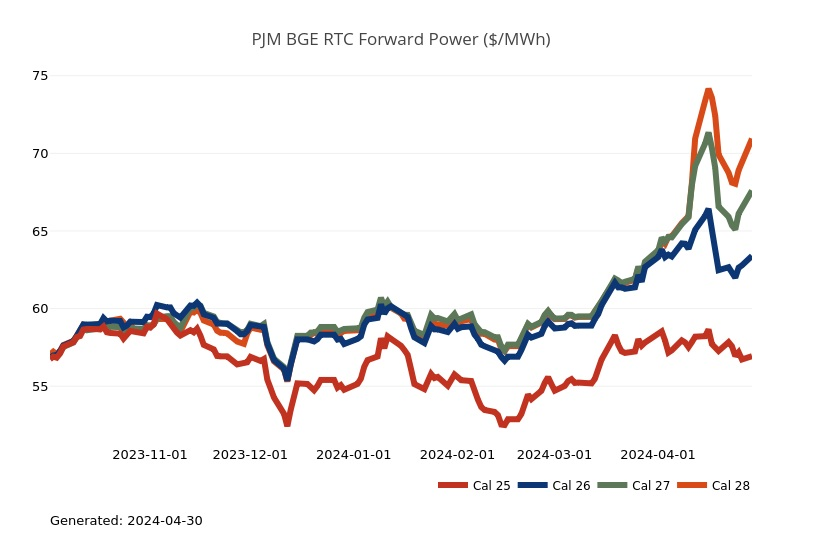

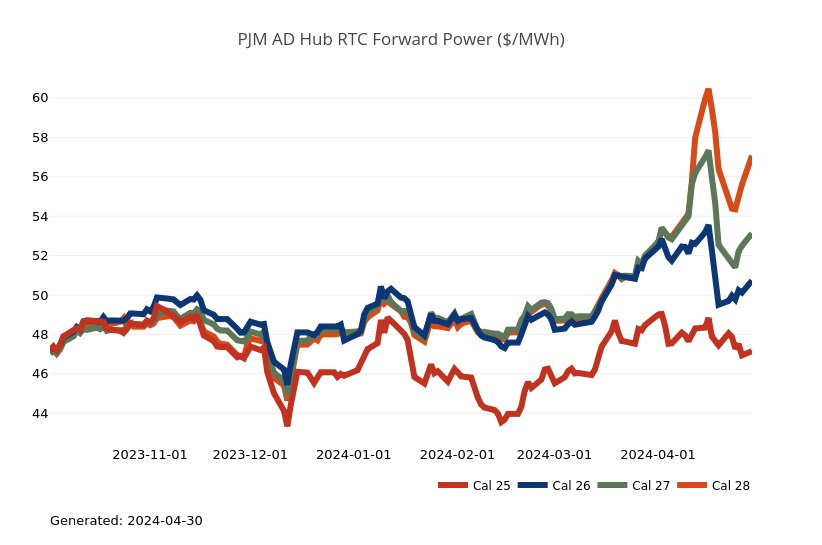

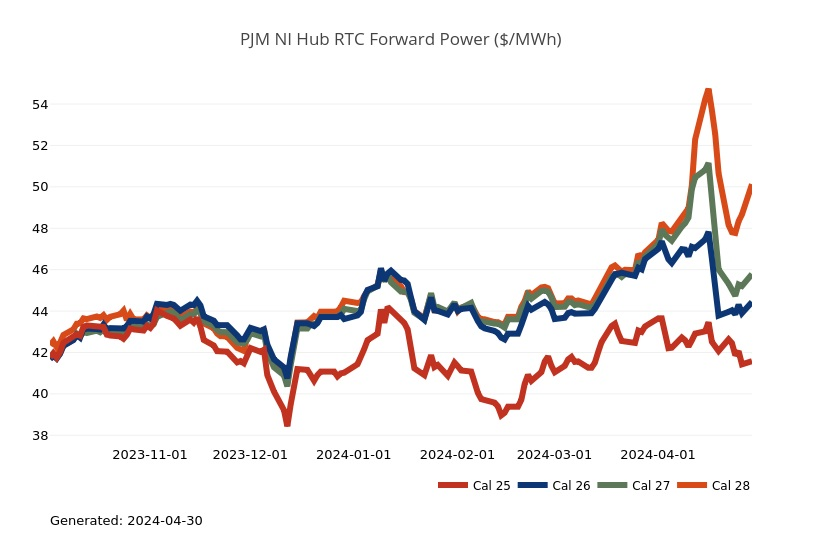

- The Mid-Atlantic Region’s forward power prices retreated last week after surging the week prior. Much of the sudden increase in prices, particularly further-out on the price curve, was likely due to somewhat of a “kneejerk” reaction to increases in future demand forecasts centered around the growth due in data center and crypto-mining facility load. The market seemed to experience a bit of a correction at the end of last week as the market was probably perceived to be a bit over-bought. Power forward prices for the 2025-2029 terms were -3% lower, on average, over the past week but still +6% higher over the past month. While power forward pricing continues to find support in longer-term pricing, index prices remain weak, driven by persistently soft spot natural gas prices in the current market. The month-to-date, day-ahead average settlement price for April in West Hub is $28.55/MWh, which is +20% higher than March’s settlement price average and -47% lower than a year ago.

- Talen Files Reliability-Must-Run (RMR) Agreements at FERC Covering Brandon Shores and Wagner – On 4/6/23, Talen notified PJM of the intent to deactivate its 1,295 MW coal-fired Brandon Shores facility outside of Baltimore due to air permit limitations because capacity market rules made a fuel conversion uneconomic. On 10/16/23, Talen also notified PJM that it planned to deactivate its Wagner facility also located outside of Baltimore. Wagner consists of three oil-fired steam units and one combustion turbine totaling 841 MW and is being deactivated due to the economic risk associated with continued operation in the face of low margin energy market economics, low-capacity prices and significant Capacity Performance penalty risk due to run hour limitations. The Brandon Shores and Wagner deactivations were both planned for 6/1/25 but PJM has determined that closing Brandon Shores Units 1 and 2 and Wagner Units 3 and 4 (702 MW) would adversely affect reliability in PJM until certain transmission upgrades are completed. The expected in-service date for these upgrades is 12/31/28. This led PJM and Talen to negotiate RMR agreements to allow recovery of cost-based rates during the term of the agreements for each of Brandon Shores and Wagner 3 and 4, which Talen filed with FERC on 4/18 (see Brandon Shores RMR and Wagner RMR). The deactivation of Wagner 1 and Wagner CT 1 (139 MW) is expected to proceed as planned by 6/1/25.

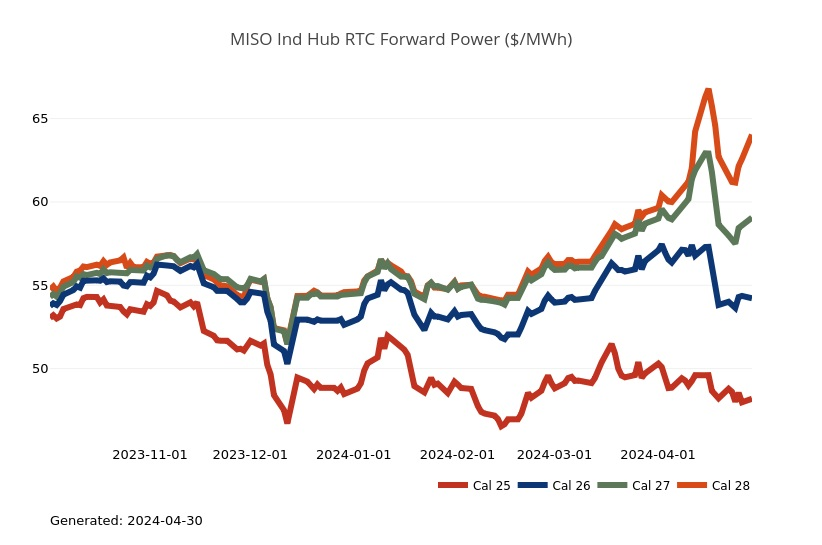

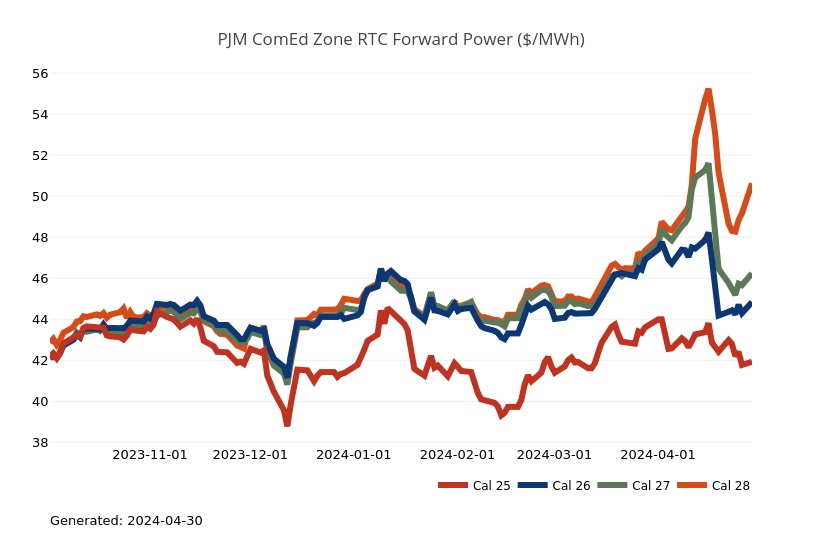

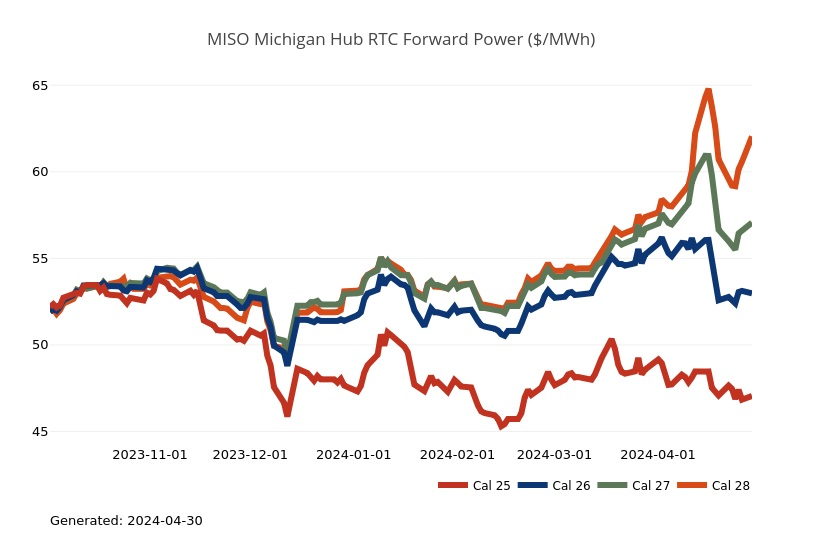

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices retreated last week after surging the week prior. Much of the sudden increase in prices, particularly further-out on the price curve, was likely due to somewhat of a “kneejerk” reaction to increases in future demand forecasts centered around the growth in data center and crypto-mining facility load. The market seemed to experience a bit of a correction at the end of last week as the market was probably perceived to be a bit over-bought. Power forward prices for the 2025-2029 terms were -4% lower, on average, over the past week but still +4% higher over the past month. While power forward pricing continues to find support in longer-term pricing, index prices remain weak driven by persistently soft spot natural gas prices in the current market. The April month-to-date, day-ahead average settlement price in Adhub is currently $26.17/MWh or +19% higher than last month, but -47% lower than last year at this time, while in COMED, the index price is $18.15/MWh or +10% higher month-over-month, but -41% lower than last year.

- Last year happened to be a good year for solar in Ohio, but not as good a year as it has been in the past for wind generation. While the Buckeye state developed upwards of 1,735 GWh’s of new solar generation in 2023, which was the ninth-straight year of growth for that technology, the amount of wind generation growth declined for the first time in the last ten years. Wind generation capacity declined slightly from 3,154 GWh's in 2022 to 2,828 GWh's in 2023. Renewable energy in Ohio accounted for 8.3% of the total electricity in the state last year. Wind generation was down due to some unfavorable weather conditions in the Midwest along with blade and turbine issues that have plagued the industry as well. New builds have also faced significant headwinds that have made it a challenge to continue its pace of capacity growth. Siting issues, higher interest rates and supply chain delays have been a challenge over the past few years, but despite those hurdles, some major projects are expected to come on-line soon. The mammoth solar farm in Madison County, on some land owned by Bill Gates, is one of those such projects. According to the research non-profit Climate Central, nation-wide, solar generation has increased 8-fold since 2014 to 240k GWh’s, while wind generation has doubled over the past decade to 425k GWh’s. Source Axios.

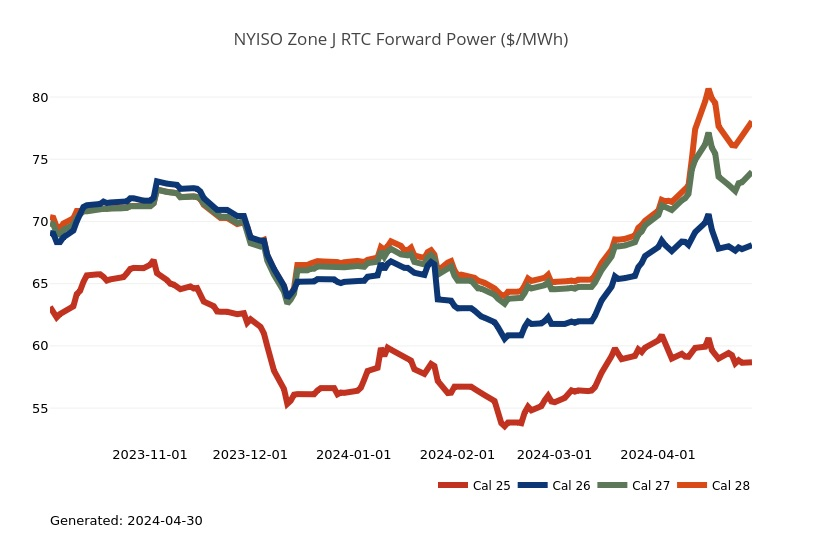

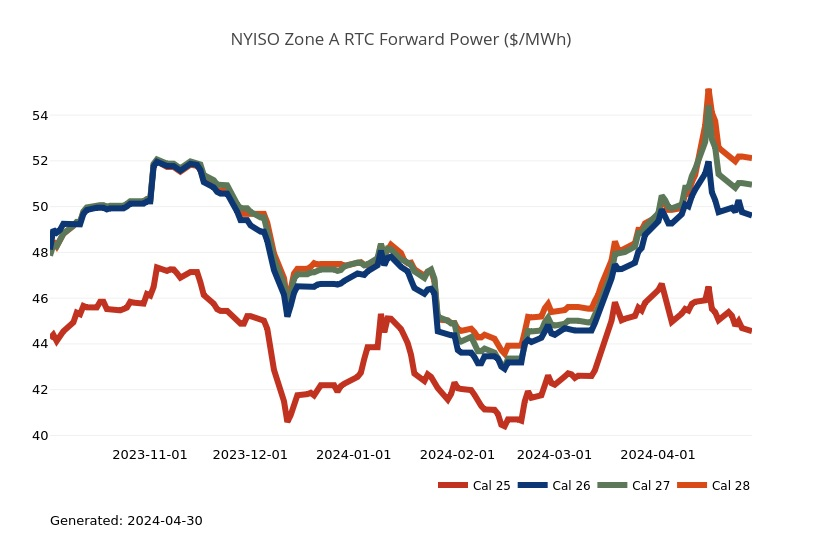

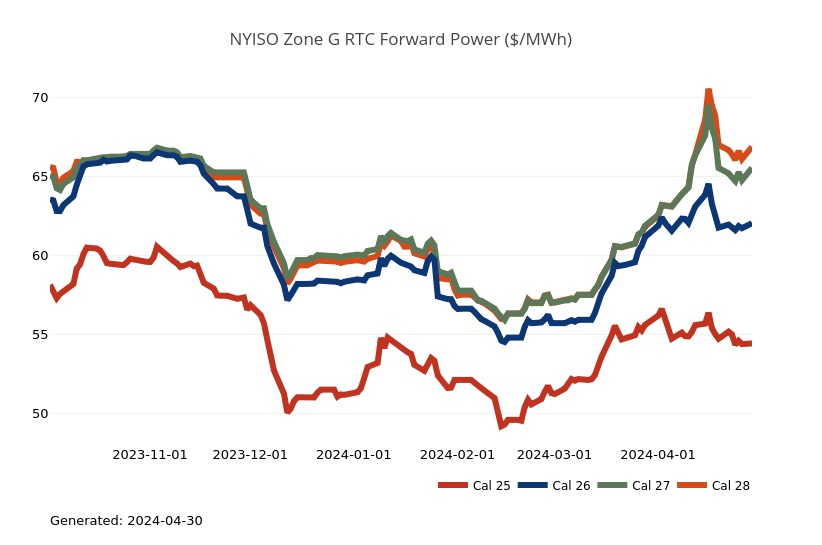

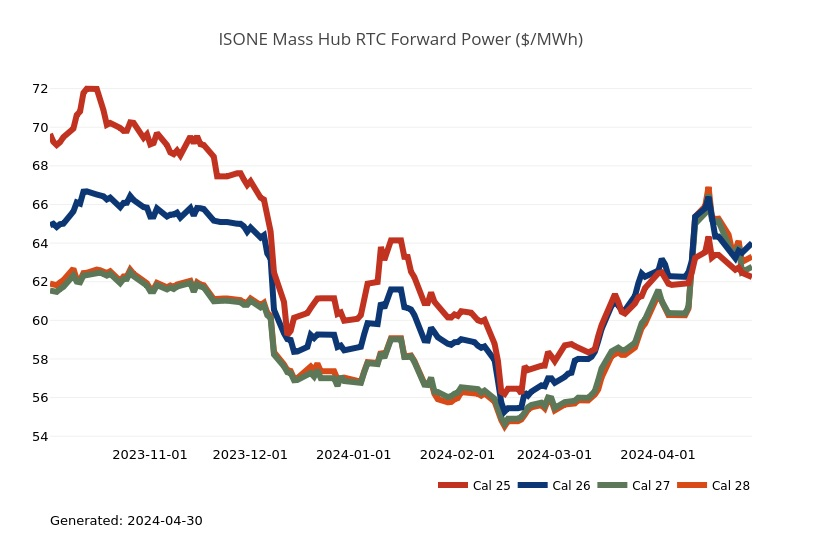

Northeast Energy Summary

- The cancellation of three wind projects that received provisional awards with NYSERDA last fall are the latest hurdle for New York State reaching its 70 percent renewable energy by 2030 goal. NYSERDA announced late last week that material modifications and other commercial complexities surrounding the projects prohibited project developers and other stakeholders from reaching an agreement on final terms for the projects, so no final awards were made. A major challenge surfaced when GE scraped plans to move forward with an 18 MW turbine as originally planned, and instead proposed using smaller 15.5 MW turbines; requiring more turbines to produce the same amount of power therefore increasing time, labor and costs necessary to complete the projects. The three offshore wind projects — two of which were expected to be fully operational by 2030 — would have provided 6.6 percent of the electricity New York needs in 2030. The projects that were negotiating contracts are the 1,404 MW Attentive Energy One project being developed by TotalEnergies, Rise Light and Power and Corio Generation; the 1,314 MW Community Offshore Wind project developed by RWE Offshore Renewables and National Grid Ventures; and the 1,314 MW Excelsior Wind developed by Vineyard Offshore with backing from Copenhagen Infrastructure Partners. With the cancellations, New York only has less than 57 percent of the forecasted 2030 load under contract or operational. NYSERDA now needs to launch its fifth solicitation for offshore wind — as only two projects remain in queue following the cancelation of a slew of projects over the last year due to high costs and regulatory hurdles. The two projects still moving forward, which still fianlizing contracts, are the 810 MW Empire Wind 1 developed by Equinor that is south of New York City and the 924 MW Sunrise Wind developed by Ørsted and Eversource off the northeast tip of Long Island. Both contracts are expected to be finalized in June and in operational in Q4 2026.

- On 4/12, FERC approved a proposal by ISO-NE reducing its Forward Reserve Market (FRM) offer cap from $9,000/MW-month to $7,100/MW-month and delaying the publication of offer data from about four months to a year after each auction (ER24-1245). ISO-NE designed the market changes in response to concerns raised by its Internal Market Monitor that recent summer FRM auctions had been “structurally uncompetitive” and that future auctions could be susceptible to market power. The IMM concluded the previous $9,000 offer cap “substantially overstates a reasonable upper bound on competitive forward reserve supply offers,” while the shorter timeline for offer publication “may provide strategic information to participants” in subsequent auctions. FERC found that the offer cap reduction provides “sufficient flexibility for resources to participate at their expected costs within the upper end of a competitive offer, while also providing protection from the potential exercise of market power” and the delay of offer data publication “balances the need for market transparency with the need to limit the possibility that market information may lead to noncompetitive outcomes.” The changes took effect on 4/15, in time for the first 2024 FRM auction on 4/17. FRM auctions, held twice annually to procure reserve capacity, will be replaced by ISO-NE’s new day-ahead ancillary services market in March 2025.

- FERC & Federal Archives

The Federal Energy Regulatory Commission is an independent regulatory agency that oversees the transmission of electricity, natural gas and oil in interstate commerce, as well as regulating hydroelectric.

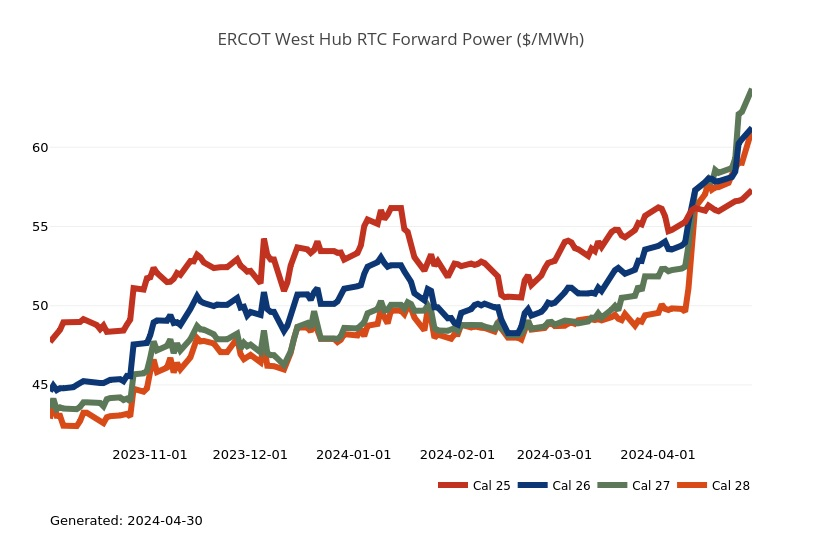

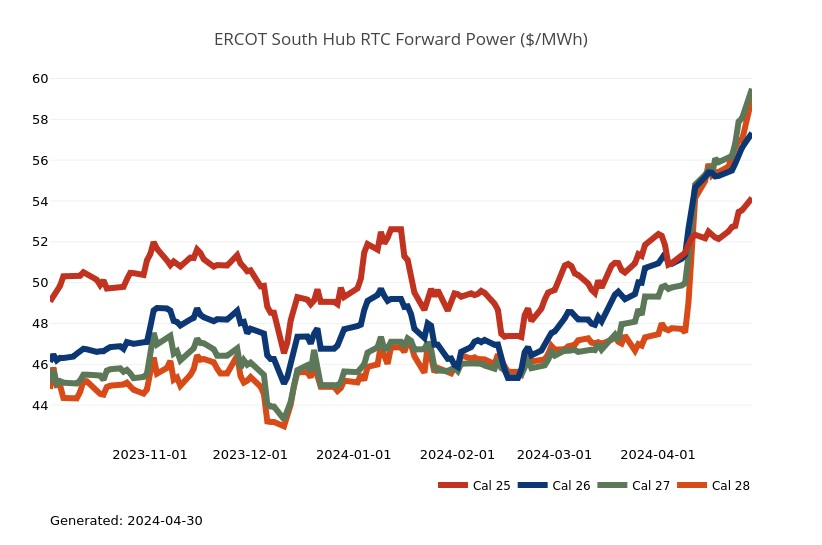

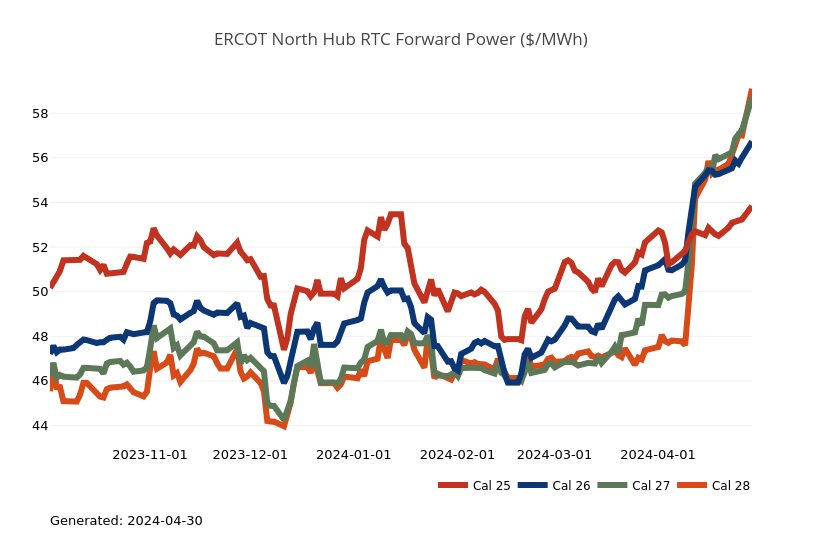

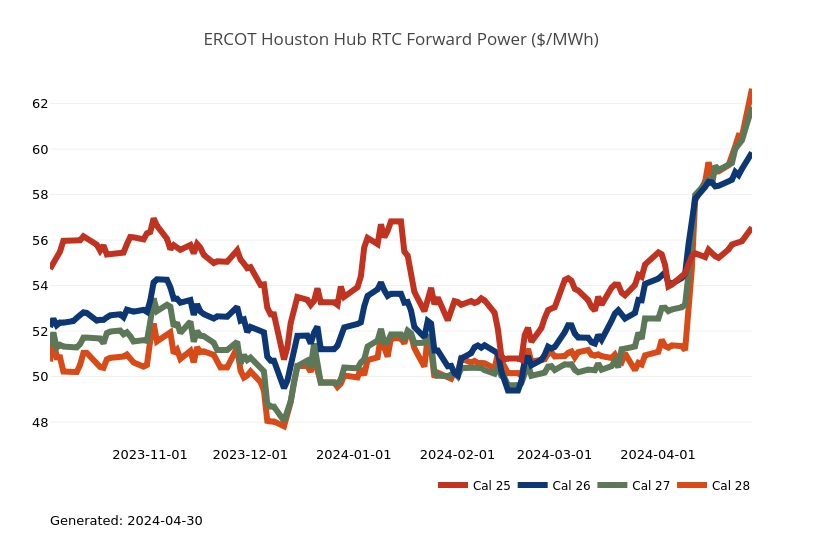

ERCOT Energy Summary

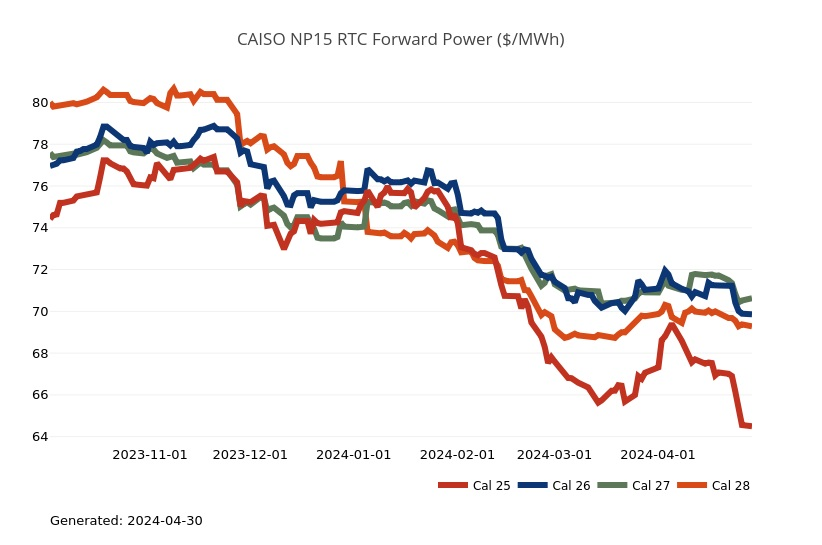

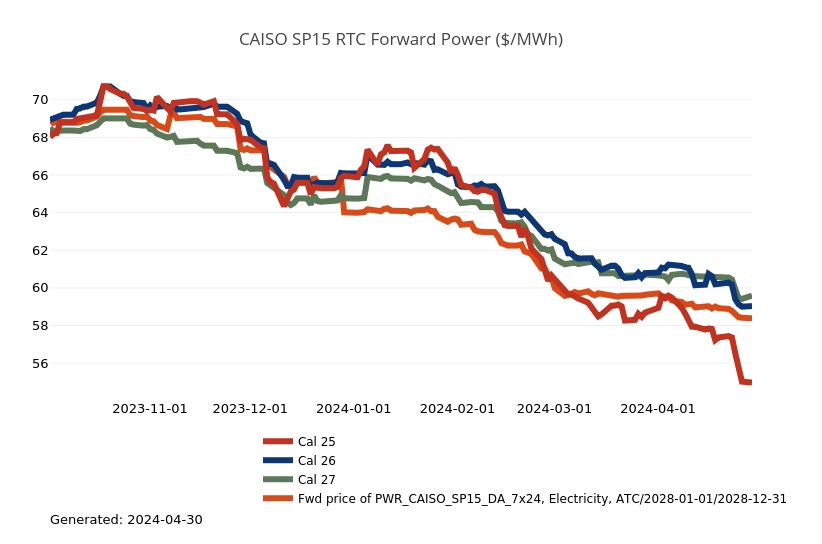

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- Southern California and the DSW had a glorious weekend of springtime heat which meant temps in the 80s and 90s respectively were on the board. We’ll have a couple more days of lingering heat with high temps expected in the 90s again in interior cities likes Phoenix and Vegas, while the major population centers along the California coast struggle to make it into the 70s given a strong onshore flow. The overall late month/early May outlook did not change much over the weekend. The models continue to suggest the more consistent warmth to be focused across the eastern half of the nation throughout the next couple of weeks with stronger warmth at times across the DSW. This means it looks like near normal to even below normal temps at times along the California coast and mild temps across the interior West.

- A weekend of modest temps meant that natural gas demand waned as heating load disappeared but cooling load wasn’t enough to force extra thermal generation to fire up given all the solar and hydro gen hitting the system. Sendouts on the SoCalGas system were a paltry 1.9 Bcf while PG&E came in at something like 1.2 Bcf which are effectively the lowest demand numbers we’ve seen thus far this yr. With the gas caverns across the state sitting at fill levels that would normally be seen in July, both LDCs had to hit the high OFO button in order to keep their systems in balance. Starting yesterday (Monday), SoCalGas lost access to the injection capacity at the Aliso Cyn storage facility as its planned maintenance cycle kicked off and is expected to last until May 8th. Meaning the system will have to rely on the import pipelines to manage system flexibility. A weather outlook for the SoCal coast that includes a heavy onshore flow will keep daytime temps in check and drop the overnights in the LA Basin down to the 50o mark should provide some support in terms of light gas demand for the balance of the wk. There is more maintenance popping up within PG&E that is now part of their maintenance plan as the weekends and the month of May is going to present a challenge given their gas storage levels and the majority of the snowpack is still sitting on the Sierras (snowpack is healthy at about 27 inches, more than a third higher than normal for mid-April.) SoCalGas released an updated Maintenance Outlook on Monday that suggests a raft of outages will impact the Northern Zone for the rest of the summer. Currently the flows are restricted to 1 Bcf per day due to the work on the L235 pipe that connects the Needles receipt point into the LA Basin. That work is expected to run through July 15th. After which they will reinstate the Topock outage and Northern Zone restriction which looks slated to go through the rest of summer keeping total capacity through the zone limited to just 1.1 Bcf per day (compared to 1.6 Bcf/day when the zone isn’t being restricted).

- Heads up to our readers with exposure to PG&E residential rates. Amid multiple rate hikes that saw the average household in its service territory paying an extra $34.50 a month for service this yr, PG&E last wk asked the CPUC for permission to bill its ratepayers for a 30-second television ad titled "Undergrounding 10,000 Miles of Powerlines for Safety." The utility requested that the ad -- along with similar spots that a PG&E spokesperson said have cost up to $6M since April 2022 to produce and air -- be covered through the ratepayer-funded Fire Risk Mitigation Memorandum Account, which was set up to record activities the utility takes to harden its system against disasters like wildfires and improve its response to such events. Ratepayer advocates categorized the cheery ad, which features PG&E’s CEO in a hardhat touting the utility's power line undergrounding efforts, is a clear example of brand advertising rather than safety messaging. State and federal law prohibits IOUs from billing their customers for anything other than providing safe and reliable electricity service, but critics say such statutes are full of loopholes.

Stay up-to-date on the latest energy news and information:

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, May 8 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for more information on our next Fortunato & Friends webcast featuring Constellation's Chief Economist, Ed Fortunato and special guest to be announced soon!

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.