A Guide to Electric Vehicle Federal Tax Credits

- Home Page

- Energy 101: Resources to Help Understand Energy

- Energy Education

- A Guide to Electric Vehicle Federal Tax Credits

If you’re thinking about buying an electric vehicle (EV), you’ll want to be informed about the electric vehicle tax credits that may be available to you. The Inflation Reduction Act of 2022, the Clean Vehicle Credit and the Qualified Plug-in Electric Drive Motor Vehicle Credit (IRC 30D) are just some of the new ways you can possibly save money on the purchase.

These changes amended EV tax credit law in several important ways:

- The federal EV tax credit only applies to vehicles assembled in North America.

- Dealerships will be able to offer the value of a tax credit to consumers upfront in 2024, simplifying the process of qualifying for and claiming the benefit.

- The tax credit for a used car comes to the lower of $4,000 or 30 percent of the vehicle's sale price when purchased from a dealership. For new cars, the credit caps at $7,500.

- For used cars, your income must be less than $150,000 for joint filers, $112,500 for a head of household, or $75,000 for an individual.

- For new cars, your income must be less than $300,000 for joint filers, $225,000 for a head of household, or $150,000 for an individual.

- Bidirectional EV chargers that charge the car’s battery and also power your house using the car’s battery can also qualify for tax incentives.

Click to learn more about Federal and State Laws and Incentives. The Inflation Reduction Act introduced a new program of tax credits for new and pre-owned electric vehicles, with up to $7,500 credit available (more details on those programs below). Check to see different manufacturer qualifications here.

The White House published a comprehensive website to help you understand the programs of the Inflation Reduction Act related to climate action. This includes EV credits, as well as other home efficiency upgrade credits available.

How do electric vehicle tax credits work?

How does the EV tax credit work? That credit, and other tax incentives that may apply when buying an EV, depend on the following factors.

- Battery capacity. The IRS calculates your tax credit based on the size of the battery pack in the car. Start with a minimum of $2,500 for a 5kWh battery pack, then add $417 for all battery packs. Add an additional $417 per kWh in excess of 5 kWh. The federal EV tax credit is the sum of these up to a cap of $7,500.

- Income (individual or household). For new and used vehicles, your income must be below the thresholds mentioned above.

- Date of purchase. The new law applies to EVs purchased after December 31, 2022,and extends 10 years until December 2032.

- State laws and other incentives. You may qualify for more than a federal EV tax credit. Many states are offering incentives and EV tax credits. The Department of Energy maintains an extensive and up-to-date list of EV tax credits by state.

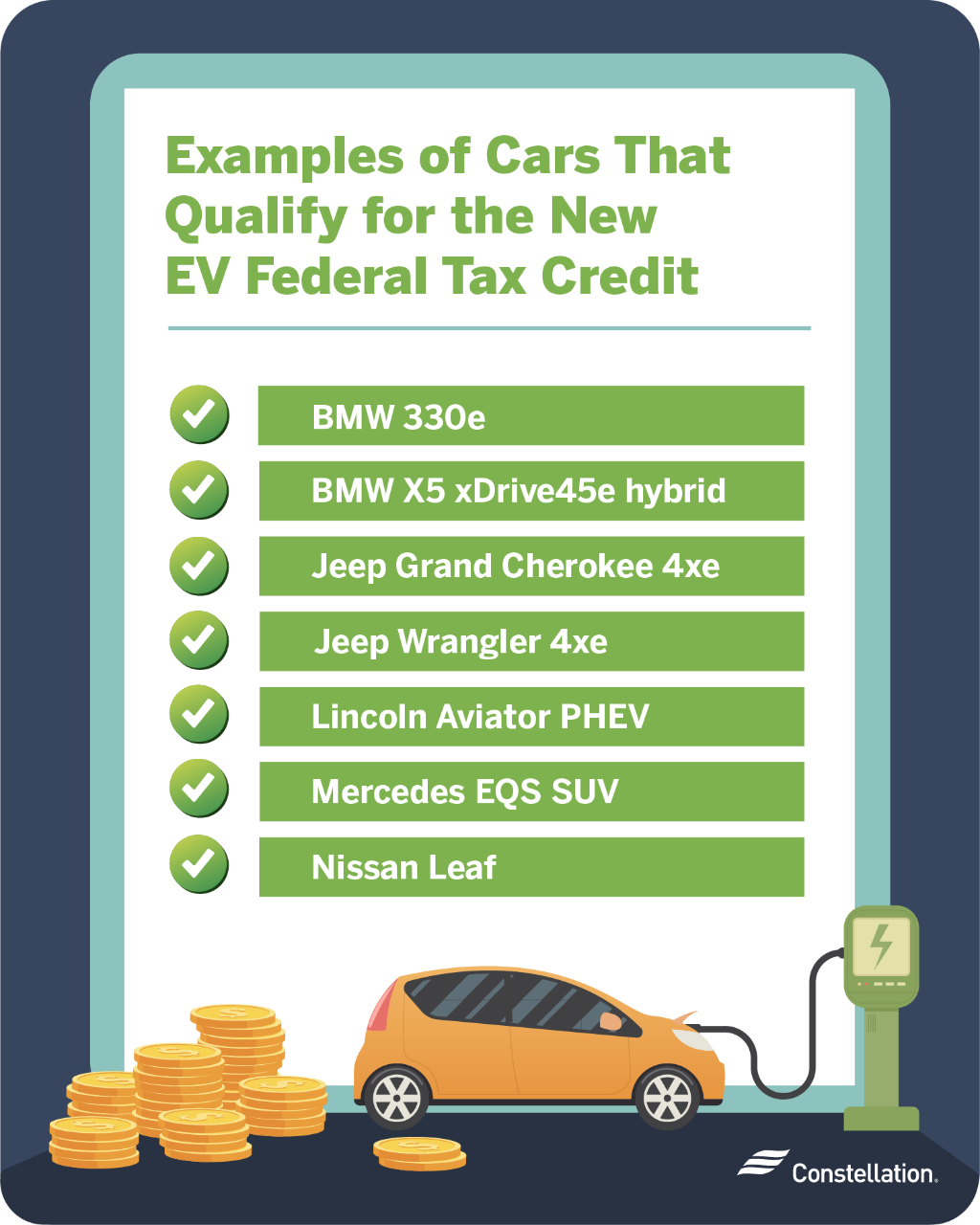

Which cars qualify for the new EV federal tax credit?

The EV tax credit only applies to vehicles assembled in North America. The Department of Energy lists some 30 models eligible for the federal tax credit, however the list may not be complete or up-to-date. Some of the 2022/2023 models listed that meet the manufacturer sales cap include:

- BMW 330e

- BMW X5 xDrive45e hybrid

- Jeep Grand Cherokee 4xe

- Jeep Wrangler 4xe

- Lincoln Aviator PHEV

- Mercedes EQS SUV

- Nissan Leaf

Which cars won’t qualify under the new federal EV tax credit law?

Wondering if vehicles like used hybrid cars qualify for tax credits? Many manufacturers produce cars in multiple locations, making most lists incomplete, open to interpretation and subject to change. To be certain your vehicle will qualify, you need to check and verify its place of manufacture. In many cases, the Vehicle Identification Number (VIN) can be a key to that information. Check the U.S. Department of Transportation's NHTSA VIN decoder website and then follow up by obtaining written verification by your dealer.

Eligibility limitations - electric vehicle price and buyer’s income

To make sure you qualify for the largest electric car tax credit, be mindful of these specific limits:

Eligibility limits for new electric vehicles

- Price limit for new electric cars:

The vehicle sticker price matters. The price of the car must be less than $55,000. SUVs, vans, and pickups must be less than $80,000.

- Income limits for new electric cars:

The income limits mentioned above apply. To recap, your income must be less than $300,000 for joint filers, $225,000 for a head of household, or $150,000 for an individual.

- Limits by filing status:

You have to meet income limits by filing status that are different when you file jointly, as head-of-household or as a single person.

Eligibility limits for used electric vehicles

- Price limit for used electric cars:

A used EV must cost less than $25,000.

- Income limits for used electric cars:

The income limits for buyers of used cars are half of the income limits for new car buyers. Specifically, your income must be less than $150,000 for joint filers, $112,500 for a head of household, or $75,000 for an individual.

- Limits by filing status:

As with buying a new EV, income limits by filing status apply when you file jointly, as head-of-household, or as a single person.

Frequently asked questions on electric vehicle federal tax credits

How do I claim the EV tax credit?

The process is easy. Fill in form 8936 when you file your annual income tax return. You will need to enter the VIN number and other details about the vehicle and purchase price.

How much can you write off for an electric car?

Your federal EV tax credit is capped at $7,500 for a new car and $4,000 for a new one.

What happened to the tax credit that existed prior to the Inflation Reduction Act?

These tax credits still apply to any electric vehicle purchased before August 16, 2022, and for vehicles used before January 1, 2023.

What if I purchased a credit-eligible EV before the passage of the Inflation Reduction Act?

The time of purchase matters. You can only claim the tax credit for vehicles purchased after December 31, 2022.

EV home charger installation services from Constellation

Once you decide to buy an electric vehicle, the next consideration is how to charge it. You can find an electric car charging station near you. For most people, however, plugging your vehicle into your home electrical system is the most convenient way to keep your EV charged. And you can save money on installation with rebates and incentives. Constellation Home in Maryland can make setting up your home for EV charging fast and easy.

- We ensure your charger is compatible with your existing home system

- We handle all the permits, inspections and paperwork

- Your installation is covered by Constellation for an entire year

Get your EV charger installed now

If you have questions, we have answers about charging your EV at home. The Inflation Reduction Act introduced a program of tax credits for new and pre-owned electric vehicles, with a credit of up to $7,500 available.