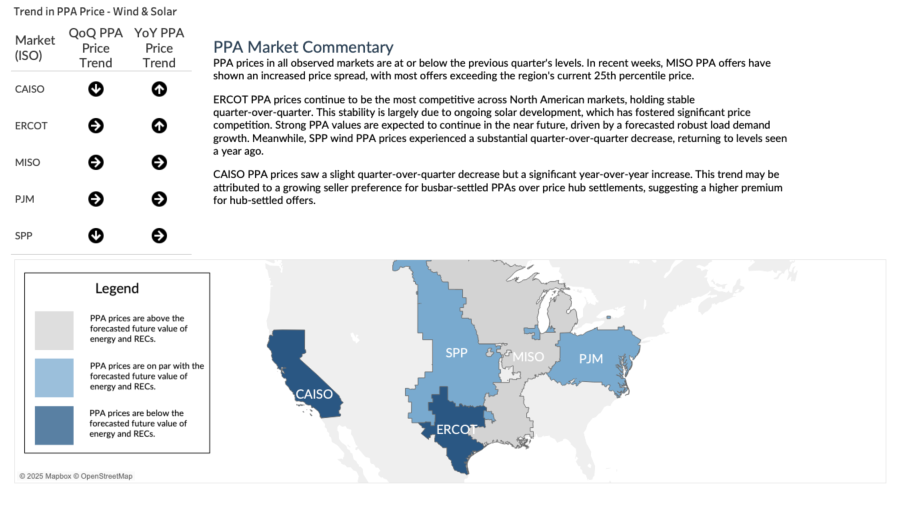

New Section Added!: At the conclusion of each weekly publication, you’ll now find insights in collaboration with LevelTen Energy on Power Purchase Agreements (PPAs), along with notable developments in the renewable energy market. Stay current on emerging trends, transaction activity, and key news shaping the clean energy landscape.

Weekly Energy Industry Summary

Commodity Fundamentals

Week of June 30, 2025

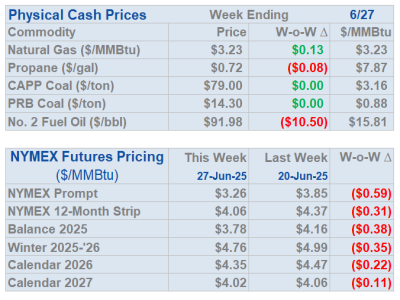

By The Numbers:

- NG '25 prompt-month NYMEX natural gas settled at $3.46 per MMbtu, down $.29/MMbtu, on Monday, June 30.

- WTI '25 prompt-month crude oil settled at $65.11 per barrel, down $.41 per barrel on Monday, June 30.

Natural Gas Fundamentals - Neutral

- Prompt NYMEX natural gas settled at $3.46 per MMbtu, down $.29/MMbtu on Monday, June 30.

- June 2025 was the 4th hottest since 1950 providing support to gas throughout.

- The first major heat wave in the east peaked last week. A more variable pattern will prevail in the coming weeks.

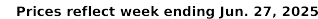

- Natural gas production broke out of its 3 month range this week, posting an all-time high of just over 107 Bcf per day a few days ago. Is this a short-term blip or does the production trajectory take a move to the upside is the question.

- Year-to-date production averaged 104.6 Bcf per day vs. 101.4 Bcf per day for the same period last year.

- Power generation demand averaged 33.8 Bcf per day year-to-date, vs. 33.4 Bcf per day for the same period last year.

- Residential/Commercial demand averaged 27.0 Bcf per day vs. 20.3 Bcf per day for the same period last year.

- Industrial demand averaged 24.1 Bcf per day vs. 23.2 Bcf per day for the same period last year.

- LNG exports averaged 15.2 Bcf per day vs. 12.9 Bcf per day for the same period last year.

- Exports to Mexico averaged 6.4 Bcf per day vs. 6.2 Bcf per day for the same period last year.

Crude Oil - Neutral

- NYMEX (WTI) prompt-month crude settled at $65.11, down $.41 per barrel on Monday June 30.

- Last week crude settled at $68.51/bbl (Monday, June 23).

- Thus far, the ceasefire between Iran and Israel has held.

- OPEC is meeting on Sunday and expected increase production.

- Crude oil is currently trading very near its 200-day moving average.

- A trade deal with China may be a positive sign for crude oil demand in the second half of this year.

Economy - Neutral

- The Big Beautiful Bill (BBB) appears to be heading to the finish line.

- If passed, the tax cuts from Trump's first Administration would be made permanent.

- The BBB continues to rack up spending and deficits. The Administration is focused on economic growth as a means to mitigate deficit spending.

- U.S. unemployment has held steady at 4.2%.

- The equities markets are near all-time highs.

- The housing market is a sore spot with sales of new homes and housing starts lagging.

- GDP forecasts for the second quarter vary widely -- The Atlanta Fed forecasts a 4.6% boost, while the Philadelphia Fed forecasts a range of 1.5% to 2.1%. Kiplinger's outlook is 3-4%.

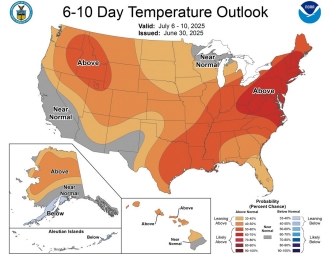

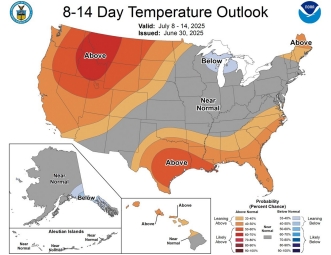

Weather - Bullish/Neutral

- The biggest heat event in the month of June is in the rear view mirror.

- Temperatures in the East will moderate from last week, but seasonal heat will prevail.

- It's summer. It's going to be hot. However, this July will likely not be as hot as the past several years.

Weekly Natural Gas Report:

- Inventories of natural gas in underground storage for the week ending June 20 are 2,898 Bcf; an injection of 96 Bcf was reported for the week ending June 20.

- Gas inventories are 179 Bcf above the five-year average and 196 Bcf less than the same time last year.

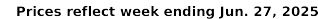

Weekly Power Report:

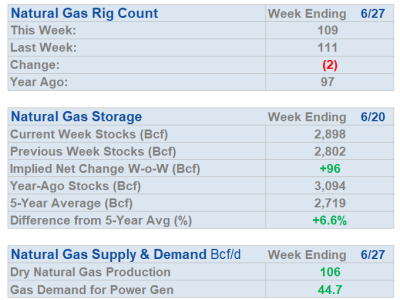

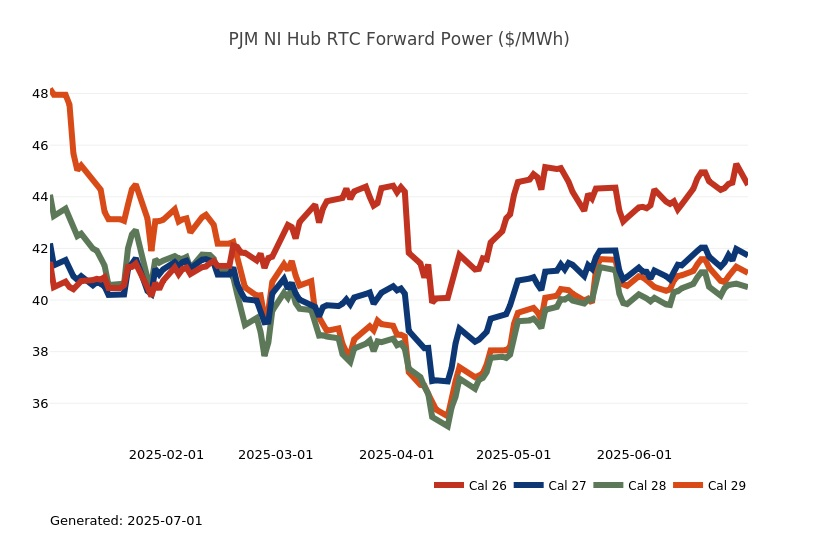

Mid-Atlantic Electric Summary

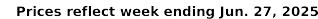

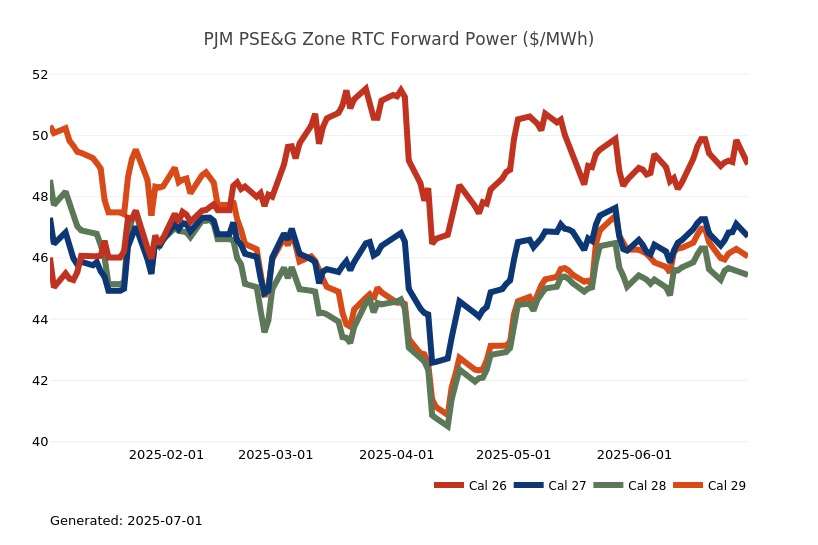

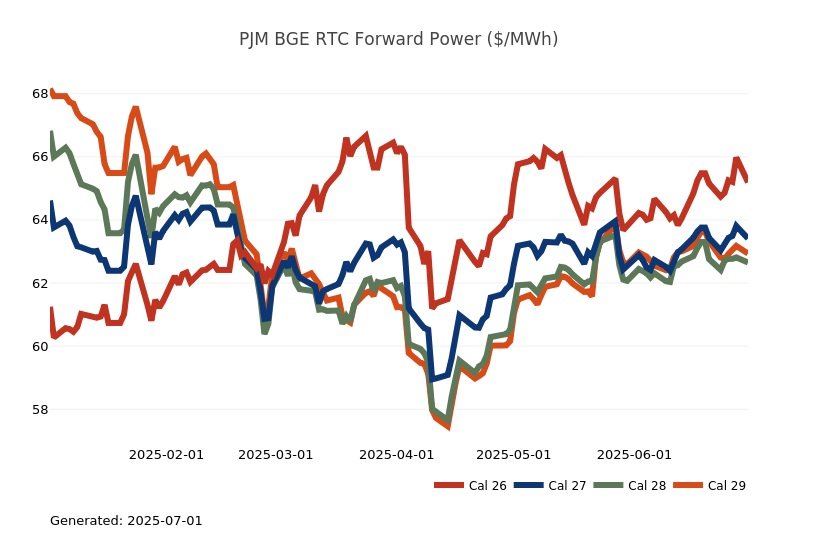

- The Mid-Atlantic Region’s forward power prices were slightly higher on the front of the price curve and relatively unchanged on the back, over the past week. August natural gas futures moved into the lead on Friday and rose after a string of losses had brought the contract into oversold territory, opening the door for bargain buying. The prompt-month contract settled at $3.74/MMBtu, up 21 cents on the day as the August contract rolled to the front-month position ahead of hotter weather, stronger seasonal demand and a looming uptick in LNG feed-gas flows. Power prices could see some downward pressure this week, though, as NYMEX saw an ~8% sell-off on Monday. The strongest heat this week is in the upper West with a variable pattern in the Midwest and East. This brings a warm start to the week with a cool down toward the 4th of July before trending back up next week. Power futures were 1% higher last week throughout the 2026-2027 terms, while the 2028-2030 strips were unchanged. The month-to-date, day-ahead settlement price in West Hub is averaging $46.29/MWh for June thus far, which is 32% higher than last month, as well as being 49% higher than a year ago for the month.

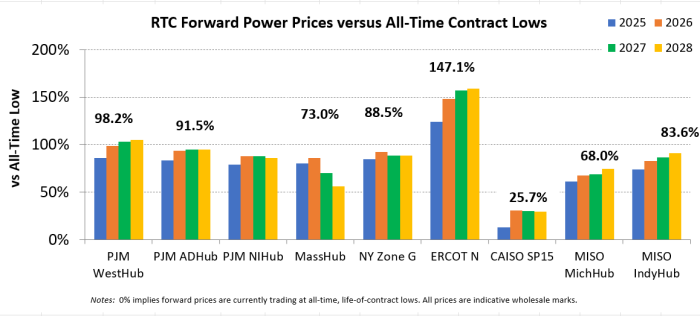

- PJM Electricity Demand and Prices Spike During June 23-25 Heat Wave - Record-setting temperatures this week sent PJM hourly demand increasing to levels not seen since 2011. PJM maintained both Hot Weather Alerts and Maximum Generation/Load Management Alerts throughout the heat wave and initiated Pre-Emergency Load Management reduction actions on all three days. Although actual Load Management reductions may not be known until 3 months after the event, PJM published summaries of the volumes deployed from both economic demand response and administrative load management resources (collectively DR). PJM’s highest peak was set 19 years ago at over 165 GW during the summer of 2006. During this week’s hot weather, prices reflected the high demand and tightening supply with five-minute LMPs exceeding $3,000/MWh in many intervals and the congestion component of the price approaching $1,700/MWh in some locations.

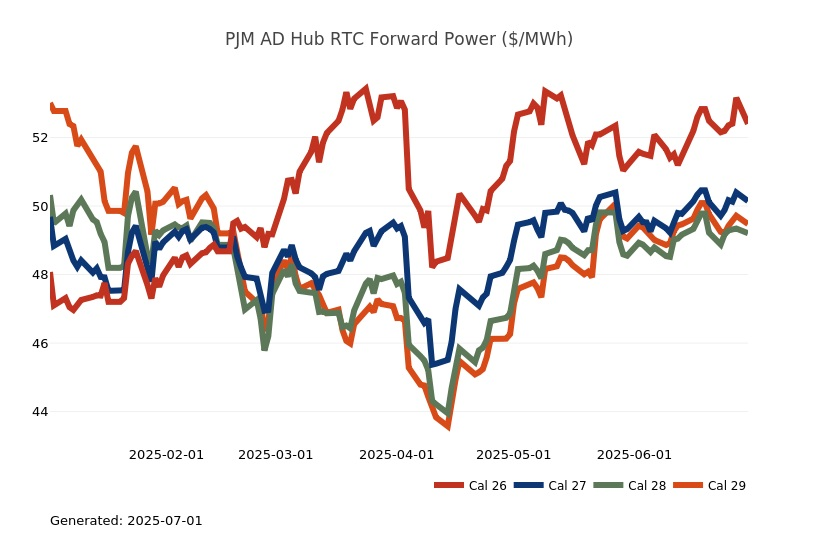

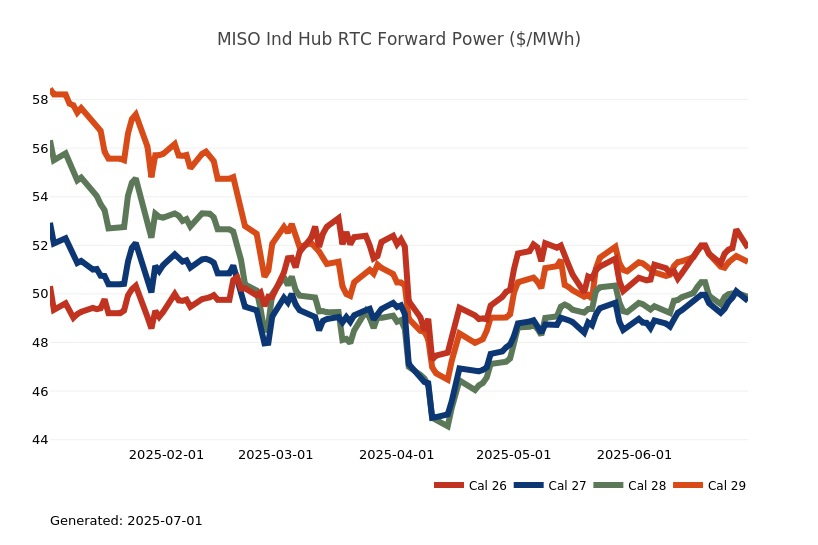

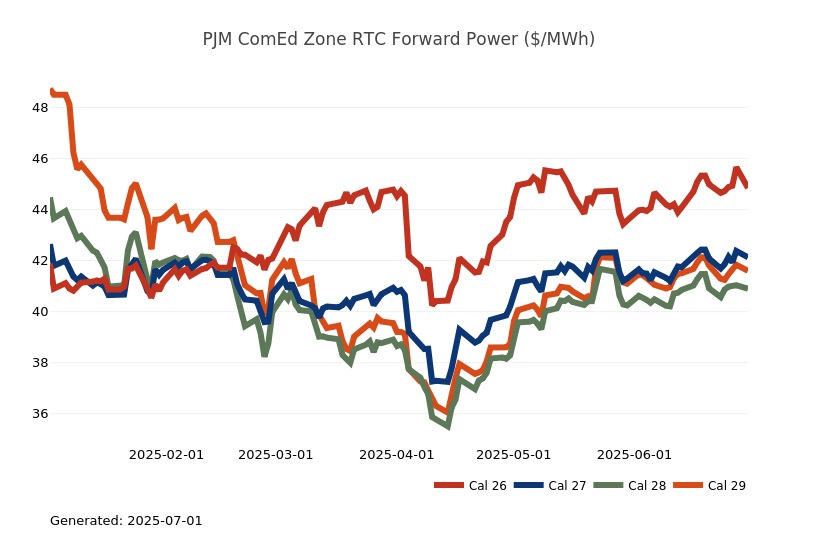

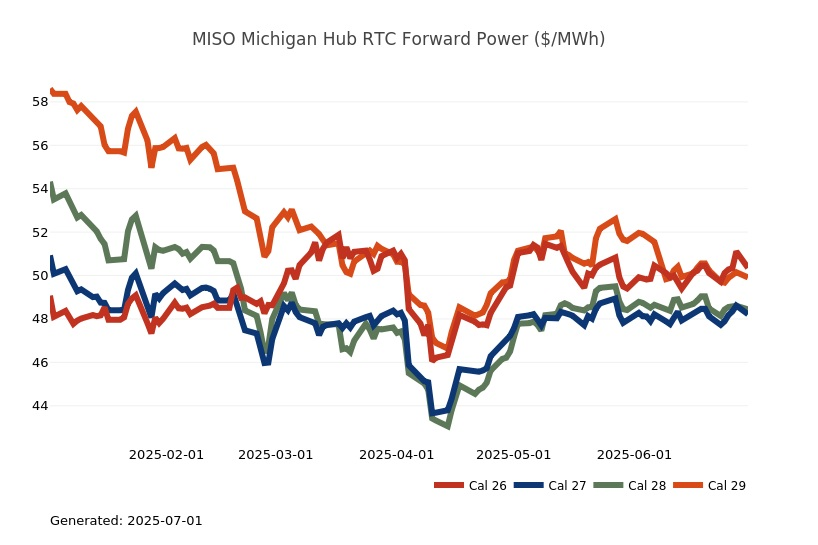

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices were higher throughout the price curve over the past week. August natural gas futures moved into the lead on Friday and rose after a string of losses had brought the contract into oversold territory, opening the door for bargain buying. The prompt-month contract settled at $3.74/MMBtu, up 21 cents on the day as the August contract rolled to the front-month position ahead of hotter weather, stronger seasonal demand and a looming uptick in LNG feed-gas flows. Power prices could see some downward pressure this week, though, as NYMEX saw an ~8% sell-off on Monday. The strongest heat this week is in the upper West with a variable pattern in the Midwest and East. This brings a warm start to the week with a cool down toward the 4th of July before trending back up next week. Power futures were 2% higher last week for both the 2026 and 2027 terms, while the 2028-2030 strips were up about 1%. The month-to-date, day-ahead settlement price in COMED is averaging $40.19/MWh thus far or 36% higher than last month, while in AdHub those prices are averaging $43.83/MWh or are 34% higher than the previous month. In Michigan, the month-to-date average price is currently 46.35/MWh or 34% higher than last month, while Ameren is averaging $43.11/MWh or 34% higher than the previous month of May.

- PJM Electricity Demand and Prices Spike During June 23-25 Heat Wave - Record-setting temperatures this week sent PJM hourly demand increasing to levels not seen since 2011. PJM maintained both Hot Weather Alerts and Maximum Generation/Load Management Alerts throughout the heat wave and initiated Pre-Emergency Load Management reduction actions on all three days. Although actual Load Management reductions may not be known until 3 months after the event, PJM published summaries of the volumes deployed from both economic demand response and administrative load management resources (collectively DR). PJM’s highest peak was set 19 years ago at over 165 GW during the summer of 2006. During this week’s hot weather, prices reflected the high demand and tightening supply with five-minute LMPs exceeding $3,000/MWh in many intervals and the congestion component of the price approaching $1,700/MWh in some locations.

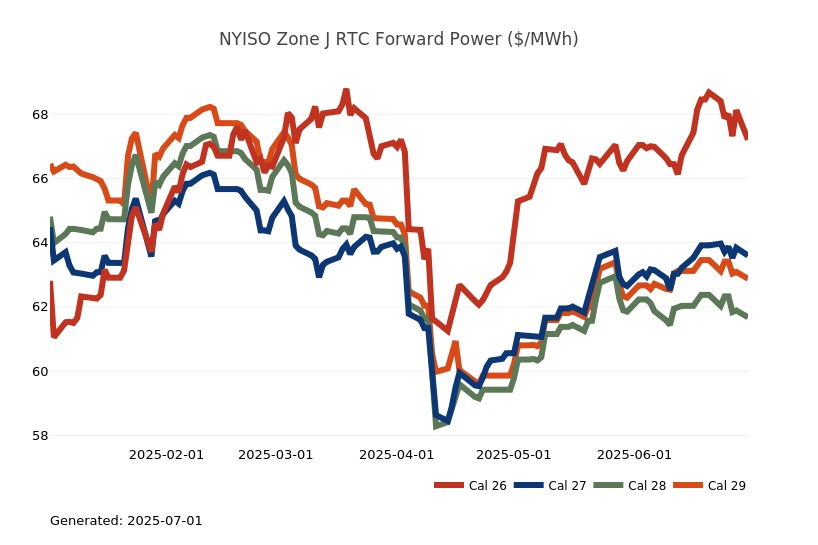

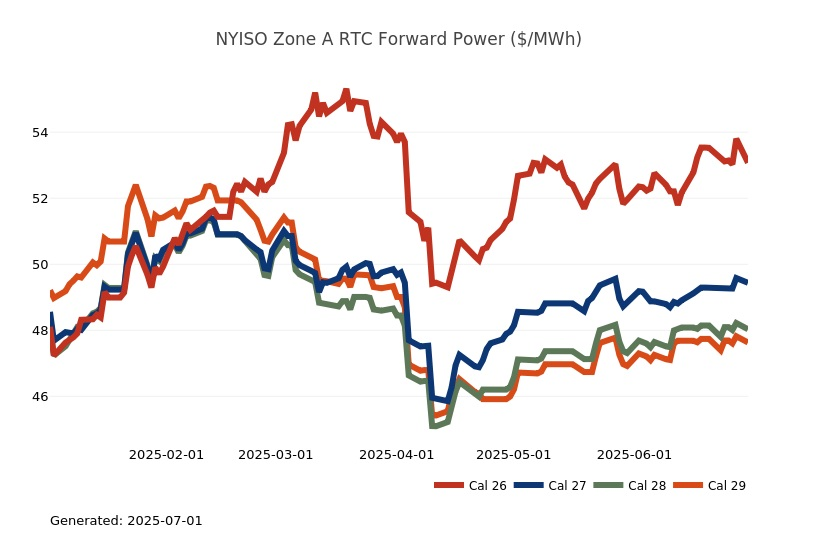

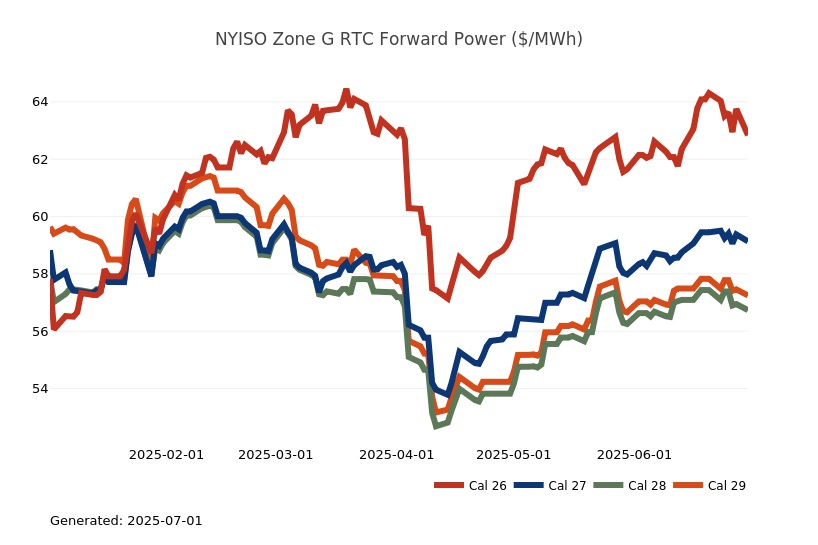

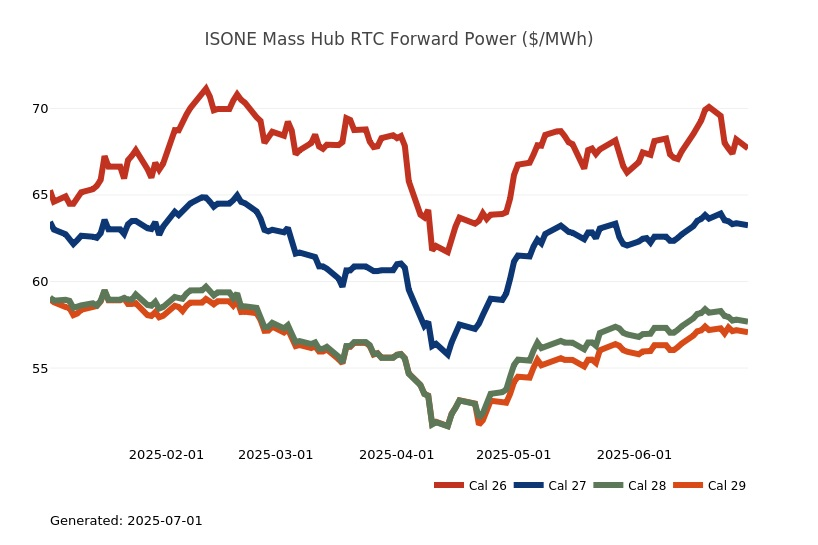

Northeast Energy Summary

- The ISO New England made a preliminary determination that a Capacity Scarcity Condition (CSC) occurred in one or more Capacity Zones within the New England system on June 24, 2025, triggering a Pay for Performance Event (PFP). A CSC occurs when one or more of the three reserve requirements is deficient and the reserve constraint penalty factor is setting the real-time reserve price. This real-time reserve price is also included in the real-time locational marginal price (LMP). A CSC can occur in one or more five-minute pricing intervals. ISO’s determination is subject to change pending the finalization of real-time reserve prices for the relevant time period, which occurs within five business days from the applicable Operating Day. ISO New England continues to monitor grid conditions as hot, humid weather persists across the region. Consumer demand for grid electricity unofficially peaked Tuesday evening at 26,024 megawatts (MW), the highest level seen in the region since 2013. Following the unexpected loss of generation in the late afternoon, ISO New England managed the regional grid under a Power Caution. This step allows system operators to take additional actions, including calling on reserve resources, to balance the system.

- The Maine legislature finished its session on June 18 after considering several energy-related bills. LD 1868, which passed and has been since signed by the Governor, creates a new category of Class III resources, including nuclear power, hydroelectric power, or any resource with a “de minimums level of greenhouse gas emissions,” effective September 30, 2025. Additionally, the bill increases the Renewable Portfolio Standard requirements to 100% clean energy by 2040 by adding an additional 1% Class IA and 1% Class III obligations per year from 2030 to 2040. Constellation expects to incorporate these new requirements into their retail offering prices where applicable.

- On June 23, New York's Governor Hochul instructed the New York Power Authority (NYPA) to initiate the development of a new 1+ GW nuclear power project in upstate New York, citing the need to provide clean power to new industries with high energy demand. NYPA was directed to assess technologies, business models, and site selection in collaboration with the New York State Energy Research and Development Authority’s (NYSERDA) ongoing development of a master plan for Responsible Advanced Nuclear Development in New York, and in coordination with the Department of Public Service regarding potential contributions from ratepayers to support the project. NYPA will issue a Request for Information in the coming weeks, followed by a Request for Proposal by the end of the year or early 2026, seeking a public/private partnership.

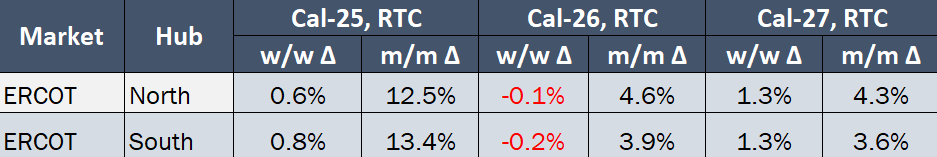

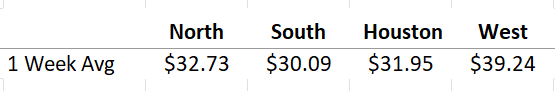

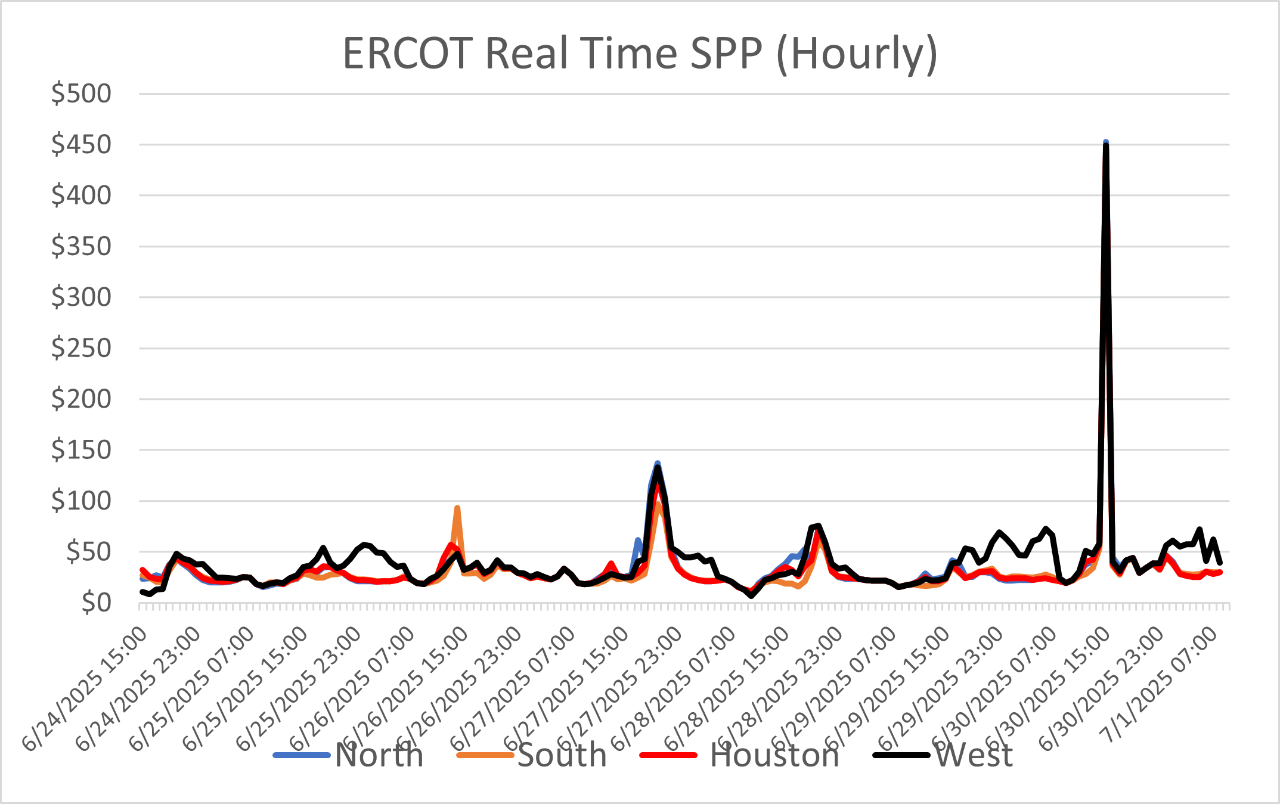

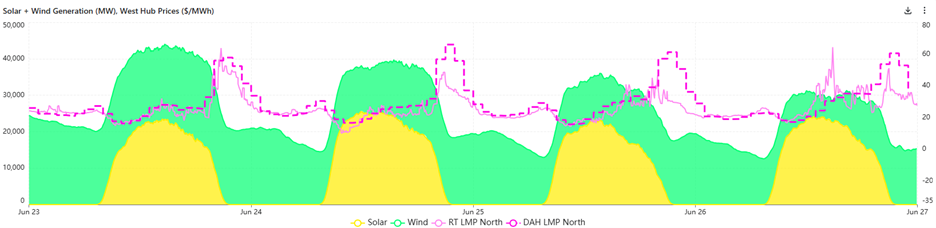

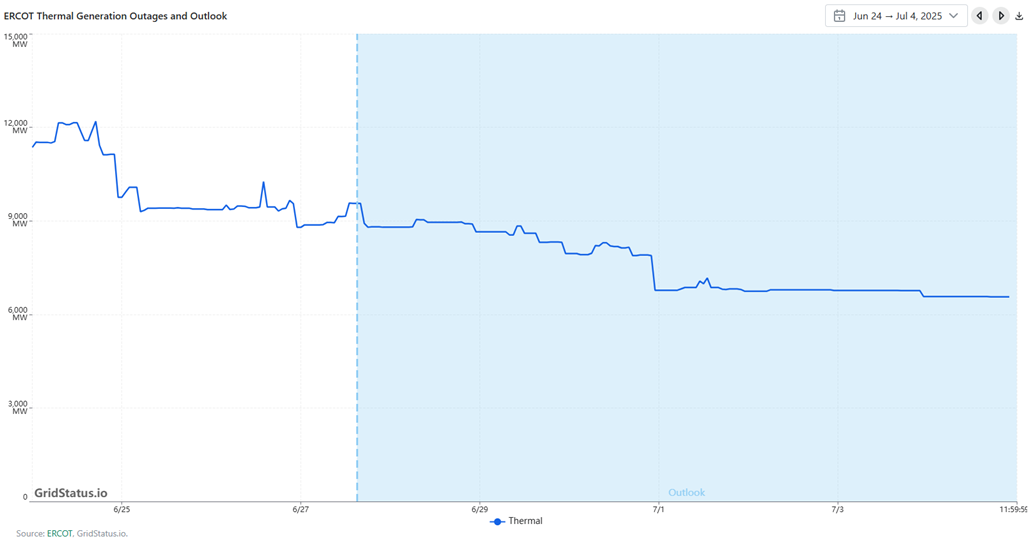

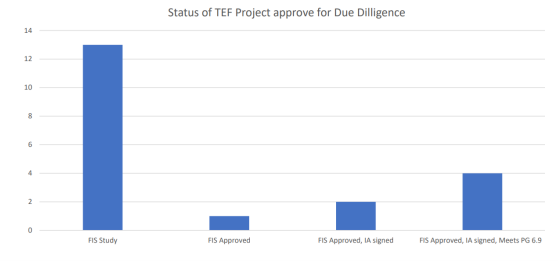

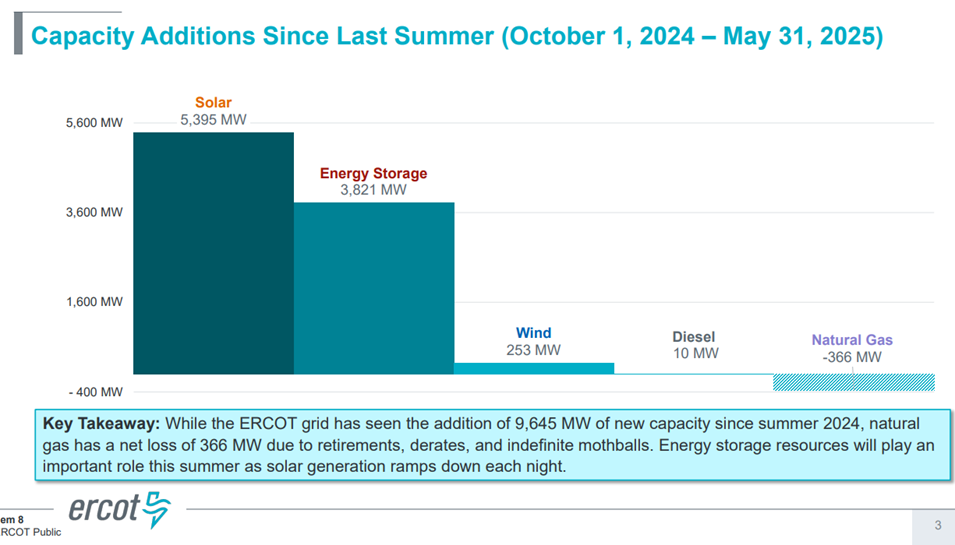

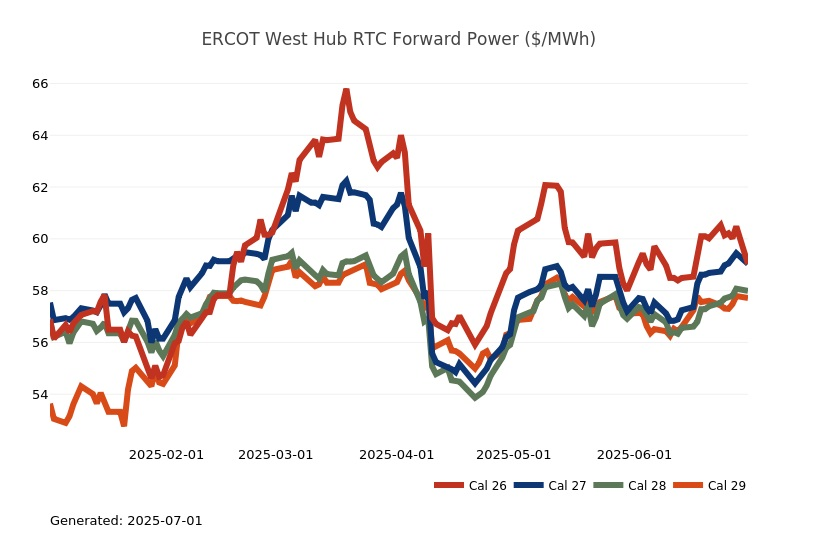

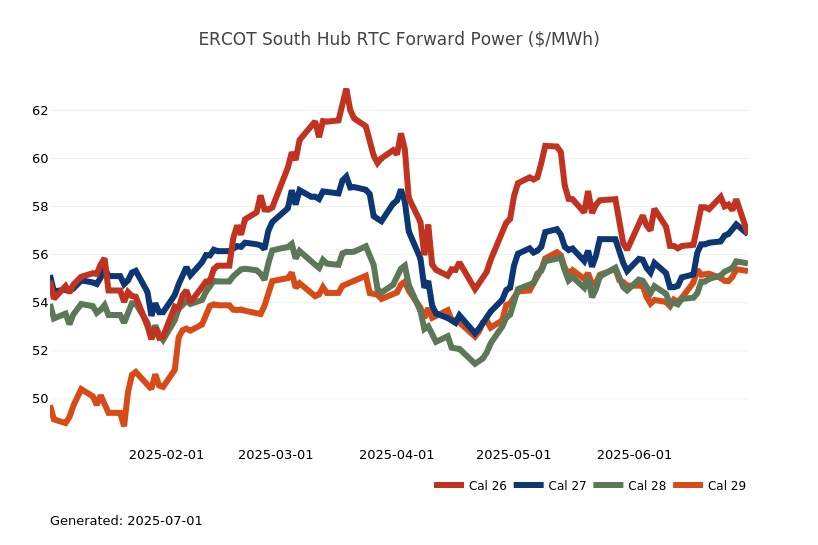

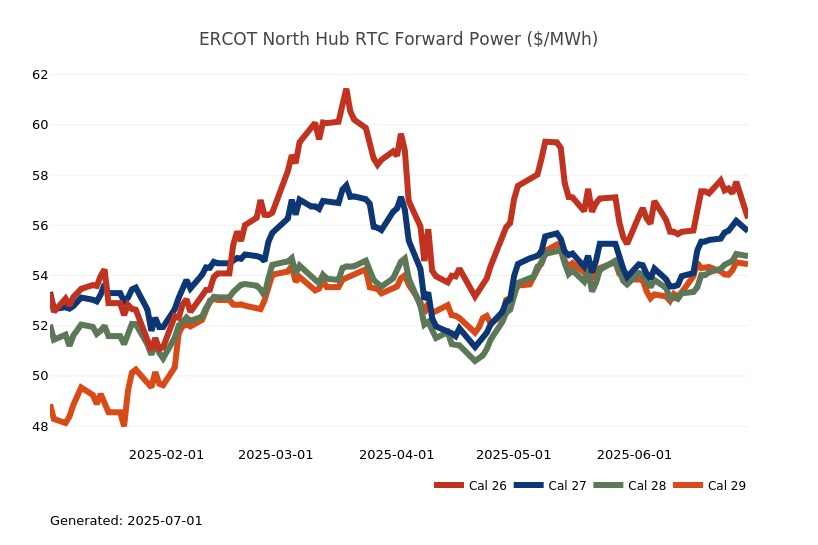

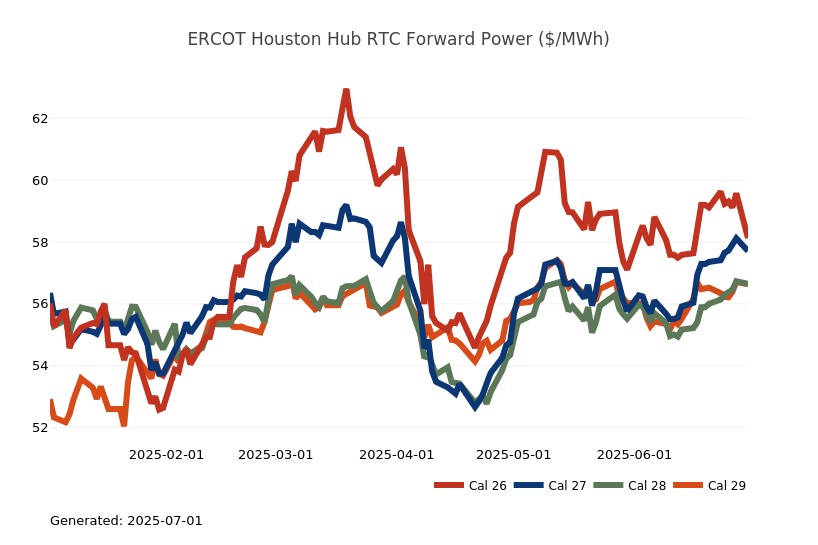

ERCOT Energy Summary

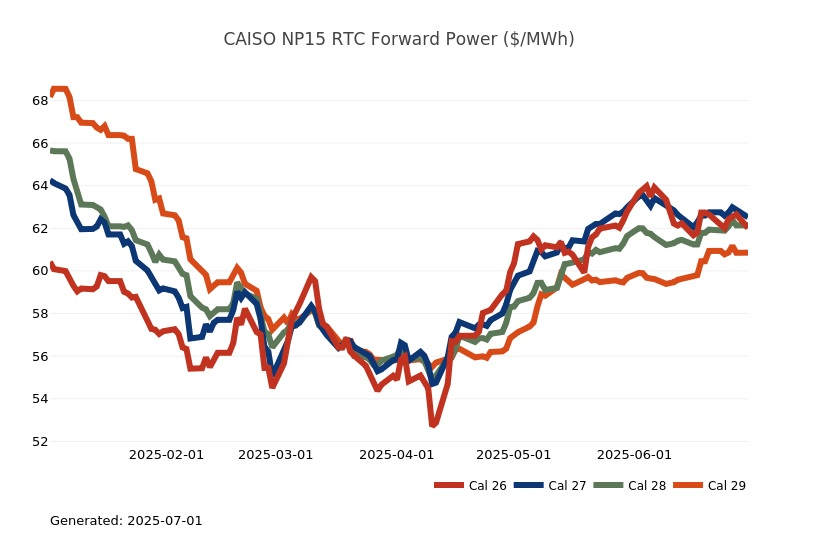

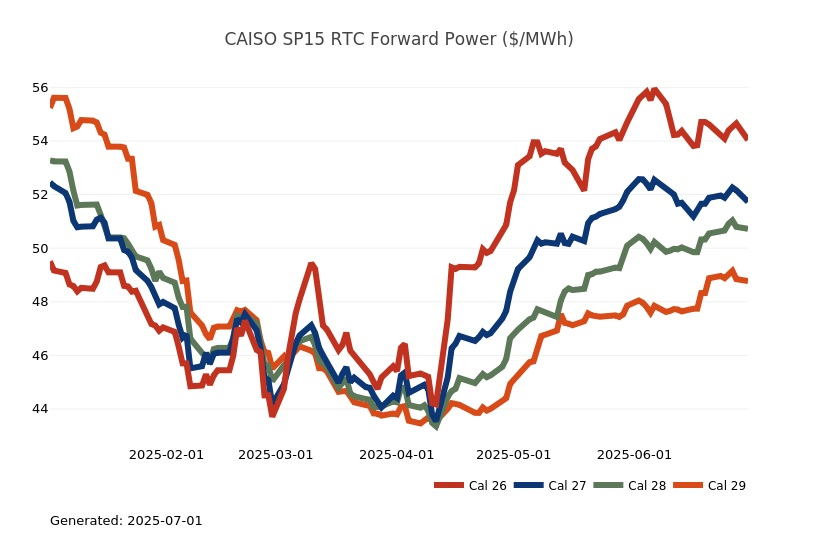

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- The weather story in the West today is all about the Pacific Northwest and their near-100o temps expected in inland areas which will drive much-above normal temperatures closer to the coastal load centers. This will all last until tomorrow when the temperatures should back down, beginning at those coastal pop centers and eventually farther inland by the end of the week as more seasonable conditions arrive for the weekend. The strong heat will linger today across the Desert SW cities before searing temperatures break down as the chances of thunderstorms increase around the Four Corners region. Inland California is expected to turn hotter for a brief period towards the balance of next week, although not to extreme levels. A hotter than normal weather pattern will likely persist into the middle of the month, especially across the interior West and Northwest, but this should be more of a simmer than a boil, with conditions being elevated but lacking a dramatic crest.

- Natural gas markets could deliver some volatility even if they lack intense heat as the main driver. As we’ve noted for many weeks, maintenance on a couple pipes running into SoCal kicks in beginning today. SoCalGas loses supply via two outages at the North Desert and Topock zones. The north zone programs begins today and is slated to run through November 2026, while the Topock region starts on the 30th and will last for the balance of summer. On the natural gas pricing front, PG&E has posted a Low Operational Flow Order (OFO) notice for the last day of June bucking the common theme throughout the month of June which had been High OFO notices. Their abundant storage situation is driving less flexibility in NorCal to deal with daily imbalances. Demand across the region will be supportive today and tomorrow at the very least and is showing in both the day-ahead and real-time price action within CAISO. Conditions on the grid have grown tighter since last week as temperatures across the state have warmed. The heat in neighboring control areas and the need for overnight AC use is showing in the CAISO day ahead auction prices as negative midday prices in SP15 have disappeared and the zone cleared showing only a few dollars’ worth of congestion to the NP15 price for flow today - $43.27 in the north and $40.26 down south for peak hours. For off-peak SP15 jumped up to $48.08 while N15 was a mere $45.25. Reservoir storage and the hydro generation it brings are weighing in when you see pricing action like that.

- There are a couple different items exerting pressure on gasoline prices, the first is slated to begin today. Prices at the pump in California will make a small jump, spurred by a state sales tax hike. A second effort, which is to bring stricter rules on refineries to encourage them to create lower-carbon fuels, will have an impact but to what degree is under contention, although one estimate suggests the combined increases could boost gas prices by nearly 70 cents a gallon. For taxes, the State adjusts its fuel tax rates based on data from the Dept of Finance annually, and the new rate goes into effect on July 1. This year, the change on gasoline and diesel excise taxes will move the former to 61.2 cents per gallon from the current rate of 59.6 cents, and on diesel from 45.4 cents to 46.6 per gallon. This tax increase occurs in an environment where the California Air Resources Board (CARB) rules intended to “encourage” more low carbon fuel production continue to turn the dial up on California based refineries, combined with rules enacted in 2024 that require refineries to keep more fuel in inventory and at some point, submit data to the Division of Petroleum Market Oversight, so that the energy commission may penalize oil companies that exceed a “maximum gross refining margin.” This penalty has yet to be implemented, but it would be the first of its kind in the nation. So far, what we know about the increased regulatory burden on refineries is two companies announced planned closures late last year – Valero’s refinery in Benicia and Phillips 66 of their facilities in Carson and Wilmington. California has 13 operational refineries now; five are relatively small processing only about 4% of the crude oil, the remaining eight major refineries account for the other 96% - Phillips 66 and Valero’s facilities fall in this category.

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, July 16 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Join us our Fortunato & Friends webinar on Tuesday, July 1 at 2 p.m. ET featuring Constellation's Chief Economist, Ed Fortunato and special guest, Jeff Hirsch, CEO of Hirsch Holdings, discussing energy and commodity markets in turbulent times.

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.