New Section Added!: At the conclusion of each weekly publication, you’ll now find insights in collaboration with LevelTen Energy on Power Purchase Agreements (PPAs), along with notable developments in the renewable energy market. Stay current on emerging trends, transaction activity, and key news shaping the clean energy landscape.

Weekly Energy Industry Summary

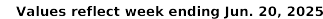

Commodity Fundamentals

Week of June 23, 2025

By The Numbers:

- NG '25 prompt-month NYMEX natural gas settled at $3.70 per MMbtu, down $.15/MMbtu, on Monday, June 23.

- WTI '25 prompt-month crude oil settled at $68.51 per barrel, down $5.53 per barrel on Monday, June 23.

Natural Gas Fundamentals - Neutral/Bearish

- Prompt NYMEX natural gas settled at $3.70 per MMbtu, down $.15/MMbtu on Monday, June 23.

- One week ago, NYMEX prompt-month settled at $3.75 per MMbtu.

- Big heat in the east peaks today.

- Temperatures in the east will be moderating next week.

- Production continues to hold steady for the second quarter.

- Year-to-date production averaged 104.6 Bcf per day vs. 101.5 Bcf per day for the same period last year.

- Power generation demand averaged 33.3 Bcf per day year-to-date, vs. 32.9 Bcf per day for the same period last year.

- Residential/Commercial demand - averaged 27.8 Bcf per day vs. 21.6 Bcf per day for the same period last year.

- Industrial demand averaged 24.1 Bcf per day vs. 23.4 Bcf per day for the same period last year.

- LNG exports averaged 15.2 Bcf per day vs. 12.9 Bcf per day for the same period last year.

- Exports to Mexico averaged 6.4 Bcf per day vs. 6.2 Bcf per day for the same period last year.

Crude Oil - Neutral

- NYMEX (WTI) prompt-month crude settled at $68.51, down $5.53 per barrel on Monday June 23.

- After a big spike in oil pricing action pursuant to the war between Israel and Iran, oil sold off as a cease fire was announced, broken and then re-established this morning. The situation is dynamic. Iran had threatened to block the Straits of Hormuz -- the ability of the Iranian Navy to carry this out for any period of time is limited, but a short-term risk to this major oil-supply artery where 20% of global supply originates, gave a boost to crude before the sell-off.

- Iran's oil producing and refining assets have been spared -- thus far.

- There are many moving parts in the Middle East and the energy trade could change at a moment's notice.

Economy - Neutral

- U.S. home prices cool to near two-year low, The Wall Street Journal reports.

- Powell reaffirms "wait-and-see" posture on rate cuts, citing "solid economy."

- "New real estate math: half a million more sellers than buyers," The Wall Street Journal reports.

- Global business remains resilient in the face of tariffs, Middle East war, The Wall Street Journal reports.

- The 10-year Treasury yield is little changed.

- Retail sales fell 0.9% in May, worse than expected.

- Despite the May drop in retail sales, consumer sentiment in June improved.

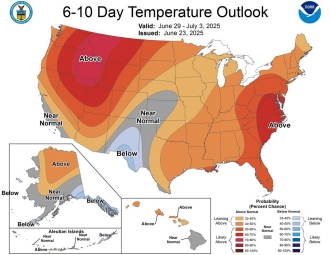

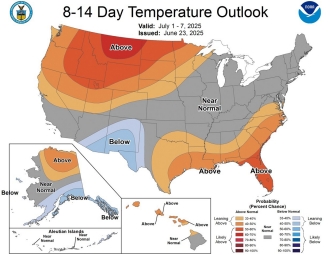

Weather - Bullish/Neutral

- The weather this week is bullish, but trends neutral as the heat wave in the East gives way to more moderate temperatures into the weekend.

- Temperatures in the East will moderate next week.

- The 16-30 day pattern show a warm national outlook across the north through Texas.

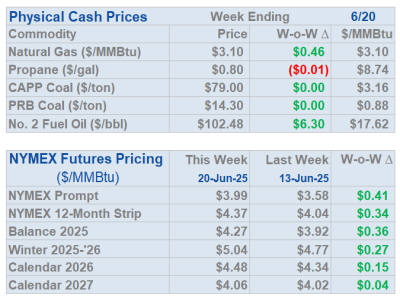

Weekly Natural Gas Report:

- Inventories of natural gas in underground storage for the week ending June 13 are 2,802 Bcf; an injection of 95 Bcf was reported for the week ending June 13.

- Gas inventories are 162 Bcf above the five-year average and 233 Bcf less than the same time last year.

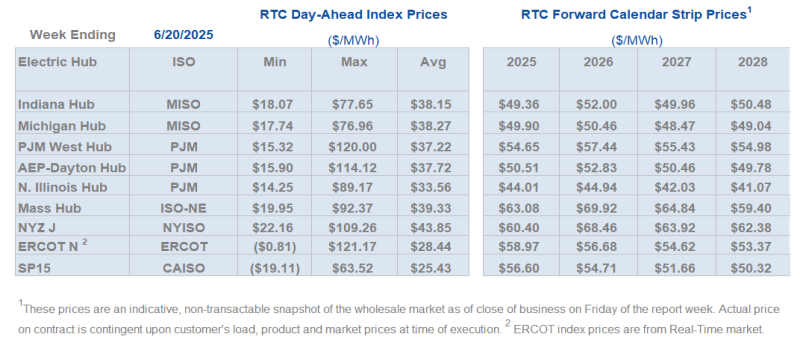

Weekly Power Report:

Mid-Atlantic Electric Summary

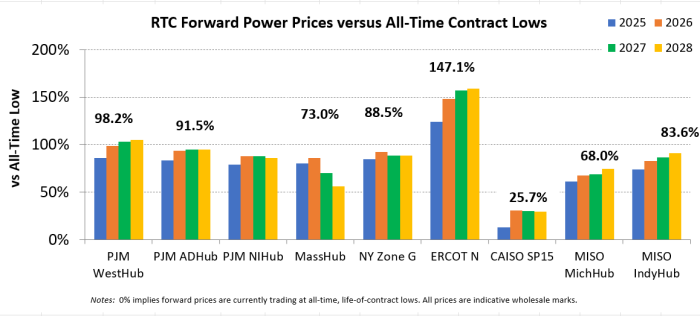

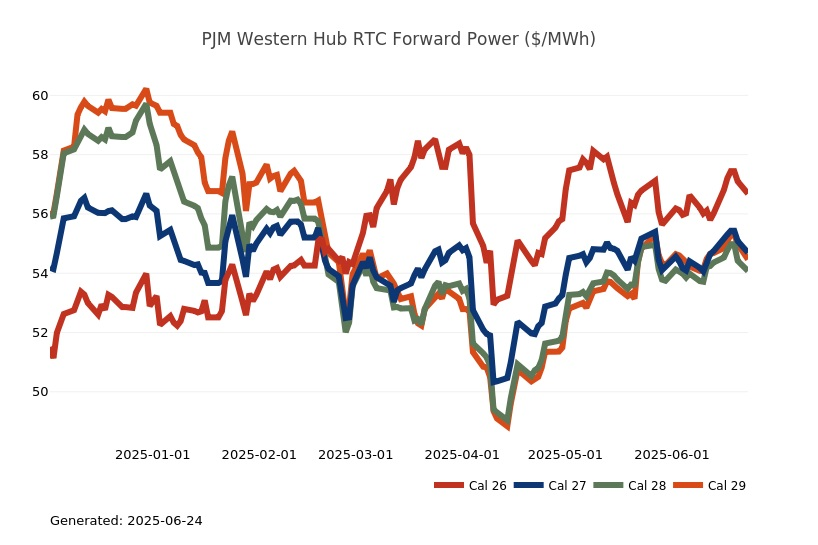

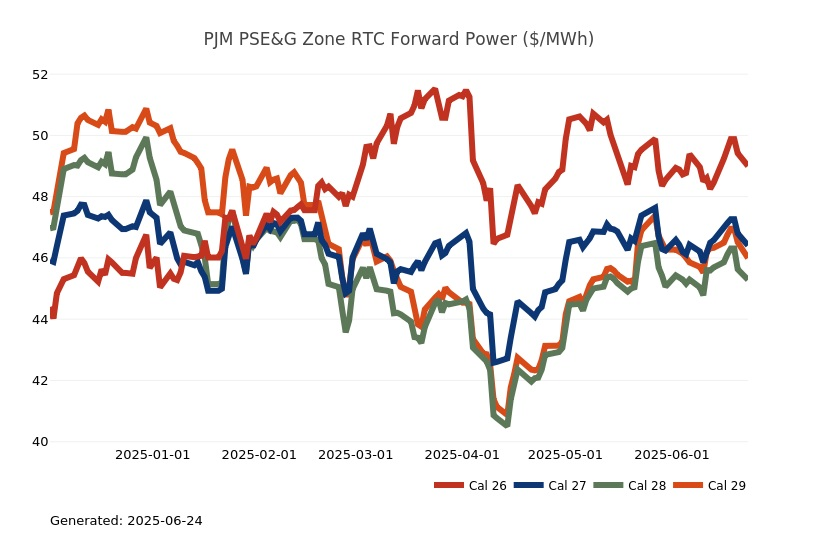

- The Mid-Atlantic Region’s forward power prices were higher last week as natural gas prices rallied above $4.00/MMBtu briefly, being supported by this week’s heat. Gas prices sold-off the past couple of sessions, on weaker spot prices, as milder temperatures later this week and some profit-taking seem to be in play as well. It will feel like summer across the eastern United States for most of this week under an expansive heat ridge that has set up over the region. This feature starts to back down later this week, with storm chances increasing. This lowers the heat but keeps the humidity going. The evolution of the pattern next week shows ridging backing down in the East and building in the West. Power futures were 1% higher last week throughout the 2026-2030 price curve with the Cal’26/27 strips 1-2% higher while the rest of the terms were unchanged. Forward prices over the past month were approximately 3-4% higher on average, for all the terms. The month-to-date, day-ahead settlement price in West Hub is averaging $42.74/MWh for June thus far, which is 22% higher than last month, as well as being 37% higher than a year ago for June.

- BPU Announces Energy Storage Program - On 6/18, the Board of Public Utilities (BPU) approved Phase 1 of the Garden State Energy Storage Program (GSESP). This effort, formerly known as the New Jersey Storage Incentive Program, is designed to expand the amount of grid-scale energy storage capacity in New Jersey. GSESP is a multi-phase program designed to deploy 2,000 MW of energy storage by 2030, a mandate established by New Jersey’s Clean Energy Act of 2018. The BPU views energy storage systems as crucial for integrating intermittent renewable energy sources like solar, strengthening grid resilience against outages, and reducing carbon emissions. The GSESP initiative will be conducted in multiple phases. The program will include both large-scale grid infrastructure and smaller, localized energy storage solutions.

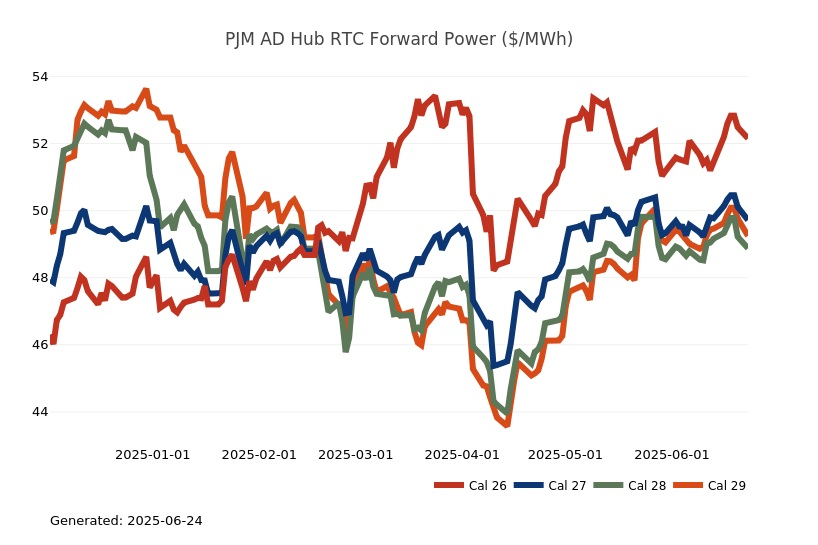

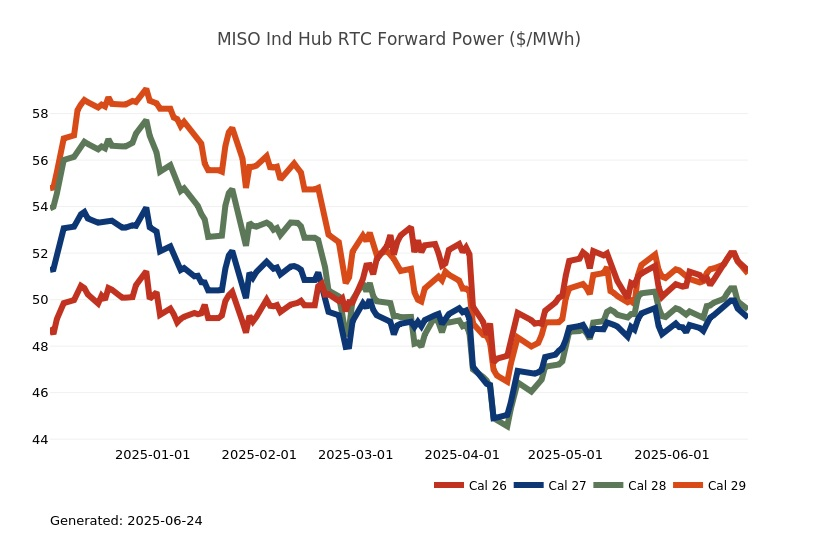

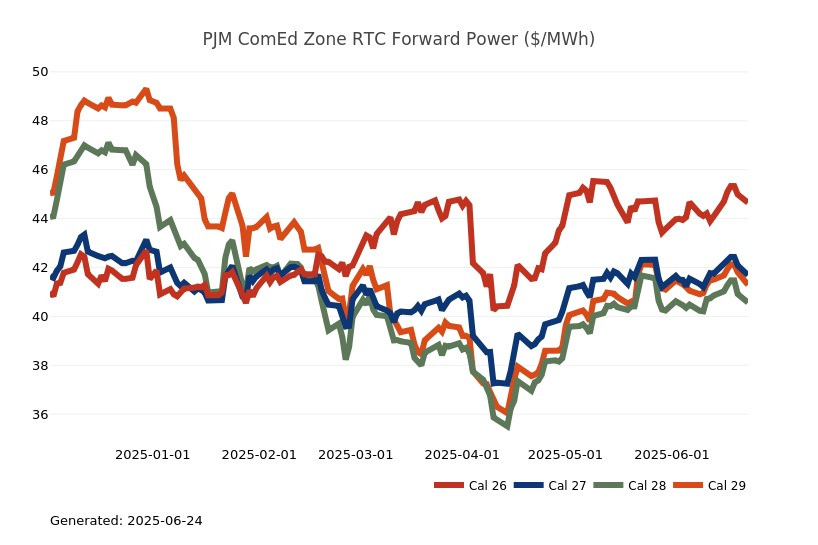

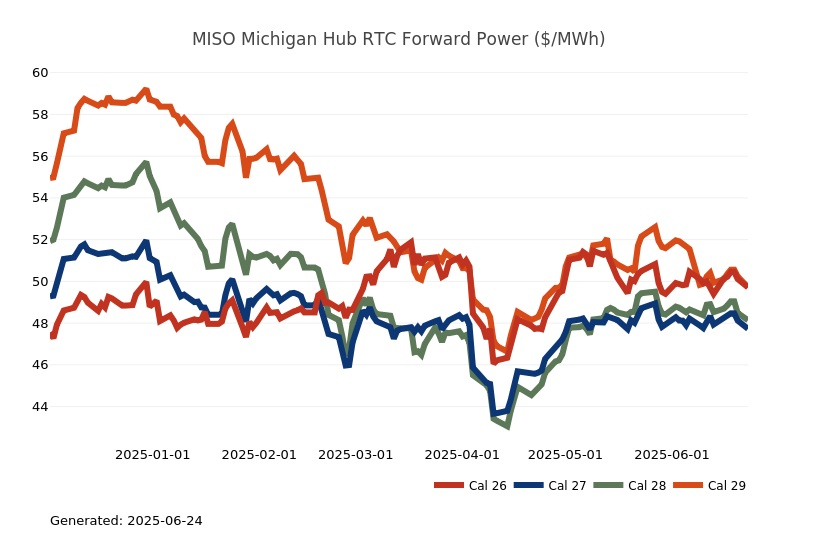

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices were higher last week as natural gas prices rallied above $4.00/MMBtu briefly, supported by this week’s heat. Gas prices sold-off the past couple of sessions, amid weaker spot prices, as milder temperatures later this week and some profit-taking seem to be in play as well. It will feel like summer across the eastern United States for most of this week under an expansive heat ridge that has set up over the region. This feature starts to back down later this week, with storm chances increasing. This lowers the heat but keeps the humidity going. The evolution of the pattern next week shows ridging backing down in the East and building in the West. Power futures were 1% higher last week throughout the 2026-2030 price curve with the Cal’26/27 strips 2% higher while the rest of the terms were unchanged. Forward prices over the past month were approximately 3% higher for all the terms. The month-to-date, day-ahead settlement price in COMED is averaging $36.53/MWh thus far, which is 24% higher than last month, while in AdHub those prices are averaging $40.72/MWh or 25% higher than the previous month. In Michigan, the month-to-date average price is currently 42.65/MWh or 24% higher than last month, while Ameren is averaging $39.79/MWh or 23% higher than the previous month of May.

- Illinois Holds Resource Adequacy Study Workshop - On 6/16, the Illinois Power Agency, Illinois Commerce Commission, and Illinois EPA held its first workshop on the resource adequacy study the agency is required by statue to complete annually by 12/15 starting this year. The agencies provided an overview of the statutory requirements, their planned study process, and planned stakeholder involvement. The resource adequacy study must identify whether a resource adequacy shortfall will occur in Illinois during the 5-year forecast period. If a shortfall is identified, then the resource adequacy study must develop an action plan to address the shortfall, which may reduce or delay emissions reductions requirements for in-state generators, as necessary, or identify resource needs to address the issue. The agencies’ consultant, E3, provided a workplan overview, covering resource adequacy in Illinois as a state in both the MISO and PJM markets, the planned modeling methodology, and key resource adequacy drivers and policy considerations. The workshop closed with questions to stakeholders about which variables are highest priority in the resource adequacy process, are they missing any important policies or drivers, which drivers are most critical to explore, and is there a blind spot or gaps in the study process that may be overlooked or not otherwise addressed. Feedback was largely focused on the importance of the load forecast and coordination.

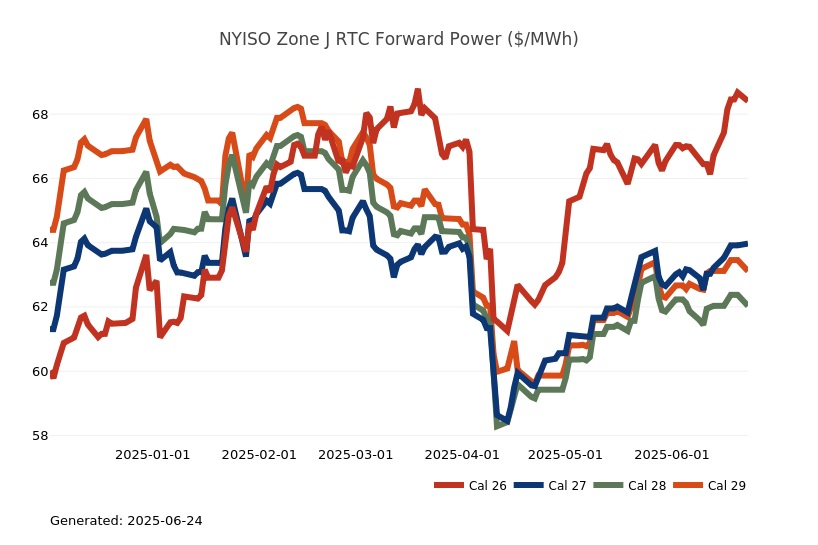

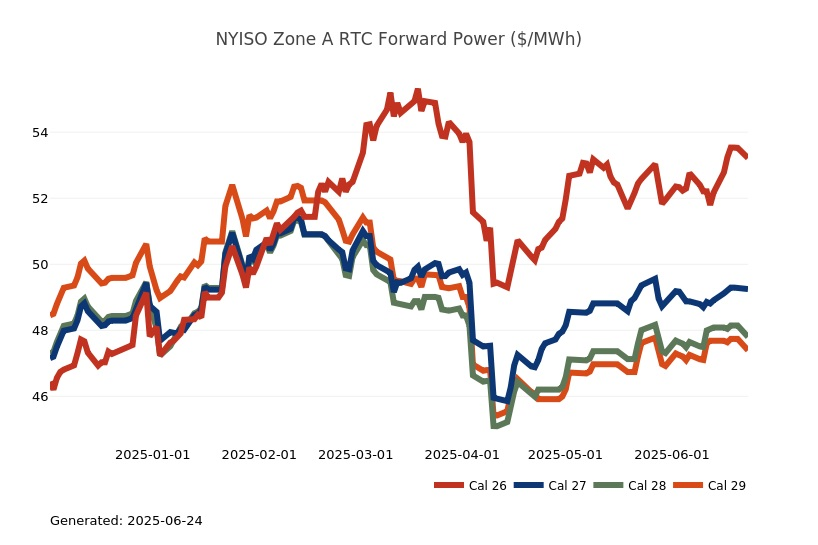

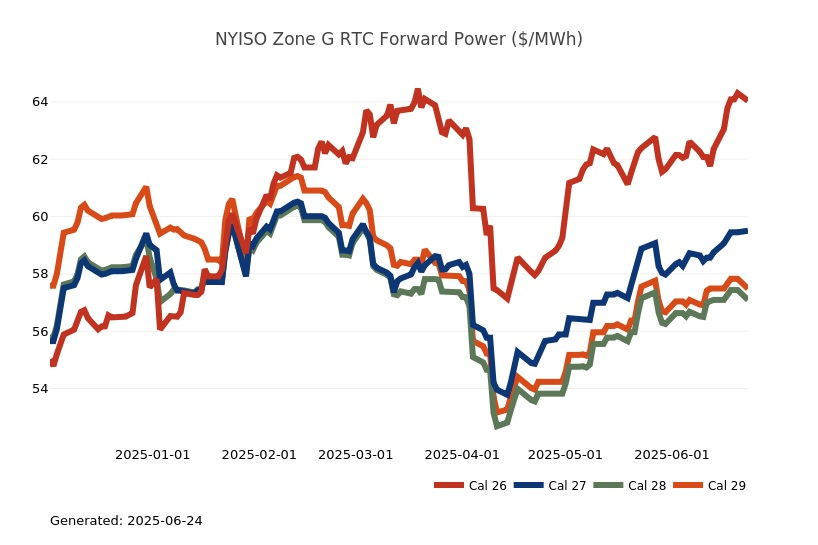

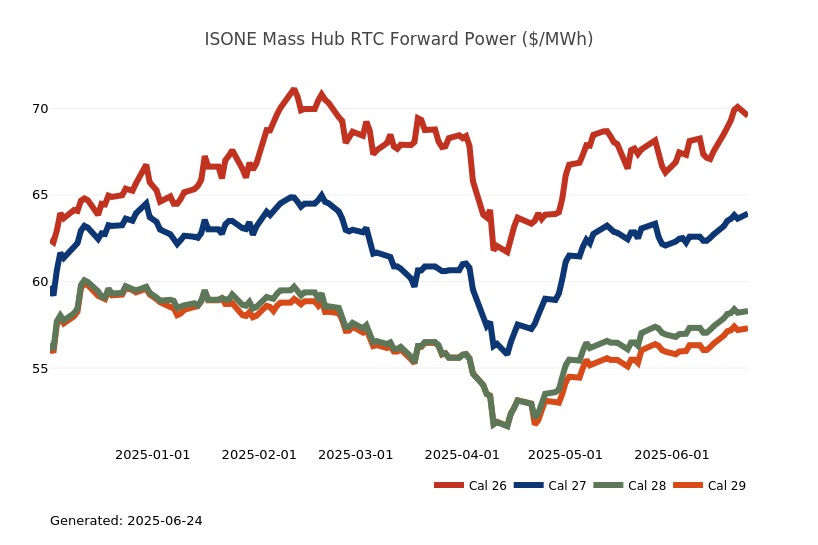

Northeast Energy Summary

- Last year, ISO New England (ISO-NE) initiated the Regional Energy Shortage Threshold (REST) project for stakeholders to better understand, particularly during severe weather events, the risk of unserved energy, consider what measure of risk the region is willing to accept, and to consider remedial measures if the risk of unserved energy exceeds the risk tolerance. ISO-NE began the REST initiative by developing a new model, the Probabilistic Energy Adequacy Tool (PEAT), to assess the risk of unserved energy. The PEAT model produces a probability-based distribution of forecasted unserved energy under certain conditions, including under severe, tail-risk weather conditions. At NEPOOL’s June 17 Reliability Committee (RC) meeting, ISO-NE introduced its proposed REST, a measure of duration and magnitude of modelled unserved energy in New England against which ISO-NE will assess the need, if any, to take risk-mitigating measures. The ISO proposes a risk tolerance level of 3% loss of load (on a per customer basis, over a 72-hour period) and 18 hours of cumulative unserved energy (over any 21-day period). According to ISO, the 3% and 18-hour standards would ensure the REST is triggered only for sustained and large energy shortfalls, not for minor or brief shortfalls. Once a REST is finalized, ISO-NE will run the PEAT model annually and compare the results to the REST. If the results show unserved energy during low-probability, tail-risk conditions exceeding both the 3% loss of load and 18-hour duration standards, ISO-NE will initiate a stakeholder process to consider what steps it and stakeholders should take. ISO-NE asked stakeholders to consider its proposed REST and provide ISO-NE with any written comments by July 17 for discussion at the August 19 Reliability Committee meeting. ISO-NE will codify the REST steps and regional risk tolerance threshold in Operating Procedure-21 (OP-21). ISO-NE plans to ask for NEPOOL votes on the OP-21 changes in the fall.

- An expansive heat ridge has set up over the East that will bring strong above normal temps across New York in the first half of the week. Temperatures are expected to reach triple digits in areas of the state on Tuesday, including New York City. The ridge starts to back down later this week, with storm chances increasing, lowering heat but keeping humidity high. Temperatures next week should back off and be close to normal. Given the strong heat and above normal temperatures, increased cooling demand will likely drive prices into the triple digits and quadruple digits, as was the case Monday afternoon when real-time prices spiked above $1000/MWh in several zones. Given the NYISO tariff establishes an ICAP annual system peaks must occur on a non-holiday weekday in July or August, this weeks heat will not set a new system annual peak for PLC/capacity tag purposes.

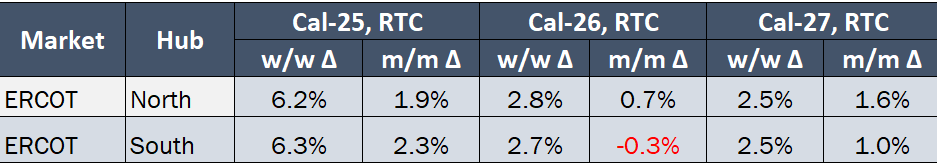

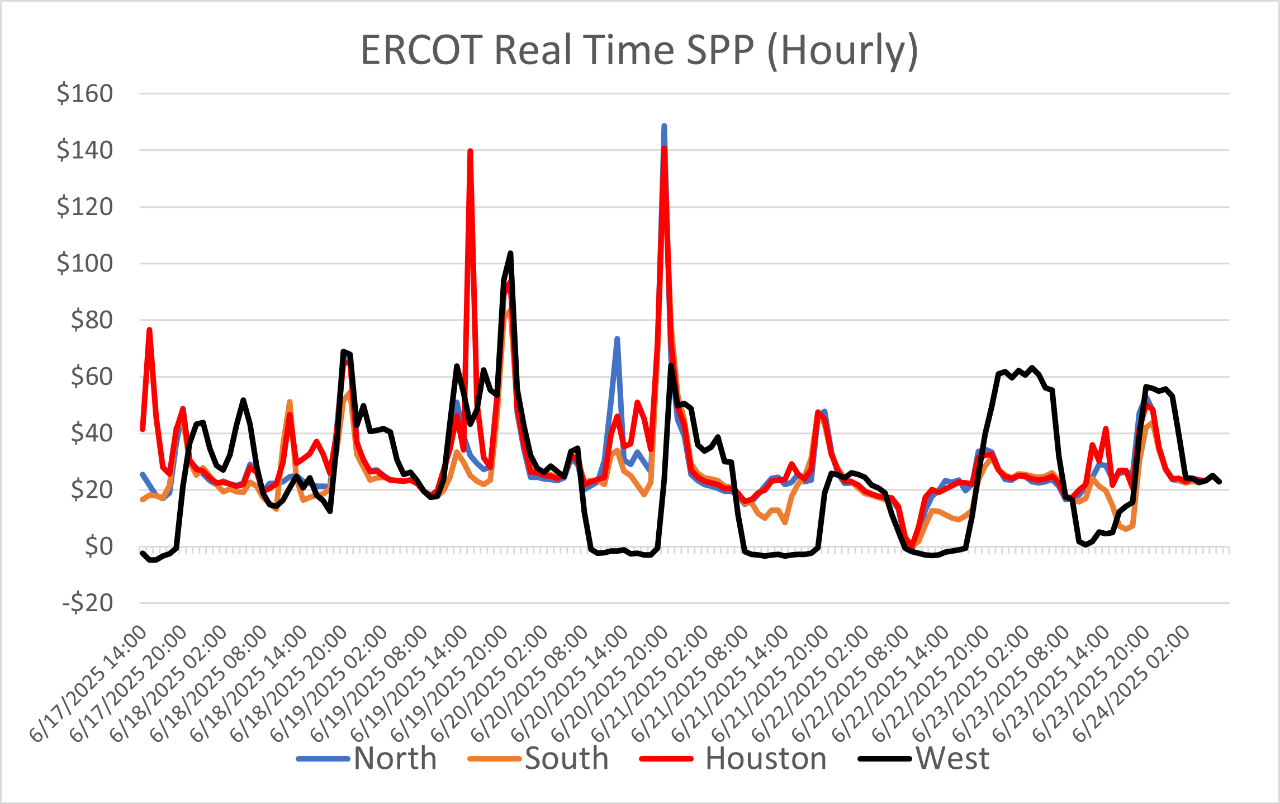

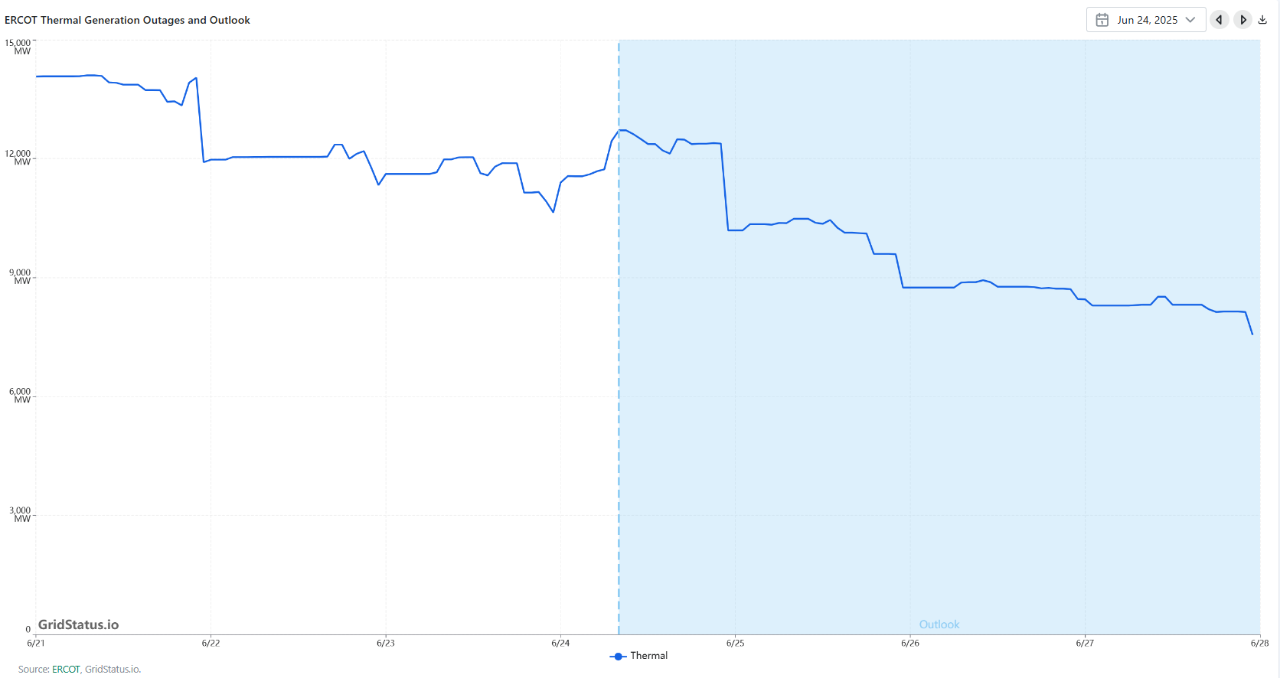

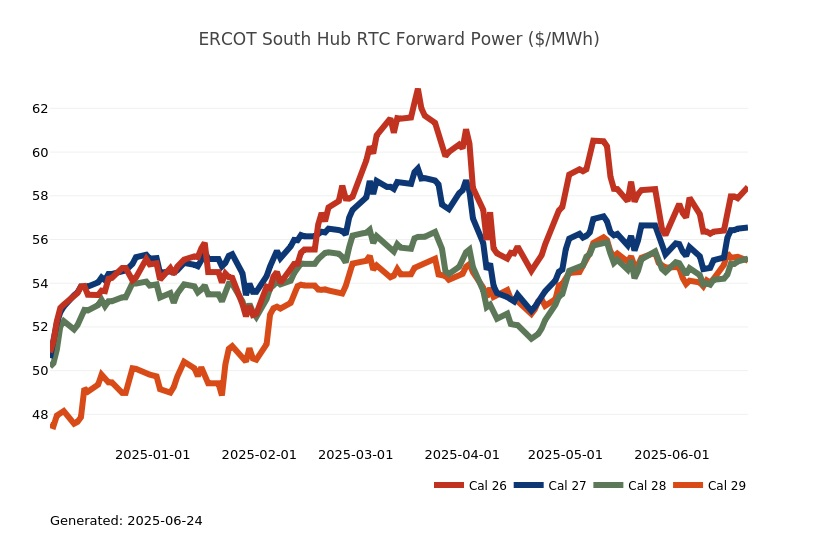

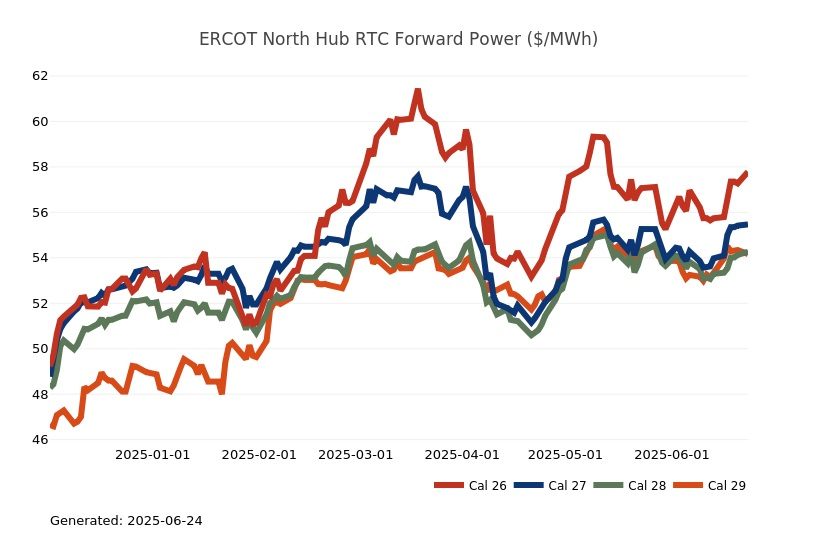

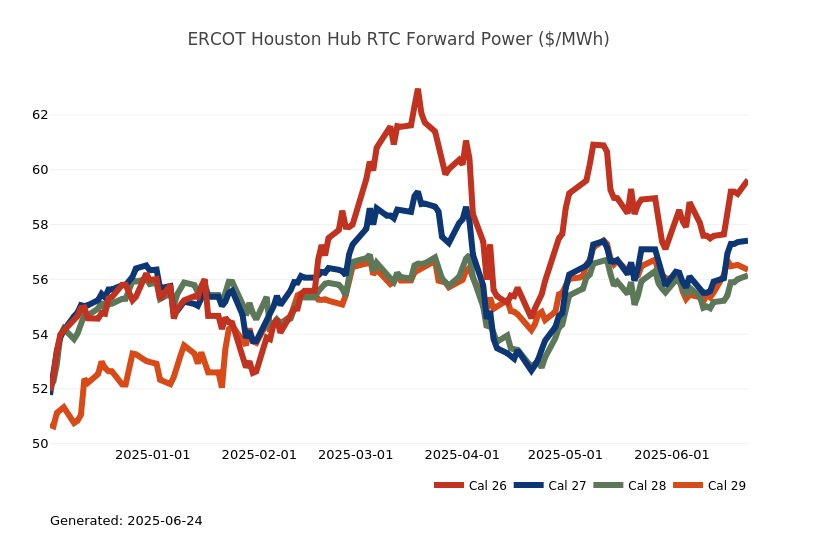

ERCOT Energy Summary

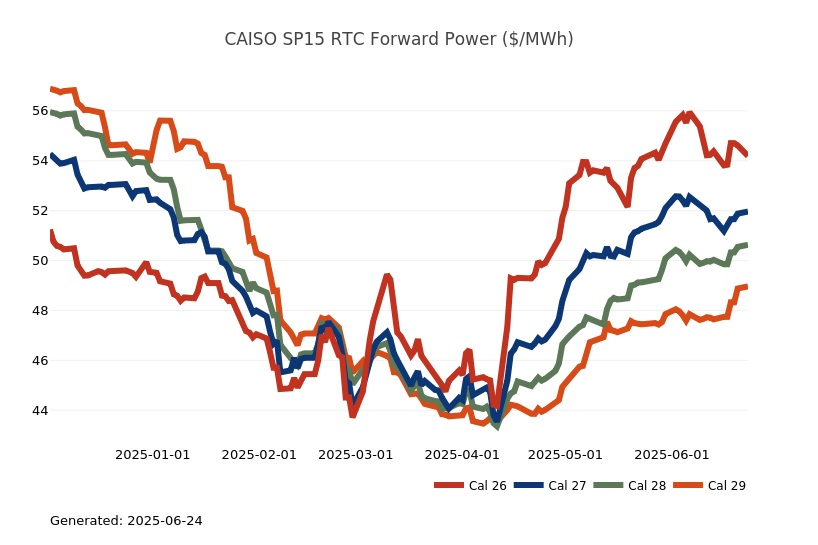

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- A major heat event is occurring across the eastern half of the U.S. early this week with record highs and warm lows expected. Several cities in the mid-Atlantic region are likely to tap 100o today or come within a degree of it. Meanwhile out West, a deep trough slid into the West over the weekend with below normal temperatures that even brought snow to the higher elevations of Montana on the first full day of summer. This trough will keep temperatures much below normal in the Interior today with cities like Salt Lake and Denver only seeing the upper 70s this afternoon and Vegas in the low-90s. As the week progresses, temperatures will moderate back toward and even slightly above normal by the end of the week. Warmth will return next week as a ridge builds across the region with the largest departures from normal across the northern Rockies and interior, places like Salt Lake could be in the upper 90s to lower 100s early next week, and daytime highs north of 110o in Phoenix. California and coastal population centers will likely remain closer to normal throughout the next couple of weeks. Overall thoughts did not change much heading into early July as the models continue to support an interior and Southwest focused hotter than normal weather pattern.

- The long-term maintenance tied to the North Zone (reminder: the critical notice was announced in mid-April, tied to the long term L4000 and L4002 maintenance work that is set to begin July 1st and end on November 1, 2026. This 18-month work will impact the North Zone transport capacity by 0.65 Bcf, which takes the working capacity down to roughly 1.0 Bcf, and Needles/Topock by more than 0.4 Bcf) is going to kick in next Tuesday, which means that the transport volume will be shifting around where there will be a reduction to the entire system by 0.3 to 0.4 Bcf/d. This explains the laser focus SoCalGas has had on injections throughout June. We expect the rate of molecules being injected to continue as the weather continues to deliver mild temperatures and moderate demand, knowing it can all change suddenly and the opportunity to build for next winter can disappear. Any notable heat in California continues to look minimal currently, but forecasts exists that call for heat late in the summer, which means August and September could get a little tight.

- Back at the CAISO Ranch, the price action coming out of the CAISO day-ahead and real-time markets of late is a good indication of what is transpiring on the grid as prices were settling in negative territory in SP15 in both markets while NP15 was seeing some sub-zero prints in real time. So far, given the young battery fleet, healthy hydro and the annual peak in daylight, the grid is capable of balancing with little effort. It should be noted that the off-peak block of hours is carrying a higher implied heat rate where natural gas is on the margin throughout the state. This low-price signal during daylight hours helps SoCalGas accomplish its mission to get as many molecules as possible in the tank prior to July 1, thus we expect to see an impressive injection rate into Aliso Cyn and other facilities this week. If SoCal is successful, they’ll have Aliso Cyn close to 56 Bcf by the end of the month which would be just shy of the 57.8 Bcf level at which it closed June 2024.

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, July 16 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Join us our Fortunato & Friends webinar on Tuesday, July 1 at 2 p.m. ET featuring Constellation's Chief Economist, Ed Fortunato and special guest, Jeff Hirsch, CEO of Hirsch Holdings, discussing energy and commodity markets in turbulent times.

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.