NOTE: We will note be sending the Energy Market Update the week of February 16 due to the federal holiday. We will return the week of February 23.

Weekly Energy Industry Summary

Commodity Fundamentals

Week of February 9, 2026

By The Numbers:

- Prompt month (March 2026) natural gas settled at $3.14/MMbtu, down $.28 on Monday, February 9.

- Prompt month crude oil settled at $64.36/bbl, up $.81 on Monday, February 9.

Natural Gas Fundamentals - Bearish

- Warmer weather enters the Midwest and Southeast driving down residential and commercial demand in its wake.

- The March Nymex contract settled at $3.14/MMBtu, down $.28/MMBtu.

- Production is back above 108 Bcf per day as freeze offs have largely abated.

- Demand from power generation, and residential/commercial customers dropped 8 Bcf over the past day in response to much warmer temperatures.

- Storage inventories are largely expected to end the season below the five year average which gives some measure of support to pricing action.

- Global LNG prices are soft, with prompt TTF trading $11.70, NBP at $10.80 and JKM at 11.10/MMbtu. Soft LNG prices are bearish of domestic natural gas all other things being equal.

- Bearish weather and recovered domestic supply are bearish of pricing action this week.

Crude Oil - Neutral/Bullish

- Oil prices bumped up $.81/bbl as WTI settled at $64.36 amid continued uncertainty regarding Iran and potential U.S. military action.

- Reports of "easing tensions" pursuant to diplomatic efforts are punctuated by news of the U.S. advising ships to steer clear of the Straits of Hormuz, the largest crude oil shipping lane globally.

- Concerns are rising relative to negotiations between Iran and the U.S. coming to an agreement on Iran ending its nuclear fuels enrichment program and the ongoing social unrest in the country.

- Insiders say that India's imports of Russian crude oil may drop by half under pressure from the Trump Administration.

Economy - Neutral

- December retail sales were flat, falling well short of estimates, CNBC reports.

- Economic data on non-farm payrolls for January will be coming later this week with expectations of a gain of 55,000 reported.

- Unemployment is expected to remain unchanged at 4.4%.

- The January consumer price index will be published on Friday.

- Weekly initial jobless claims will be released on Thursday.

Weather - Bearish

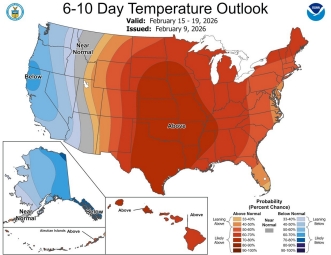

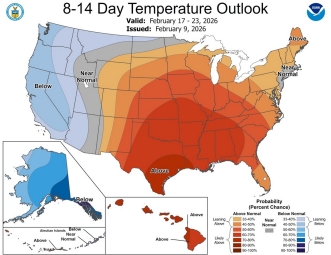

- The 16-30 day outlook shows milder air driving into the Midwest, South and Southeast with above normal conditions through much of the country.

- The exception is the far northern tier and the northeast where more "normal" conditions will persist.

- There is cold air available in western Canada, however there is no blocking mechanism currently to allow that air to flow into the U.S.

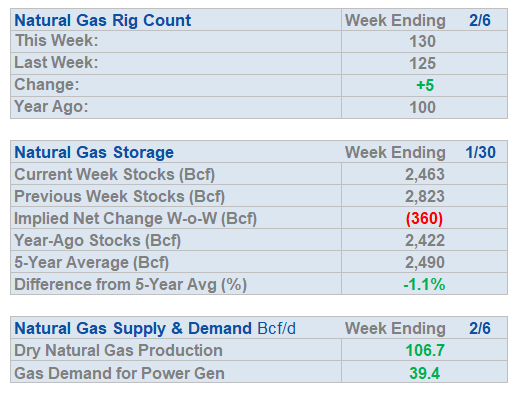

Weekly Natural Gas Report

- Inventories of natural gas in underground storage for the week ending January 30 are 2,463 Bcf; a withdrawal of 360 Bcf was reported for the week ending January 30.

- Gas inventories are 27 Bcf less than the five-year average and 41 Bcf more than the same time last year.

Weekly Power Report:

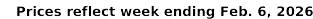

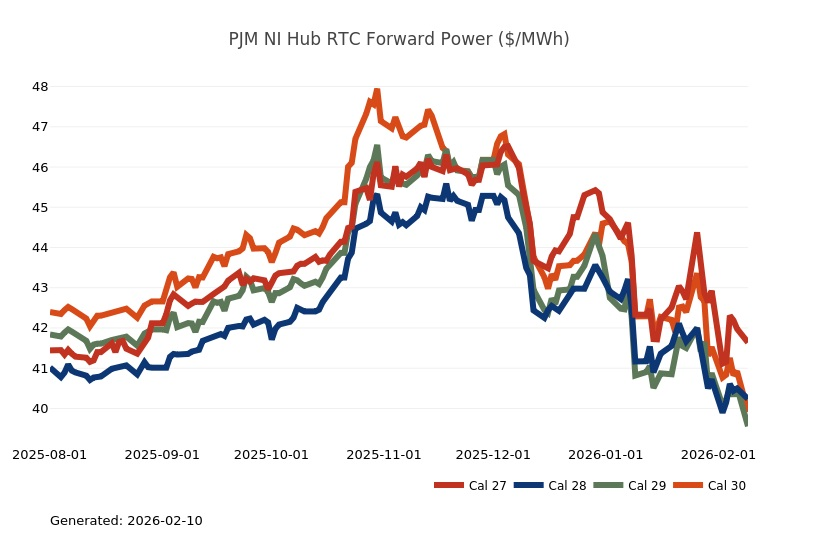

Mid-Atlantic Electric Summary

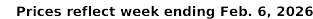

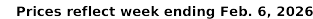

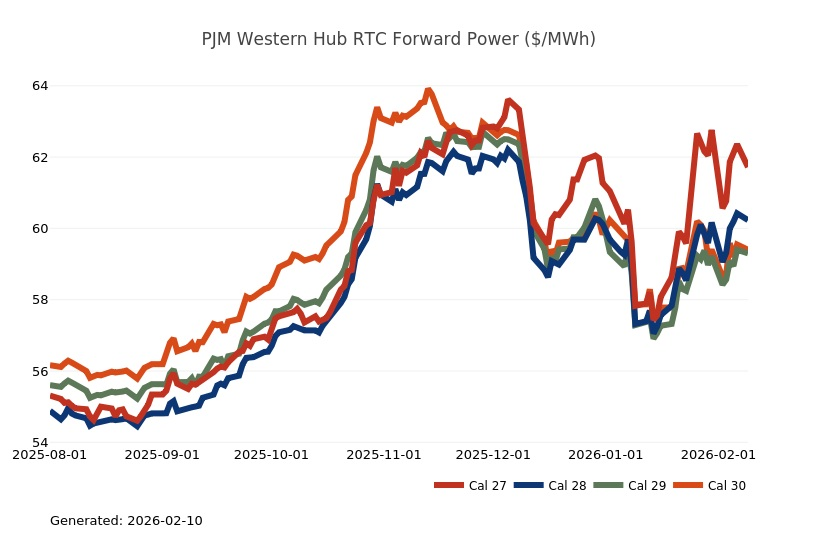

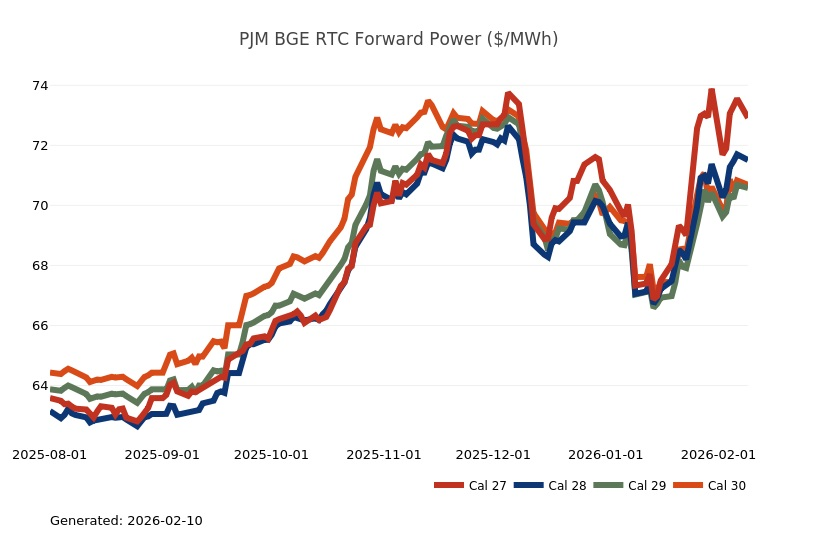

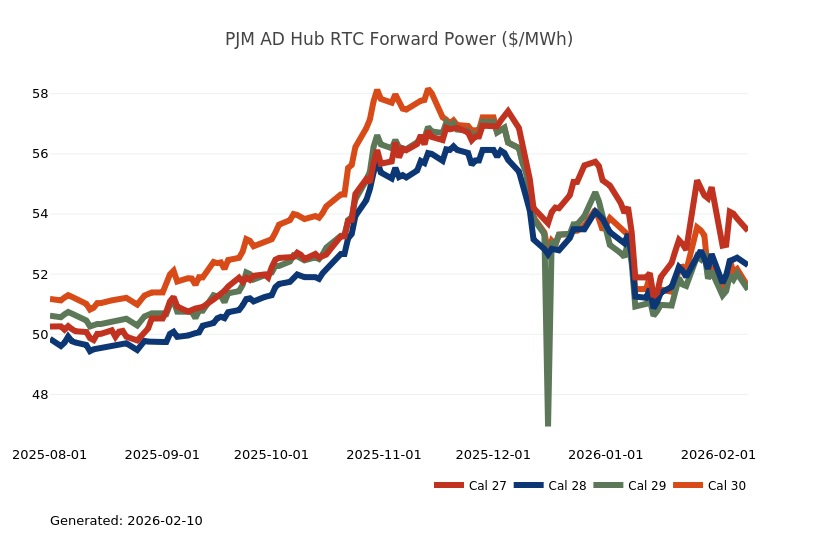

- The Mid-Atlantic Region’s forward power prices were lower over the past week, as changing forecasts began weighing on the markets. Nymex natural gas futures lost ground on Friday as two-week forecasts offered little bullish support. U.S. natural gas futures fell by more than 8% on Monday as weather forecasts turned slightly warmer and most of the freeze-off production is back except for the Northeast. A trough in the West is bringing storms and cooler-than-normal conditions. This shifts the main ridge axis over the Mid-continent, where temperatures will average well above normal as milder Pacific air pushes out the cold air. The farther east you go, the less protection there is from the Mid-continent ridge. This means storms within the pattern can bring some colder days to the far north and Northeast. Forward power prices for the 2026-2030 terms, last week, were -2% lower with a -13% decrease for the balance of 2026 and only a 1% increase for the 2028-2030 terms. The final, day-ahead settlement price average in West Hub for January is $154.93/MWh, which is 132% higher than January’s final settlement price last year in 2025.

- PJM Reports Preliminary Winter Storm Fern Results; Significant Uplift Charges - At the 2/5 Operating Committee meeting PJM reviewed the operations and market impacts of Winter Storm Fern and prolonged cold that hit the region between 1/23 - 2/2. The two highest peak days during this period were 1/29 (139,046 MW) and 1/30 (138,479 MW), both of which are in the top ten all-time PJM winter peaks. PJM secured 202(c) waivers from the Department of Energy to allow units to run above their permit limits. Thirty-nine units with an ICAP value of 5.2 GW ran a total of 1,035 hours above their permit limits under the exemption.

- PJM discussed issues with its load forecast, including one over-forecast of ~10GW, and noted that it needs to better understand the impacts of building and school closures on load. While gas production remained strong, spot gas prices through this event reached historic levels throughout the eastern U.S. with many hubs trading well over $100/MMBtu with prices in New York and New England approaching $300/MMBtu. Generator performance throughout the event was considered strong, with a generator outage rate of 13.26%, although generator performance included advance commitment of 50-60 GW throughout the week.

- Finally, PJM acknowledged that transmission outages impacted clearing prices. Day-Ahead Total Locational Marginal Price (LMP) peaked at $2,314.58/MWh while Real-Time Hourly LMP stayed below $1,000/MWh. PJM called pre-emergency Demand Response for BGE, DOM and PEPCO on 1/25 to preserve generation for later in the week. Localized congestion also peaked on 1/25 with 14 out of 18 active constraints bound at the $2,000/MWh penalty factor. PJM noted unit self-scheduling of between 68,632 MW and 53,008 MW per day. PJM noted that market rules currently under review in the stakeholder process address fuel certainty, unit forced outage risk and forecast error.

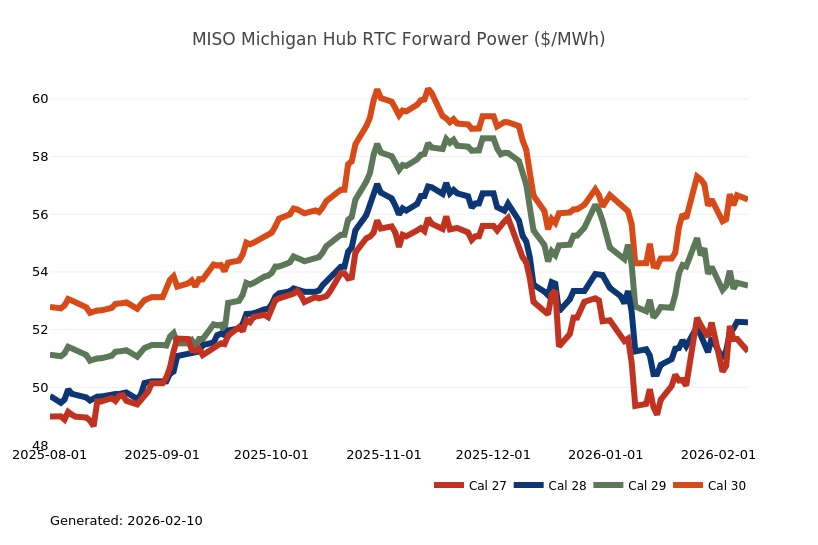

Great Lakes Electric Summary

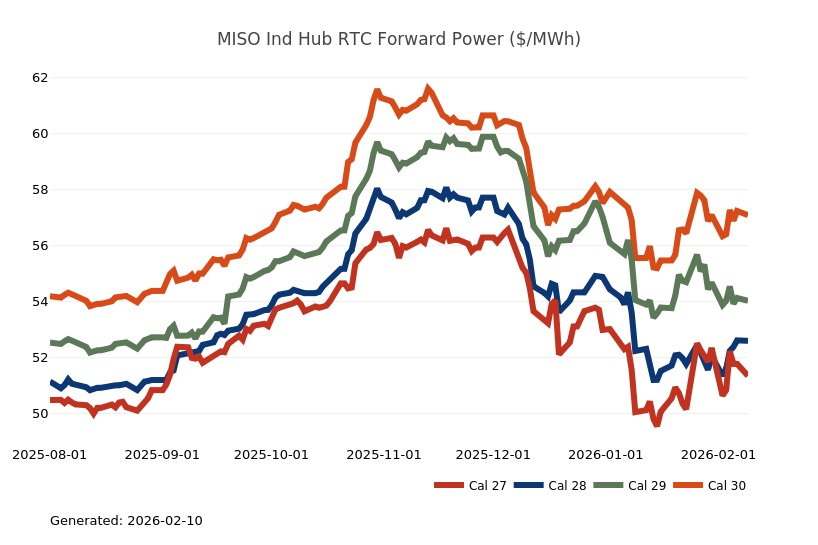

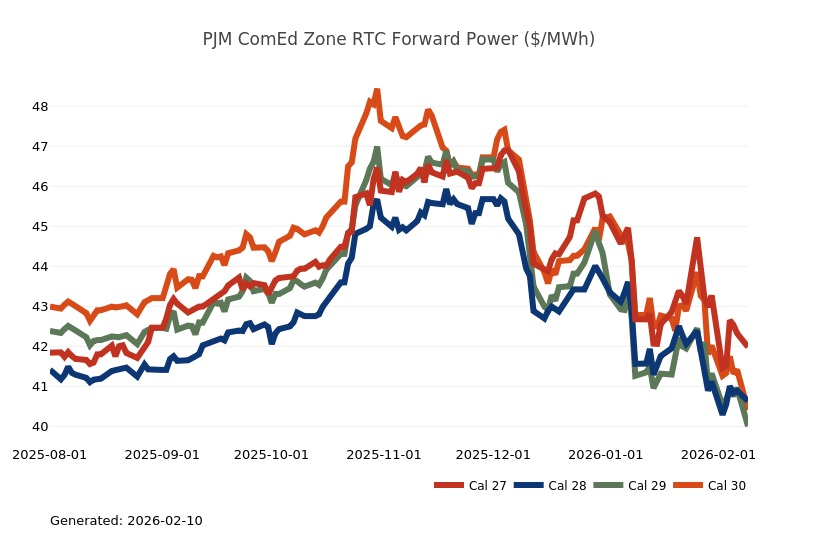

- The Great Lakes Region’s forward power prices were lower over the past week, as the expectation of warmer temperatures started weighing on markets. Nymex natural gas futures lost ground on Friday as two-week forecasts offered little bullish support. U.S. natural gas futures fell by more than 8% on Monday as weather forecasts turned slightly warmer and most of the freeze-off production is back except for the Northeast. A trough in the West is bringing storms and cooler-than-normal conditions. This shifts the main ridge axis over the Mid-continent, where temperatures will average well above normal as milder Pacific air pushes out the cold air. The farther east you go, the less protection there is from the Mid-continent ridge. This means storms within the pattern can bring some colder days to the far north and Northeast. Forward power prices for the 2026-2030 terms, last week, were -2% lower overall, with a -7% decrease for the balance of 2026 and neither an increase or decrease for the 2028-2030 terms. The final, day-ahead settlement price average in COMED for January was $84.57/MWh, which is 85% higher than January’s final settlement price last year, while in AdHub the final price settled at $104.46/MWh for the month or was 85% higher year-over-year. In Michigan, those final settlement averages for January were $98.36/MWh or 98% higher than last year for the same month, while in Ameren the final index price averaged $92.81/MWh or was 95% higher than last year.

- PJM Reports Preliminary Winter Storm Fern Results; Significant Uplift Charges - At the 2/5 Operating Committee meeting PJM reviewed the operations and market impacts of Winter Storm Fern and prolonged cold that hit the region between 1/23 - 2/2. The two highest peak days during this period were 1/29 (139,046 MW) and 1/30 (138,479 MW), both of which are in the top ten all-time PJM winter peaks. PJM secured 202(c) waivers from the Department of Energy to allow units to run above their permit limits. Thirty-nine units with an ICAP value of 5.2 GW ran a total of 1,035 hours above their permit limits under the exemption.

- PJM discussed issues with its load forecast, including one over-forecast of ~10GW, and noted that it needs to better understand the impacts of building and school closures on load. While gas production remained strong, spot gas prices through this event reached historic levels throughout the eastern U.S. with many hubs trading well over $100/MMBtu with prices in New York and New England approaching $300/MMBtu. Generator performance throughout the event was considered strong, with a generator outage rate of 13.26%, although generator performance included advance commitment of 50-60 GW throughout the week.

- Finally, PJM acknowledged that transmission outages impacted clearing prices. Day-Ahead Total Locational Marginal Price (LMP) peaked at $2,314.58/MWh while Real-Time Hourly LMP stayed below $1,000/MWh. PJM called pre-emergency Demand Response for BGE, DOM and PEPCO on 1/25 to preserve generation for later in the week. Localized congestion also peaked on 1/25 with 14 out of 18 active constraints bound at the $2,000/MWh penalty factor. PJM noted unit self-scheduling of between 68,632 MW and 53,008 MW per day. PJM noted that market rules currently under review in the stakeholder process address fuel certainty, unit forced outage risk and forecast error.

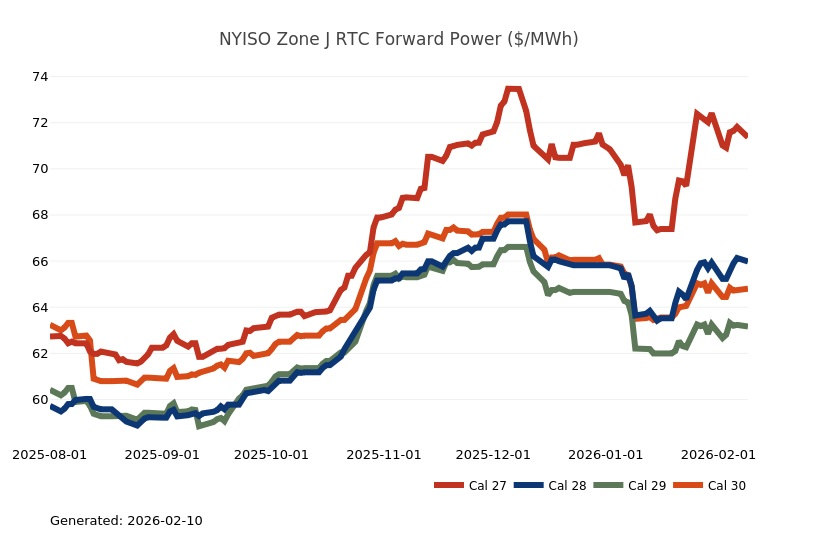

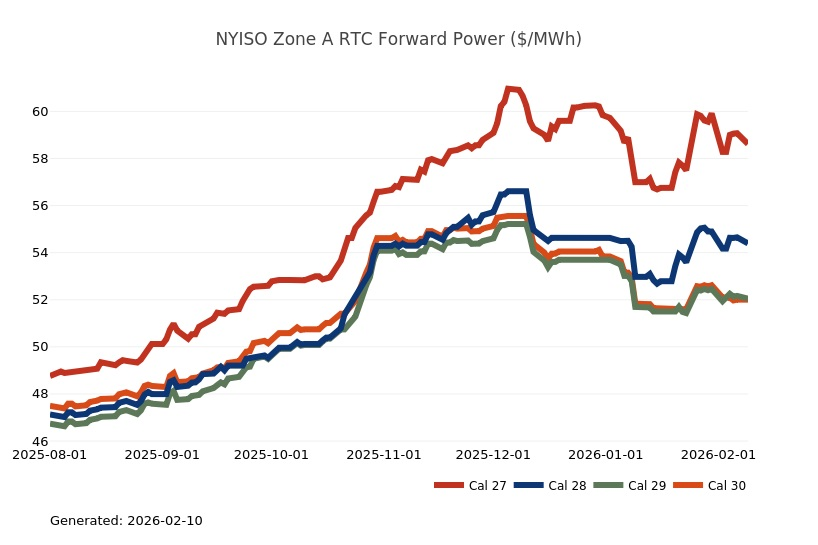

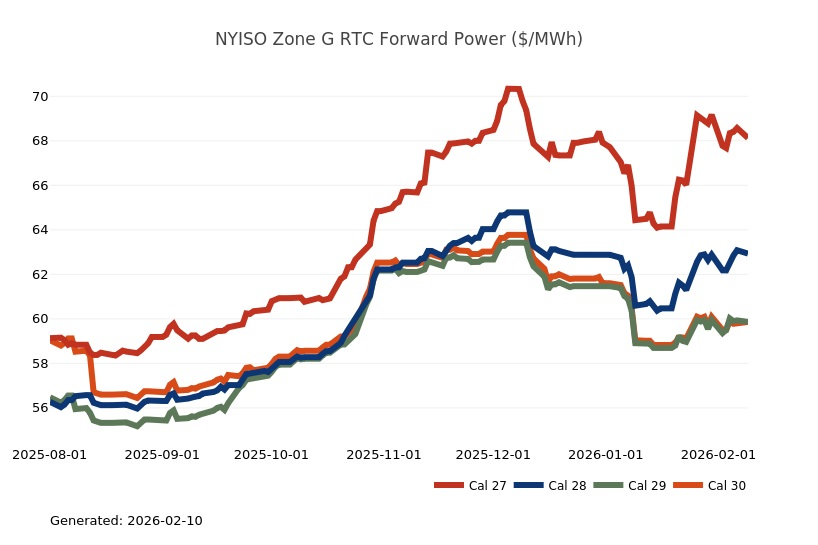

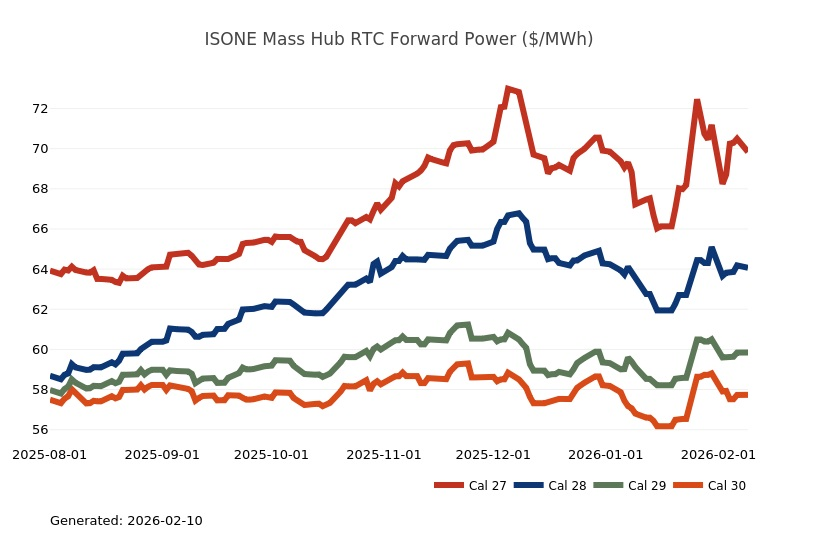

Northeast Energy Summary

- Temperatures averaged 14⁰ below normal for the last 9 days of January, and the ISO noted managing the system during this period has been the most challenging since the winter of 2017-18. Daily system peak load (~18.5GW, on average) abated somewhat relative to last week (~19.5GW), both are above normal (and not seen at these levels since winter of 2017-2018) but within 1.4% of forecast. Real-time Operating Reserve margins remain comfortably surplus. Between 1/24 and 2/1, energy from oil-fired and gas-fired generation each accounted for ~28% of all energy, with nuclear, imports, renewables and hydro contributing 19%, 11%, 9%, and 5% respectively. For this same period, total fuel oil burned was ~66 million gallons, exceeding by over 15 million gallons that used in the previous four winters. On 1/30, the DOE approved a two-week extension of the 202(c) waiver of environmental limits (now through 2/14). As of 2/1, there are 57 units on waiver request, with 21 reporting emission exceedances.

- Prices have abated and steadied. The ISO reports that the monthly energy market value in January was ~$2.3 billion (the highest in over a decade), and that the daily energy market value on 1/27 (~$422 million) was approximately two and one-half times higher than the previous high (~$170 million on 1/23/14). Forecasted Energy Requirement (FER) prices have likewise moderated this week compared to last week, and for January ISO reports FER credits were 15% of total DA E&AS market value. In summary, the system appears to be holding up well (albeit expensive) as we pass through this extended cold snap.

- Net energy imports from Canada have resumed. NECEC has been importing ~1.1 GW around the clock since 2/1, while Phase II has varied between ~300-1,200 MW. When NECEC is injecting energy, there is oftentimes significant congestion pricing in Maine ($200+/MWh) not seen prior to NECEC’s 1/16 in-service date.

- In an uncharacteristic move ISO-NE added two new items to its 2026 work plan which is typically difficult to revise once set: 1) Modifications to Pay-for-Performance (PfP). The FERC recently issued a compliance order in response to the New England Power Generators Association’s Section 206 complaint, arguing among other things, the Balancing Ratio during a PfP event should be capped at 1.0. This prevents resources from being charged penalties for not delivering more than 100% of their obligated amount. The ISO also pledged to address a loophole that unfairly benefits exports during a PfP event (a 2024 External Market Monitor recommendation) as well as examine lowering the PfP rate (currently $9,337/MWh). ISO must make a compliance fining by 7/21. 2) Modifications to Day-Ahead Ancillary Services (DASI). The ISO will also be addressing the IMM’s recommended modifications to DASI (released 2/4). The IMM made three recommendations: 1) increase the strike price, 2) reduce the Forecast Energy Requirement (FER) constraint, and 3) reduce or eliminate the reserve non-performance factor (i.e., the bias that increases the reserve requirements). Each of these recommendations will be discussed with stakeholders in detail beginning in April, with a targeted effective date by end of year.

- U.S. district judge ruled in favor of the Sunrise Wind project, rejecting the Trump administration’s national‑security rationale for halting construction. Sunrise Wind - an Ørsted‑developed, 924‑MW offshore wind project off New York’s coast - successfully argued that the stop‑work order was unsupported and financially damaging, with potential losses exceeding $8 billion if delays continued. Ørsted plans to resume work immediately following the ruling. The case unfolds against the backdrop of a politically charged energy debate in New York, where Republican gubernatorial candidate Bruce Blakeman has attacked Governor Kathy Hochul over rising energy costs, linking them to state climate policies and utility surcharges. While energy prices have been driven in part by infrastructure investments and elevated fossil fuel costs, climate‑policy‑related charges account for roughly 9.5% of a typical National Grid residential bill. Hochul has emphasized affordability and reliability, signaling openness to modifying aspects of the state’s 2019 climate law and utility rate‑setting processes. The governor continues to support offshore wind, contrasting sharply with Blakeman’s “all‑of‑the‑above” critique and Trump’s assertion that wind energy is a “scam.” All paused offshore wind projects have now secured court victories enabling construction to restart, underscoring the tension between federal actions and New York’s clean‑energy ambitions.

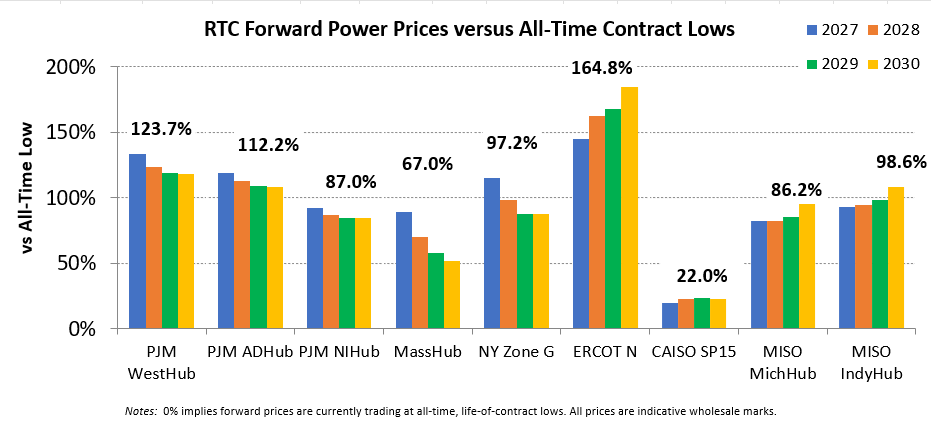

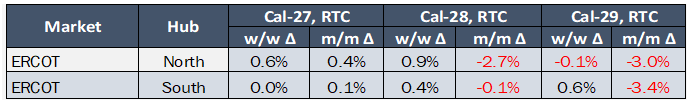

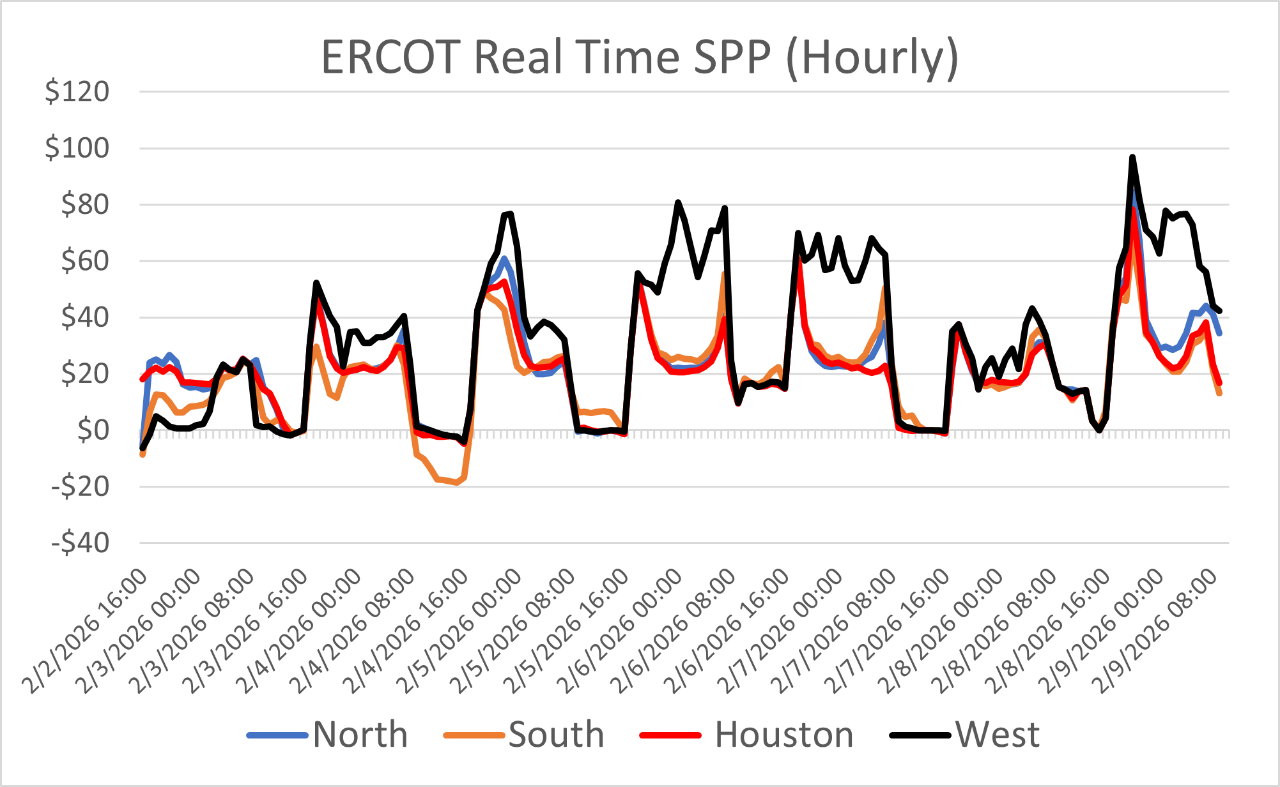

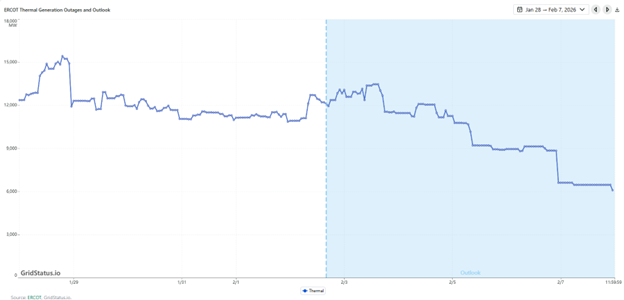

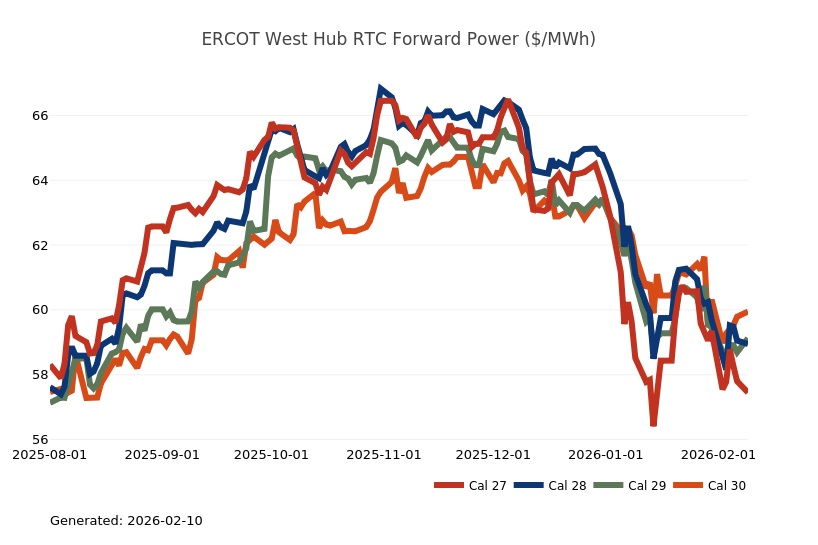

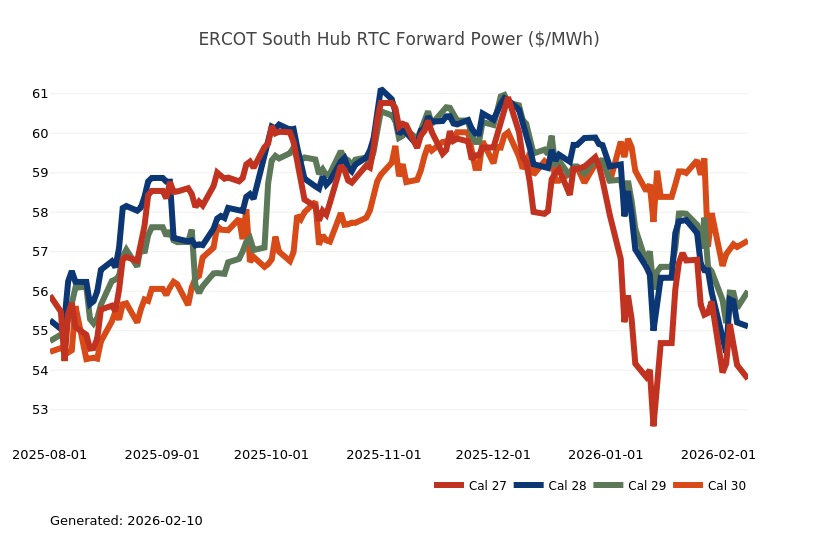

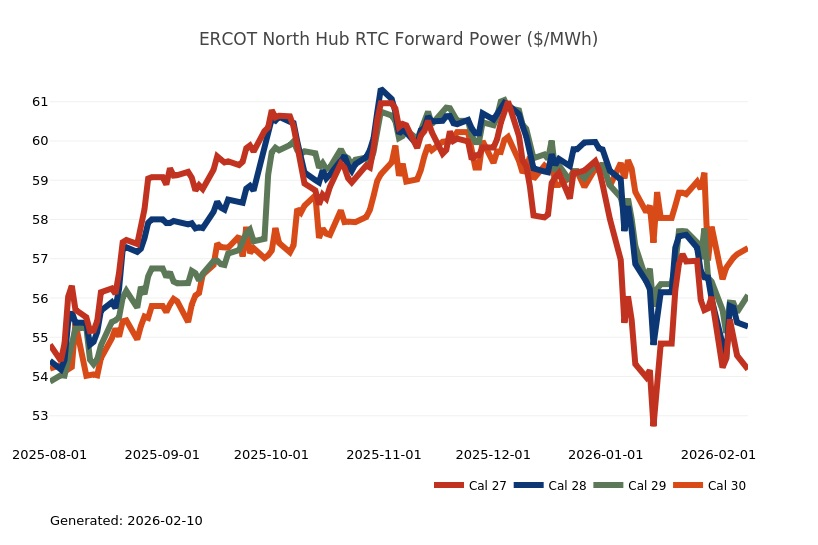

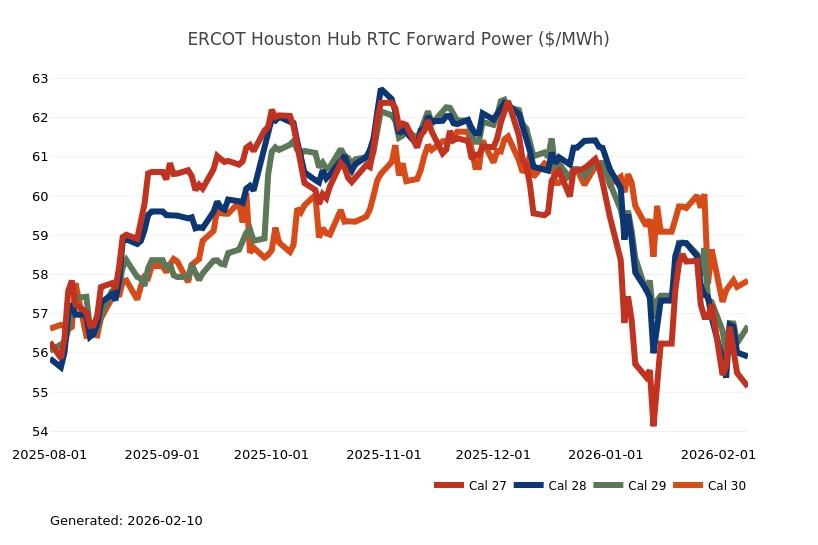

ERCOT Energy Summary

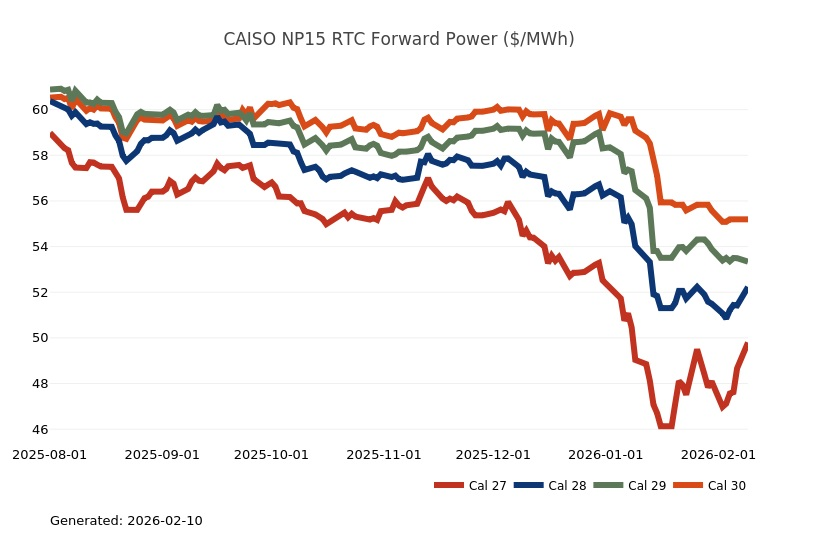

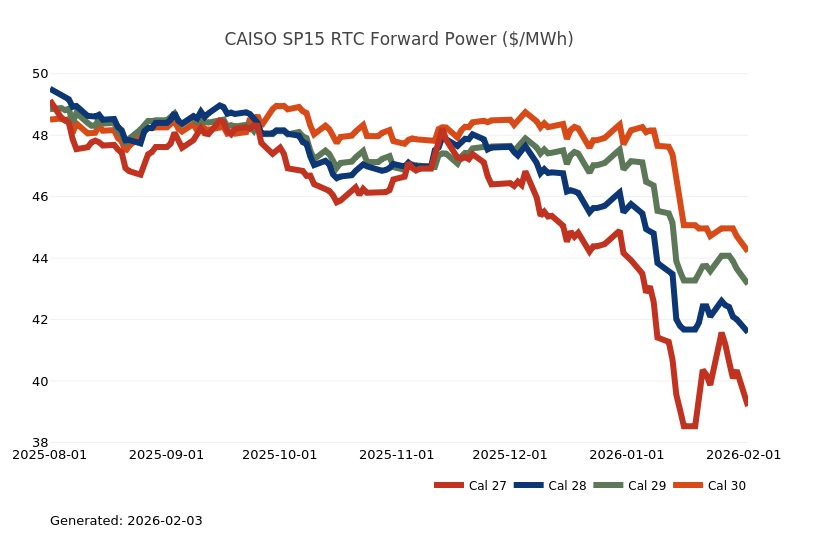

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- Warmth will linger across California and the Southwest to start the week before the pattern becomes more unsettled towards the middle of the week with an increase in storminess to the region. The pattern then looks to turn colder towards the end of this week and into the weekend as a trough digs into the left side of the map. Temperatures don't look all that extreme but will be below normal. Colder than normal temperatures are expected to persist into next week along with a very stormy pattern, mostly into NorCal and the Pacific NW. Overnight lows in the 40s will be common for California, which after the recent few weeks of much above level temperatures, will feel downright frigid. Bottom line, sadly the very warm start to February will come to an end this week for much of the West as the pattern turns colder and stormier heading into the back half of the month. One upside could be found in the chances that the upcoming precipitation arrives in the form of snowpack which may provide some relief to the underperformance of the West water year to date.

- SoCalGas is facing operational constraints in their North Zone due to the Line 225 force majeure notice from a few months back. SoCalGas stated the assessment and exploration period will be coming to an end in March and the work to fix the damaged pipe will begin in April and is expected to take months. The near-term impact from this news should be minimal given the grid has been able to handle the outage up to this point and we are headed towards a period on the grid where renewables alleviate the need for thermal gen and batteries further lighten the load. We still need to get through the upcoming colder weather, but for now nothing taxing appears headed in this direction. The days where High operational flow orders (OFOs) are in play within PG&E’s gas grid are going to be a common theme this spring given the natural gas demand outlook tied to power burns and other consumption components. An example of this was seen last week when PG&E was starting to let the High OFO notices fly. Given the small volume of gas withdrawn from storage this season, tolerances for system balancing are small.

- Also indicative of what is likely to be seen this spring, congestion was a common theme in the day ahead settlements on the CAISO last week as solar production was high which drove midday prices in SP15 well under those seen in NP15 for the same period. Fortunately for SoCalGas, this helps with system balancing given their constraints in the North Zone noted above; day ahead index buyers will rejoice as the peak solar hours clear below the $0 MWh waterline. We need to get through the near-term change in the forecast towards colder temps later in the week, which see the morning ramp period become the period of most price escalation.

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, February 25 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for information regarding our next Fortunato & Friends webinar featuring Constellation's Chief Economist and a special guest

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.