Weekly Energy Industry Summary

Commodity Fundamentals

Week of May 13, 2024

By The Numbers:

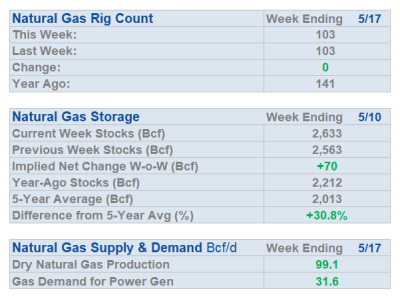

- NG '24 prompt-month NYMEX settled at $2.38/MMbtu, up $.13/MMbtu, on Monday, May 13.

- WTI '24 prompt-month crude oil settled at $79.12/bbl., up $.86/bbl., on Monday, May 13.

Natural Gas Fundamentals - Bullish

- Prompt-month (June) NYMEX natural gas futures settled at $2.38 per MMbtu on Monday, a three-and-a-half month high.

- Summer forecasts continue to signal a "hotter-than-normal" outcome on a population weighted density basis portending the potential for a robust air conditioning season and attendant surge in demand for natural gas electric-power generation.

- Natural gas power generation represents the largest component of the U.S. electric grid hitting 42% of all electricity generated last year. The next nearest competing fuel was coal at roughly 20% and nuclear at 20% as well.

- The Freeport LNG export terminal appears to continue to recover. LNG Feedgas deliveries just topped 13 Bcf per day this morning indicating that Freeport is getting up to speed. For May, LNG exports are averaging 12.6 Bcf per day. For the same period last year, LNG exports averaged 13 Bcf per day. The Freeport terminal, the second largest LNG export terminal in the U.S. had gone to near zero deliveries a month ago.

- Natural gas for electric power generation has averaged 32 Bcf per day year to date, a record performance so far despite the warmest winter since 1950. Last year for the same period, natural gas demand for electric power generation averaged 30.7 Bcf per day.

- Natural gas production for the month of May is averaging 98 Bcf per day, well below levels at the start of the year when on January 1st production was 105 Bcf per day.

Crude Oil - Bullish

- The events and geopolitical tensions remain in this market providing the potential for upside in crude oil despite recent very near-term softness in crude. For this reason, the headline on the market condition of crude oil remains "Bullish" until further notice.

- WTI near dated futures continue to hover near $80 per barrel.

- Talk of new economic stimulus by the Chinese government are propping up some demand forecasts in the near term.

- A weaker dollar this week may have contributed to some upside in crude oil pricing.

Economy - Neutral/Bearish

- The Consumer Price Index for April will be released on Wednesday.

- Equity markets will likely respond to the upside if the number shows improvement from last month's data revealing that inflation continues to be quite sticky.

- The Biden Administration announced a 100% tariff on Chinese electric vehicle imports.

- Consumer sentiment plunged to the lowest level in six months, according to the latest University of Michigan survey of consumers.

- Weekly jobless claims rose to the highest level since last August, the Bureau of Labor Statistics reports.

- Unemployment ticked up from 3.8% to 3.9% in April.

- U.S. job growth in April totaled 175,000, lower than expected.

Weather - Neutral/Bullish

- A little bit of warmth was picked up in the models this week, but not a great deal of concern for big heat this week.

- The heat will be very confined to the deep south and Southeast and is still not overly impressive.

- The key to the market, relative to weather, is the imminent summer forecast that is hotter-than-normal.

Weekly Natural Gas Report:

- Inventories of natural gas in underground storage for the week ending May 3, 2024 are 2,563 Bcf; an injection of 79 Bcf was reported for the week ending May 3, 2024.

- Gas inventories are 640 Bcf greater than the five-year average and 444 Bcf greater than the same time last year.

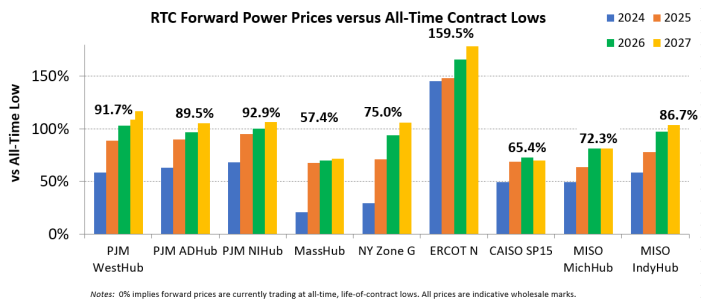

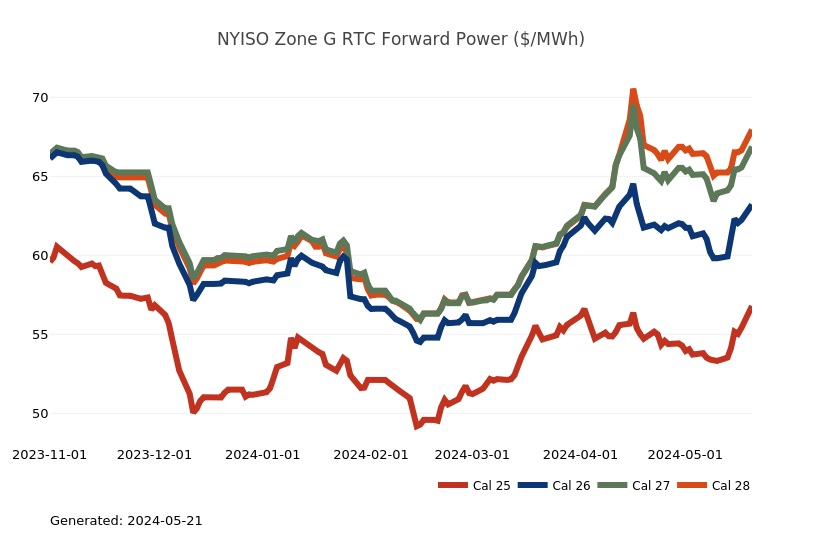

Weekly Power Report:

Mid-Atlantic Electric Summary

- The Mid-Atlantic Region’s forward power prices were lower once again, particularly on the back-end of the price curve, as a seemingly over-bought market continues to retrace from the rally highs back in March and April that was driven by longer-term forecasted demand. The weather models trended warmer over the weekend, but the impacts for this time of year are not that great. Heat is confined to the far southern tier with a storm pattern across the eastern half of the nation that prevents any durable heat from establishing. Power forward prices in the region for the 2025-2026 terms have decreased by -2% over the past week, while the outer terms from 2027-2029 have increased by +4% during that time. Current index settlement prices remain stable so far through the shoulder months. The month-to-date, day-ahead average settlement price for May thus far in West Hub is $28.47/MWh, which is +1% higher than April’s settlement price average, but -6% lower than a year ago.

- Recalculation and Re-run of 2024/25 Capacity Auctions - On 3/12, the Third Circuit Court of Appeals vacated FERC orders that had allowed PJM to retroactively change the rules applicable to PJM’s 2024/25 capacity auction. Those orders arose out of attempts by PJM to implement mid-auction rule changes related to planned generation in the DPL-S zone that did not ultimately offer into the base residual auction (BRA). In response to the Court’s vacatur, PJM requested that FERC confirm that PJM should recalculate the 2024/25 base residual auction results using the original rules. PJM also asked FERC to indicate whether PJM should rerun the Third Incremental Auction or adjust market participants’ capacity obligations in light of any new commitments in the BRA. On 5/6, with each commissioner filing a separate concurrence and stating that the agency had little choice under the Third Circuit’s decision, FERC directed PJM to reprice the BRA and to re-run the Third Incremental Action. Each of the commissioners complained that consumers in the DPL-South zone will pay more than $100 million in additional capacity costs as a result of the court’s order. Chairman Phillips and Commissioner Clements also suggested that market rules should be changed so as to expressly include a “cure period” during which RTOs could act to avoid what they perceive to be an inequitable market outcome.

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices were lower once again, particularly on the back-end of the price curve, as a seemingly over-bought market continues to retrace from the rally highs back in March and April that was driven by longer-term forecasted demand. The weather models trended warmer over the weekend, but the impacts for this time of year are not that great. Heat is confined to the far southern tier with a storm pattern across the eastern half of the nation that prevents any durable heat from establishing. Power forward prices in the region for the 2025-2026 terms have decreased by -2% over the past week, while the outer terms from 2027-2029 have increased by +5% during that time. Current index settlement prices remain stable so far through the shoulder months. The month-to-date, day-ahead average settlement price for May thus far in Ameren is $26.08/MWh, which is +13% higher than April’s settlement price average, but -9% lower than a year ago, while the month-to-date settlement price for May in Michigan is $27.01/MWh, which is +10% higher than April, but -8% lower than a year ago.

- Two Major Grid Operators Embark on Joint Planning Endeavor To Enhance Reliability - On 5/9, PJM and MISO announced that they will collaborate on an informational interregional transfer capability study in the second half of 2024. The study will identify potential opportunities for near-term transmission enhancements along the seam shared by PJM and MISO. The two ISOs will collaborate on opportunities to “engage in joint transmission analysis and coordinated modeling, and leverage planning processes to promote reliability and resilience through holistic, efficient, and cost-effective transmission planning for ratepayers.” Aiming to conclude in early 2025, findings will be shared with the Interregional Planning Stakeholder Advisory Committee, an organization whose purpose is to review and coordinate system planning activities.

Northeast Energy Summary

- On April 30, a letter from U.S. Senators Ed Markey (D-MA), Sheldon Whitehouse (D-RI), Elizabeth Warren (D-MA), and Bernie Sanders (D-VT), was sent to ISO-NE President & CEO Gordon van Welie noting the significant electric grid transformation and highlighting three key areas where they would like to see marked changes: (1) increased transparency in ISO planning and governance, (2) enhanced focus on transmission planning, and (3) fair market access. The letter implores the ISO to diversify Board Membership to include those with environmental justice backgrounds and to operate in a more open and transparent manner, by holding open meetings and publishing meeting summaries. Additionally, the senators push the ISO to improve its stakeholder participation process to better equip consumers to effectively advocate in grid proceedings. Further the senators criticize the New England Power Pool voting process, writing that it “gives outsized voting influence to power generator and utility operator members to the detriment of public interest advocates.” Given the expected growth due to electrification, the senators believe there is room for more proactive, holistic, and community-centered transmission planning. The letter suggests that the ISO expand interregional transmission planning to improve system resilience and reduce decarbonization costs through access to diverse generation across varying climate zones on both sides of the border. Further, the ISO should adopt a forward-looking approach to interconnection, by identifying collective interconnection needs and prioritizing interconnection where transmission capacity is present or approved. The letter poses four questions to the ISO and request a response by May 10:

- Will ISO-NE commit to transparent and accessible governance through open and responsive board meetings, diverse Board representation, and more proactive community engagement? If so, how is ISO-NE moving forward on these elements of governance?

- Will ISO-NE continue to improve upon its long-term transmission planning by including a more complete list of benefits, ensuring adequate evaluation and use of grid-enhancing technologies, and continuously improving the interconnection process? If so, how?

- How is ISO-NE working with states and other stakeholders to address market rules and out-of-market mechanisms that create an unfair advantage for oil and gas? What structures and frameworks are in place to determine if market rules, and out-of-market mechanisms are necessary and based on clear, cohesive, and transparent evidence? and

- How is ISO-NE ensuring market rules reduce barriers to participation by renewable resources, distributed energy, demand response, and energy storage?

ERCOT Energy Summary

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- California is finally enjoying a stretch of warmer temperatures after a cold front lingered at the end of April and through the first week of May. The models have been trending warmer across the Southwest mostly towards this upcoming weekend, otherwise the big picture forecast remains one of above normal temperatures across much of the Western U.S. and Western Canada through the remainder of this week. Starting yesterday (Monday), the Phoenix daytime high was slated to top 100 degrees in what will be the first of a string of triple digit days throughout the rest of summer. While normal in Phoenix for this time of year is in the mid-90s, it is not alone in contributing to the larger demand forecasts in the DSW; Las Vegas is seeing highs in the mid-90s this week (normal is the upper-80s). This warmer than normal leaning pattern is then expected to moderate next week as seasonable temperatures return with the potential for even cooler than normal leaning temperatures across Western Canada and the PNW at times. There is no significant heat in the west forecast into the Memorial Day weekend. While the hydro landscape is starting to see increasing snowmelt, this weather forecast supports the gradual measured pace that allows dispatchers to maximize storage and generation.

- The transition from a cold start to May to one of spring-like conditions was in play this weekend as the lack of heating and cooling demand led to both PG&E and SoCalGas to post the lowest aggregated demand numbers of the year; PG&E sendouts on Saturday were 1.2 Bcf and SoCalGas was about 1.7 Bcf. With the lower demand in play, both dispatch centers are pulling the levers accessible to each entity in terms of storage injections or reducing inbound pipeline transports to balance their systems. The weekend injection rate for PG&E averaged around 0.6 Bcf/d while SoCalGas dropped to 0.24 Bcf/d. Maintaining injection capability is critical as there is still snowmelt and hydro generation looming, plentiful solar and wind generation in Q2, a Palo Verde nuclear unit now ramping back from its maintenance outage and another on the way (Diablo’s unit is expected to return in a couple weeks), and little in the way of demand on the horizon. This does not bode well for the natural gas landscape. These conditions continue to manifest in a daily electricity market that struggles to keep prices above the $0 per MWh waterline in SP15 and close to $30 MWh in NP15.

- California’s grid is in pretty good shape for this summer’s heat waves, regulators told state lawmakers at an Assembly Utilities and Energy Committee oversight hearing last week. The state now has nearly 5000 megs of contingency power that it can tap into during extreme weather events like the heat wave that caused rolling blackouts in August 2020 and the one in September 2022 that forced the State’s Office of Emergency Services to send everyone an emergency text alert urging power conservation. The CAISO also has nearly 3000 megs of natural gas backup generation available through 2026 in the form of the old once-thru-cooling plants still lingering around the SoCal coast in Huntington Beach, Long Beach and Oxnard. CEC Vice Chair Siva Gunda cautioned during the hearing that those plants can’t be called quickly, however, and the state is still vulnerable to multiple disasters happening simultaneously, like an extended heat wave and a massive wildfire. “Some of those resources have to be turned on a few days ahead,” Gunda said. “So, if there is a sudden onset event, or if there are coincidental events like a huge heatwave going through the West and a huge fire happening that's disrupting transmission, those kinds of coincidental extreme events could still pose a threat.”

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, June 19 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for more information on our next Fortunato & Friends webcast featuring Constellation's Chief Economist, Ed Fortunato and special guest to be announced soon!

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.