Weekly Energy Industry Summary

Commodity Fundamentals

Week of February 23, 2026

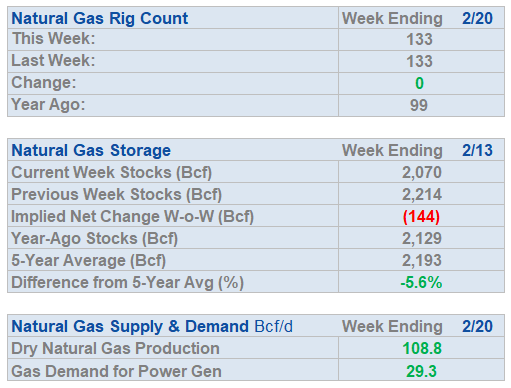

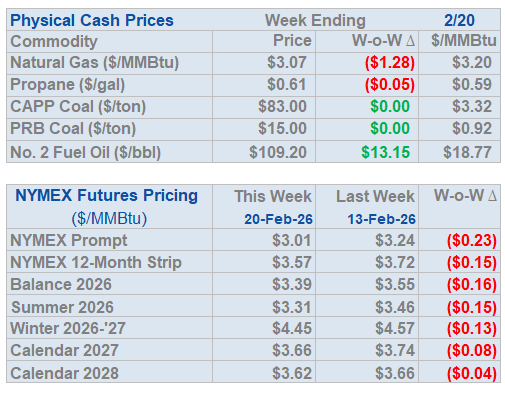

By The Numbers:

- Prompt month (March 2026) natural gas settled at $2.99/MMbtu, down $.06 on Monday, February 23.

- Prompt month (March 2026) natural gas settled at $3.14/MMbtu, on Monday, February 9.

- Prompt month crude oil settled at $66.31/bbl., down $.08, on Monday, February 23.

- Prompt month crude oil settled at $64.36/bbl., on Monday, February 9.

Natural Gas Fundamentals - Bearish

- A major winter storm blew through the Northeast dumping two feet of heavy snow on New York City and near record amounts through New England and Cape Cod. High winds accompanied the snow.

- The natural gas market shrugged off the storm amid record production, and cold weather confined mostly to the northeast and upper-Mid-Atlantic.

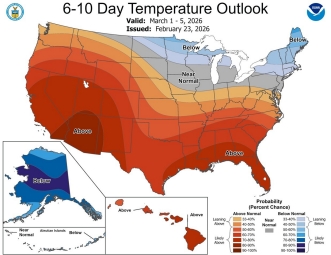

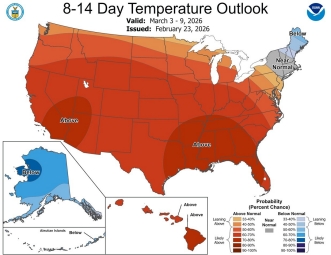

- The coldest anomalies for the next ten days will be in Northeast and some storminess is on tap for the Upper Midwest and Mid Atlantic, followed by a general warming trend in the 11-15 day forecast.

- Production is near all-time-high levels; month-to-date production averaged 109.1 Bcf per day versus 104.4 Bcf per day for the same period last year.

- Power generation demand, month-to-date, averaged 33.3 Bcf per day versus 34.5 Bcf per day for the same period last year.

- Residential/commercial demand, month-to-date, averaged 41.2 Bcf per day, versus 46.4 Bcf per day for the same period last year.

- Industrial demand, month-to-date, averaged 25.2 Bcf per day, versus 26.4 Bcf per day for the same period last year.

- LNG exports, month-to-date, averaged 18.7 Bcf per day, versus 15.5 Bcf per day for the same period last year.

- Mexico exports, month-to-date, averaged 5.4 Bcf per day, versus 5.9 Bcf per day for the same period last year.

- In general, production in February is up 4.7 Bcf per day versus last year while demand is down 4.9 Bcf per day. That difference is a major factor in the near-term pricing action.

Crude Oil - Bullish

- Oil prices continue to climb a "wall of worry" as U.S. military assets continue to pour into the Middle East in what appears to be a showdown with Iran.

- Iran proposed sending part of its highly enriched uranium abroad, diluting the remainder, and participating in a regional enrichment consortium in exchange for sanctions relief and recognition of its right to peaceful enrichment.

- The Trump Administration has delayed military action for now, but continues to reinforce U.S. military assets in the Persian Gulf as talks are set to resume in Geneva.

Economy - Neutral

- Cross border trade with Mexico has slowed as violence has erupted in over one third of the country following the killing of a drug cartel boss. Freight companies are warning that airport and trucking logistics operations could face significant hurdles, CNBC reports. Mexico is one of the top trading partners of the U.S.

- The U.S. Supreme Court ruled against the Trump Administration throwing out a significant number of tariffs imposed by the president. The decision was widely expected, however, the Administration indicated no willingness to back down noting that other statutory authority could be used to create new tariffs to replace the previous ones.

- Growth expectations for the fourth quarter came in lower than expected with GDP accelerating at 1.4% on an annualized basis. The Administration cited the government shutdown as having removed two percentage points from fourth quarter growth figures.

Weather - Neutral

- The 16-30 day outlook shows milder air driving into the Midwest, South and Southeast with above normal conditions through much of the country.

- The exception is the far northern tier and the northeast where more "normal" conditions will persist.

- There is cold air available in western Canada, however there is no blocking mechanism currently to allow that air to flow into the U.S.

Weekly Natural Gas Report

- Inventories of natural gas in underground storage for the week ending February 13 are 2,070 Bcf; a withdrawal of 144 Bcf was reported for the week ending February 13.

- Gas inventories are 123 Bcf less than the five-year average and 59 Bcf less than the same time last year.

Weekly Power Report:

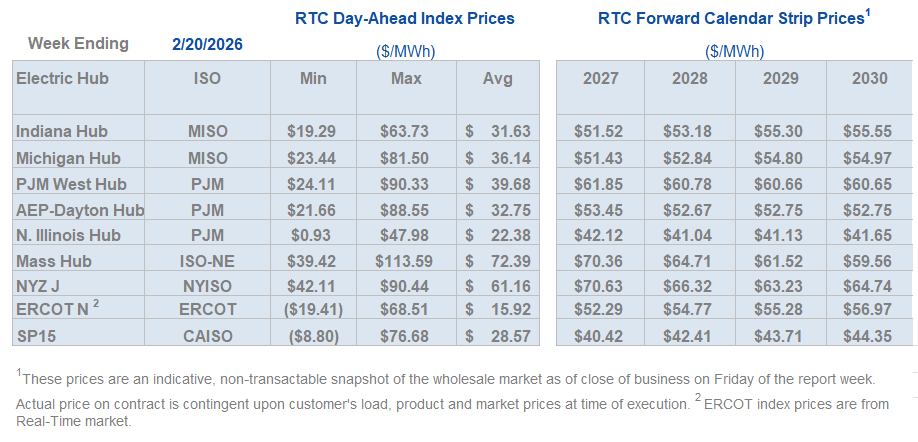

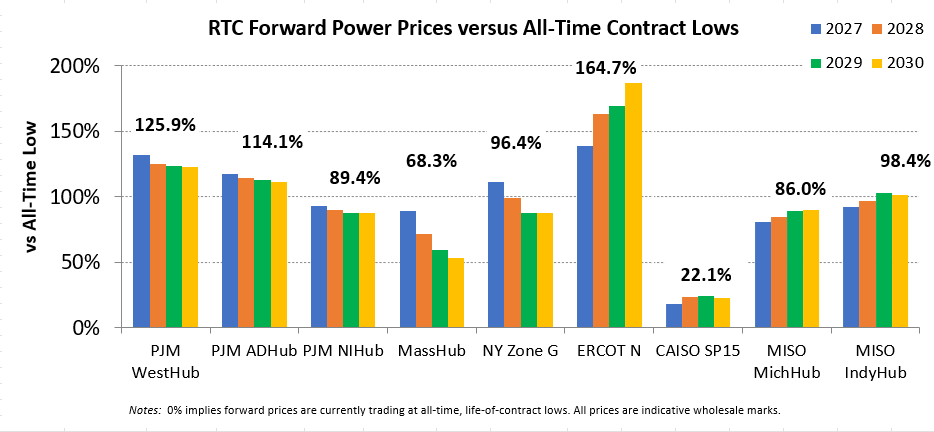

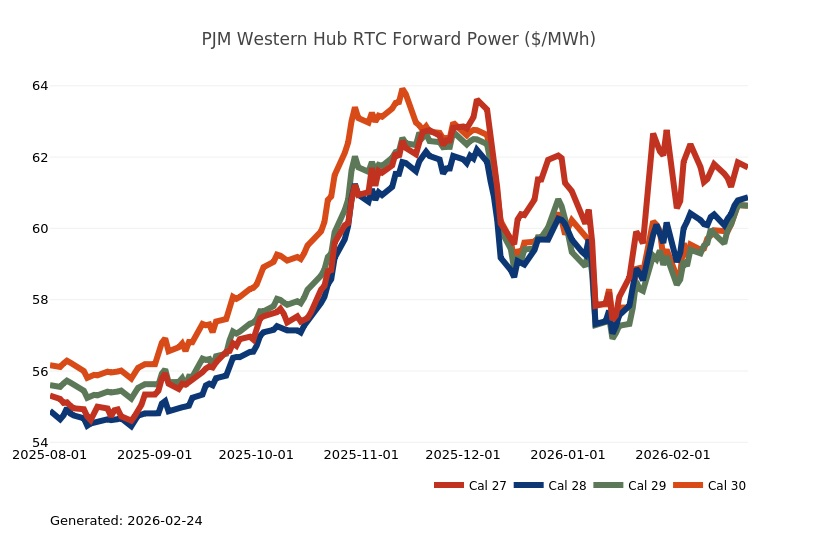

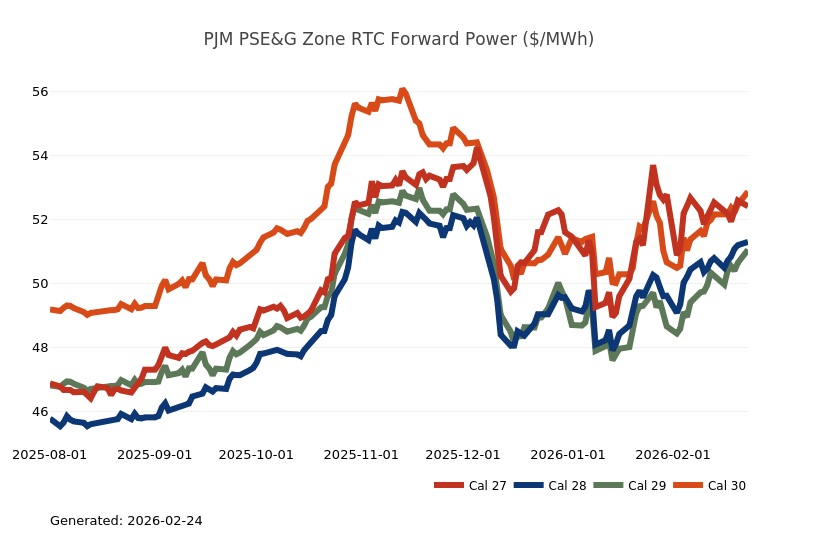

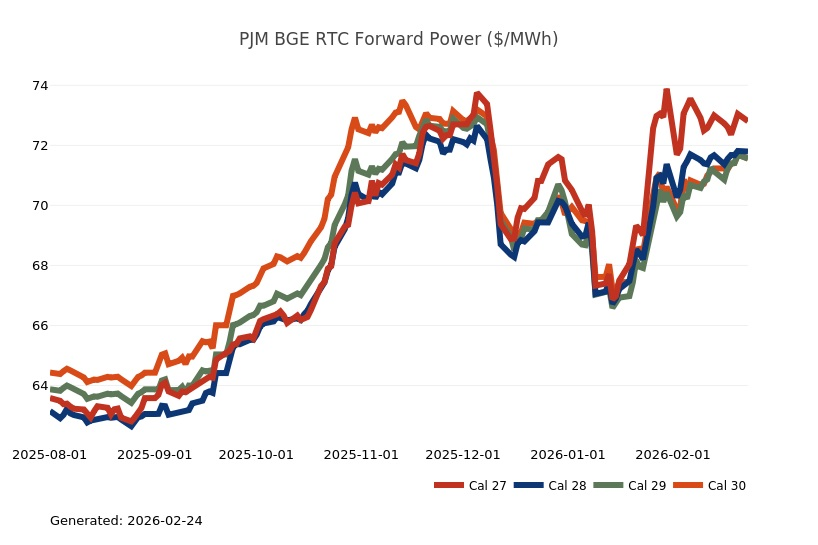

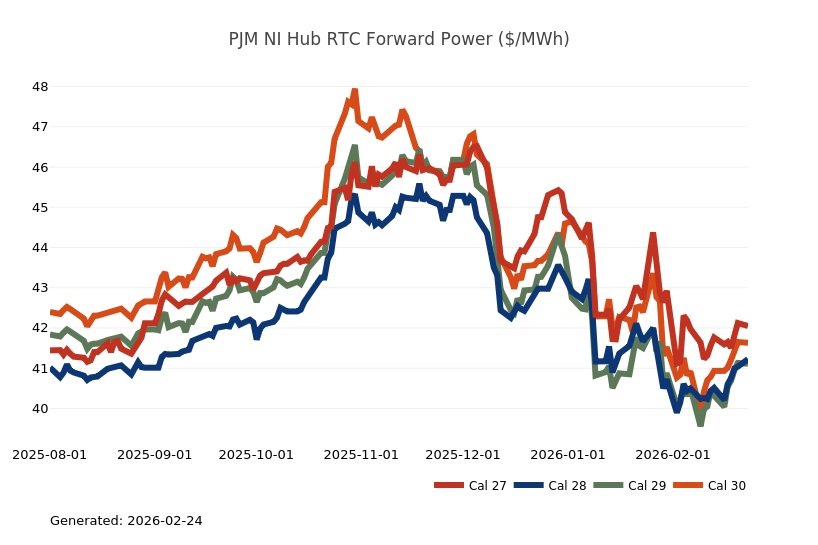

Mid-Atlantic Electric Summary

- The Mid-Atlantic Region’s forward power prices were relatively unchanged over the past week, with a slightly lower price for the balance of 2026, but some price support on the back end of the price curve. NYMEX natural gas futures jumped late Friday after trading in a tight range, as colder U.S. weather model revisions sparked buying. On Monday, natural gas prices saw some initial gains due to a winter storm but eventually pulled back as traders reassessed heating demand against ample supply. Beyond the next few days, we had an increase in heating demand, as variability in the weather pattern allows for periods of below-normal temperatures from the Midwest to the East Coast. One such event is expected early next week, however, a lack of blocking in the pattern means this will only last for a few days. Forward power prices for the 2026-2030 terms over the past week were unchanged on average, with a -1% decrease for the balance of 2026 and a 1% increase for the 2028-2030 terms. The month-to-date, day-ahead settlement price average in West Hub for February is $98.93/MWh or is -36% lower than January’s final settlement price last month.

- PJM Board Moves to Extend Price Collar for 2028/2029 and 2029/2030 Capacity Auctions - On 2/12, the PJM Board of Managers announced that it will seek to extend the existing price collar to the 2028/2029 and 2029/2030 capacity auctions, applied to the Variable Resource Requirement Curve parameters recently approved by FERC following the Quadrennial Review, as PJM conducts a broader evaluation of market incentive and advances the stakeholder process to design a backstop procurement mechanism for new supply. The decision follows the Board’s request for stakeholder feedback on a potential extension in its 1/16 decision-letter in the Critical Issues Fast Path (CIFP) stakeholder proceeding addressing large load additions.

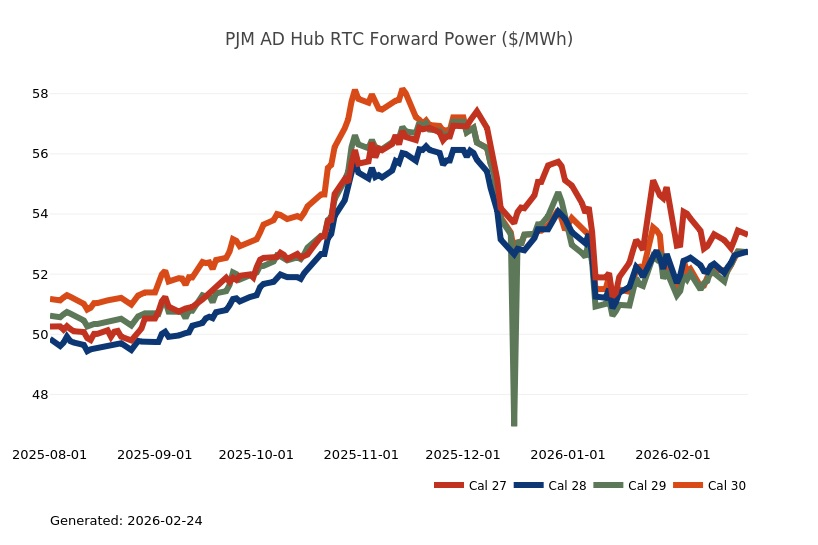

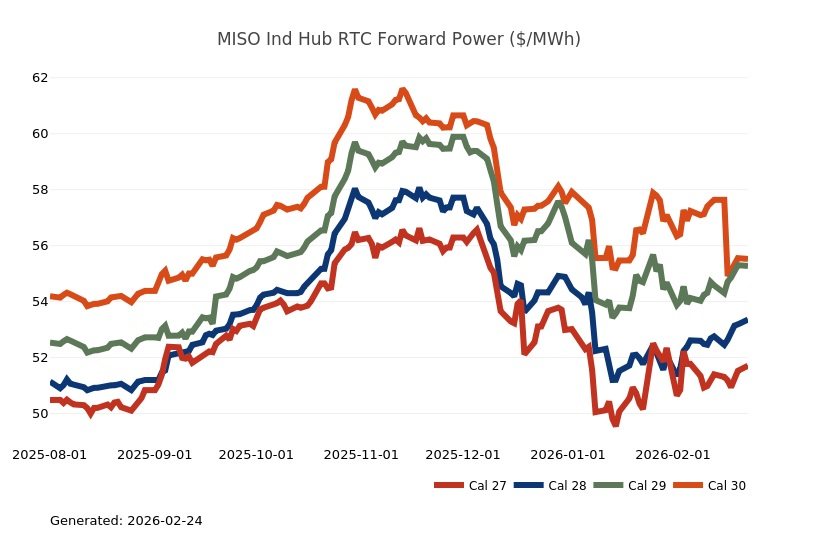

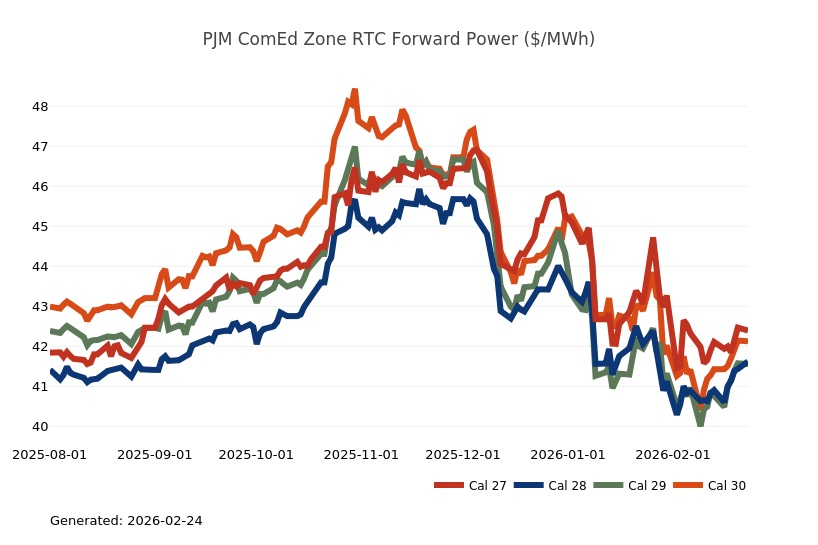

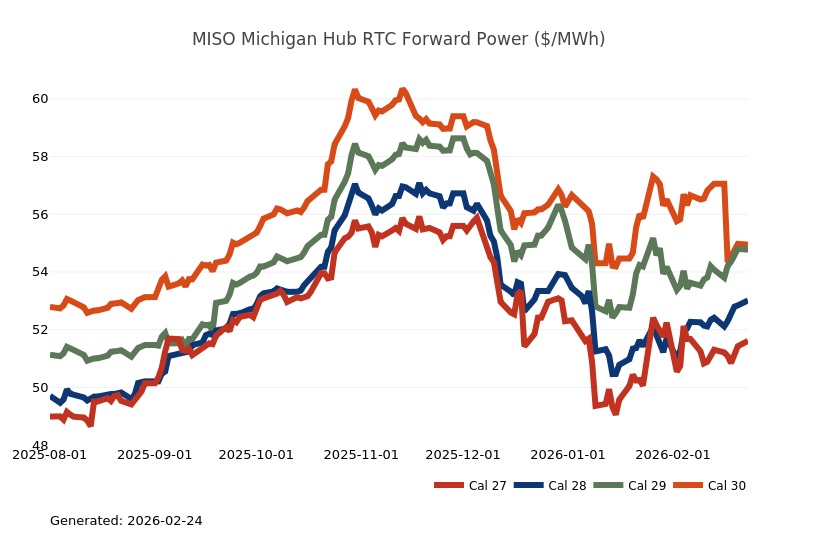

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices were higher over the past week. NYMEX natural gas futures jumped late Friday after trading in a tight range, as colder U.S. weather model revisions sparked buying. On Monday, natural gas prices saw some initial gains due to a winter storm but eventually pulled back as traders reassessed heating demand against ample supply. Beyond the next few days, we had an increase in heating demand, as variability in the weather pattern allows for periods of below-normal temperatures from the Midwest to the East Coast. One such event is expected early next week, however, a lack of blocking in the pattern means this will only last for a few days. Forward power prices for the 2026-2030 terms over the past week were 2% higher, on average, and were between 1-2% higher for any of the years in the strip. The month-to-date, day-ahead settlement price average in COMED for February is $40.30/MWh or is -52% lower than last month’s average, while in AdHub that average price is $68.52/MWh or is -34% lower than the previous month. In Michigan, that month-to-date average for February thus far is $56.82/MWh or is -42% lower than last month, while in Ameren the average price thus far is $46.09/MWh or is -50% lower than January’s average.

- PJM Board Moves to Extend Price Collar for 2028/2029 and 2029/2030 Capacity Auctions - On 2/12, the PJM Board of Managers announced that it will seek to extend the existing price collar to the 2028/2029 and 2029/2030 capacity auctions, applied to the Variable Resource Requirement Curve parameters recently approved by FERC following the Quadrennial Review, as PJM conducts a broader evaluation of market incentive and advances the stakeholder process to design a backstop procurement mechanism for new supply. The decision follows the Board’s request for stakeholder feedback on a potential extension in its 1/16 decision-letter in the Critical Issues Fast Path (CIFP) stakeholder proceeding addressing large load additions.

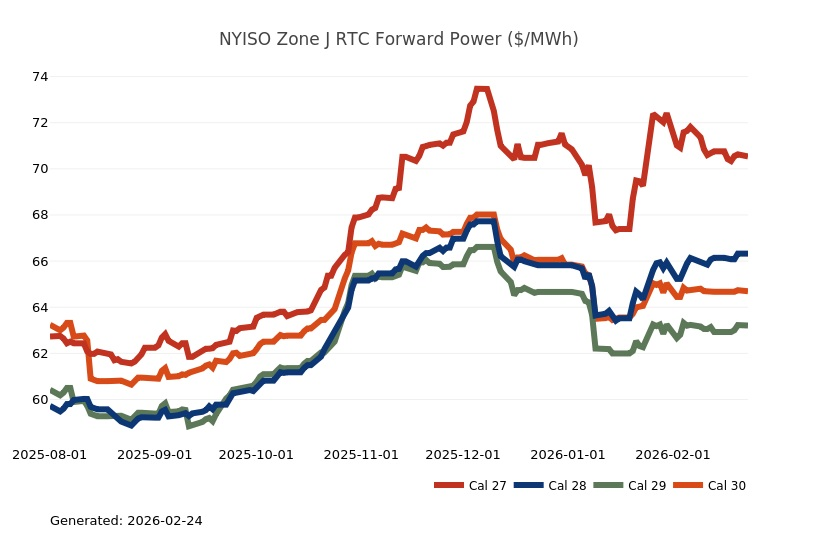

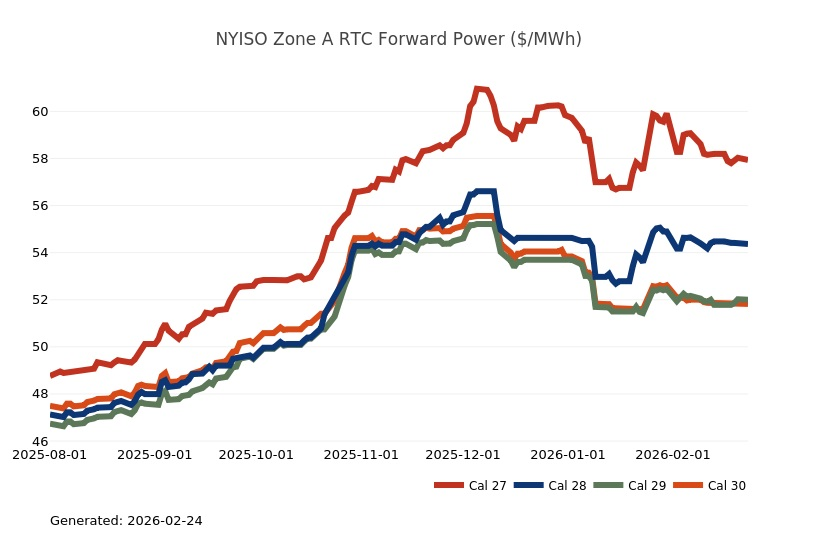

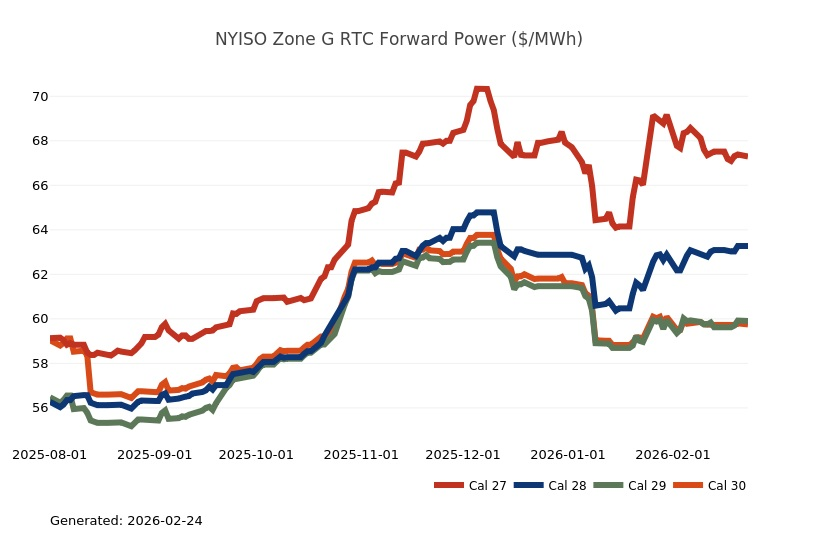

Northeast Energy Summary

- Democratic lawmakers in New York introduced legislation earlier this month to impose a three‑year moratorium on approvals for large data centers, citing concerns that the rapid growth of energy‑intensive facilities driven by the AI boom could strain the state’s electric grid, increase electricity costs for ratepayers, and undermine climate goals. The proposal, Senate Bill S824, would halt new data centers over 20 MW while state agencies conduct environmental reviews and develop regulations to address grid reliability and consumer cost impacts. The debate unfolds as Governor Kathy Hochul is promoting safeguards requiring data centers to offset their energy impacts, reflecting a broader tension between economic development, affordability, and the state’s decarbonization commitments.

- The New York Independent System Operator (NYISO) released a white paper in late January detailing the factors contributing to rising wholesale electricity prices in New York. The white paper, Impact of National & Global Conditions on Electricity Prices in New York, discusses that higher natural gas prices, growing demand from large loads, aging power generation resources, cold weather, and supply chain challenges are placing upward pressure on electricity costs.

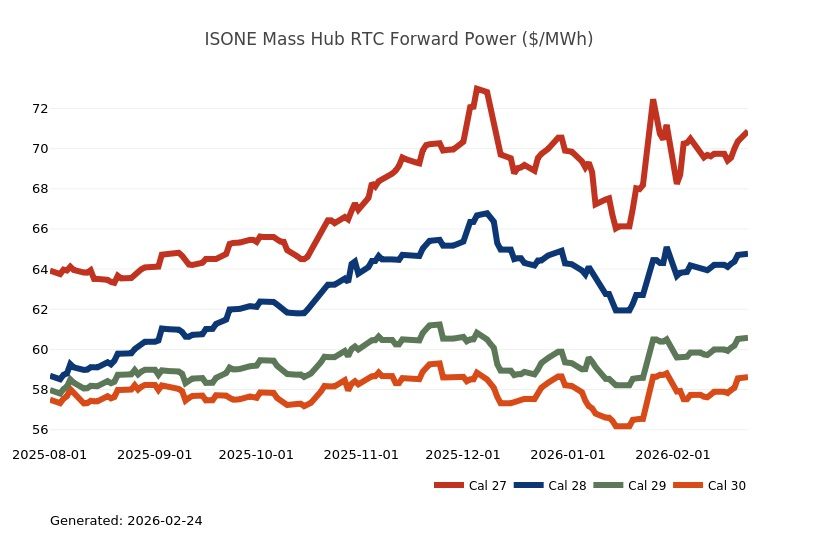

- ISONE reports that the monthly energy market value in January was ~$2.3 billion (the highest in over a decade), and that the daily energy market value on 1/27 (~$422 million) was approximately two and one-half times higher than the previous high (~$170 million on 1/23/14). Forecasted Energy Requirement (FER) prices have likewise moderated this week compared to last week, and for January ISO reports FER credits were 15% of total DA E&AS market value. In summary, the system appears to be holding up well (albeit expensive) as we pass through this extended cold snap.

- Net energy imports from Canada have resumed. NECEC has been importing ~1.1 GW around the clock since 2/1, while Phase II has varied between ~300-1,200 MW. When NECEC is injecting energy, there is oftentimes significant congestion pricing in Maine ($200+/MWh) not seen prior to NECEC’s 1/16 in-service date.

- In an uncharacteristic move ISO-NE added two new items to its 2026 work plan which is typically difficult to revise once set: 1) Modifications to Pay-for-Performance (PfP). The FERC recently issued a compliance order in response to the New England Power Generators Association’s Section 206 complaint, arguing among other things, the Balancing Ratio during a PfP event should be capped at 1.0. This prevents resources from being charged penalties for not delivering more than 100% of their obligated amount. The ISO also pledged to address a loophole that unfairly benefits exports during a PfP event (a 2024 External Market Monitor recommendation) as well as examine lowering the PfP rate (currently $9,337/MWh). ISO must make a compliance fining by 7/21. 2) Modifications to Day-Ahead Ancillary Services (DASI). The ISO will also be addressing the IMM’s recommended modifications to DASI (released 2/4). The IMM made three recommendations: 1) increase the strike price, 2) reduce the Forecast Energy Requirement (FER) constraint, and 3) reduce or eliminate the reserve non-performance factor (i.e., the bias that increases the reserve requirements). Each of these recommendations will be discussed with stakeholders in detail beginning in April, with a targeted effective date by end of year.

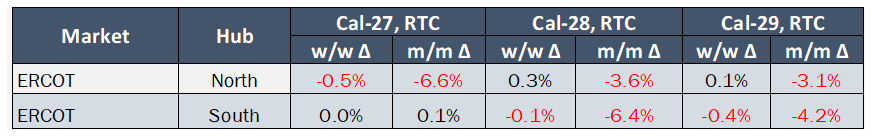

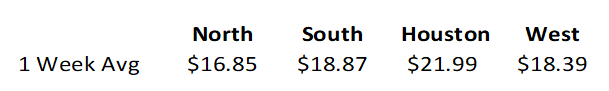

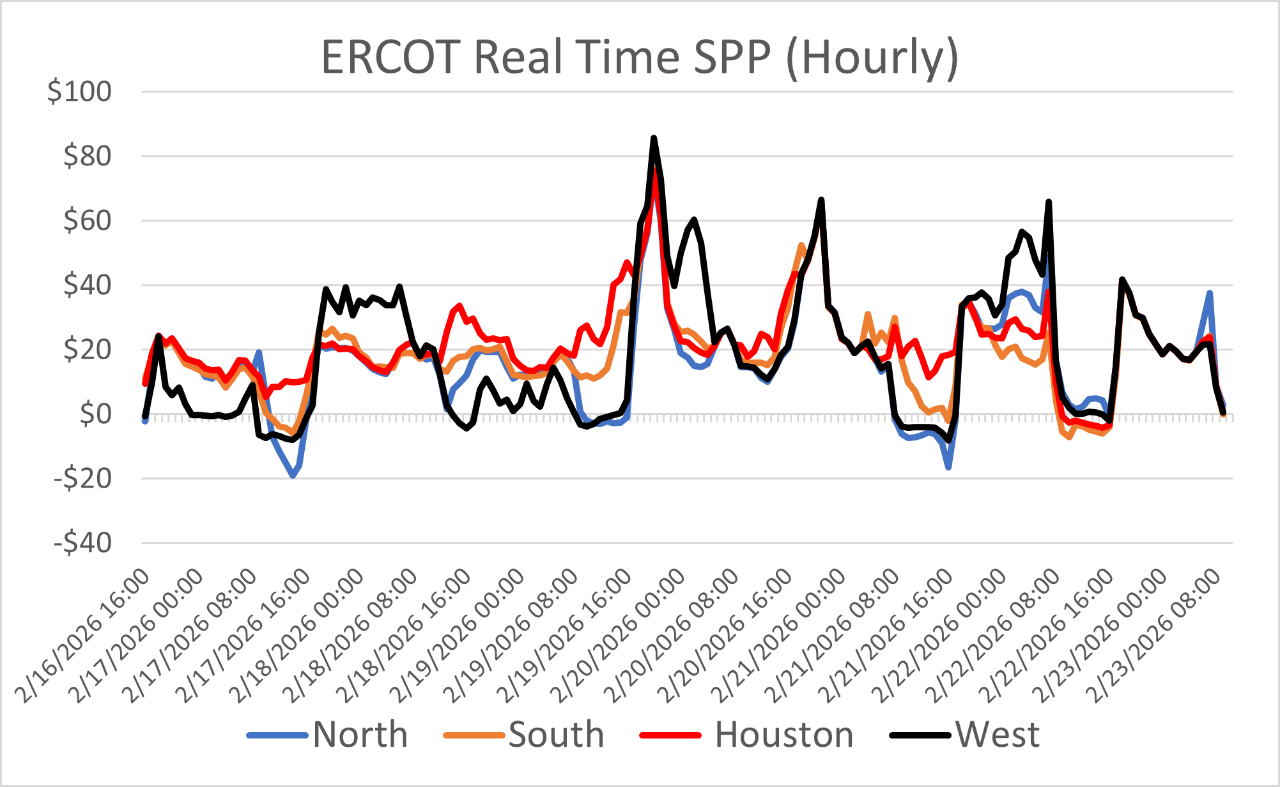

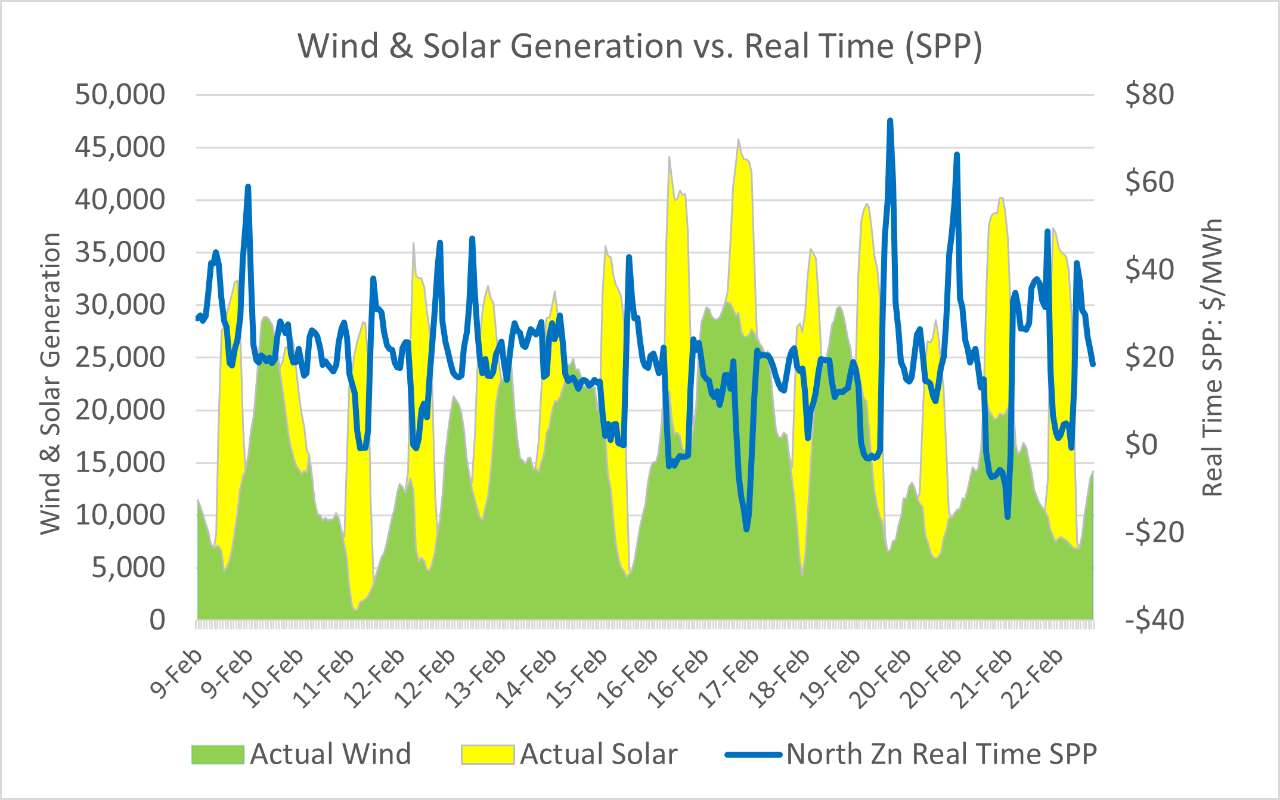

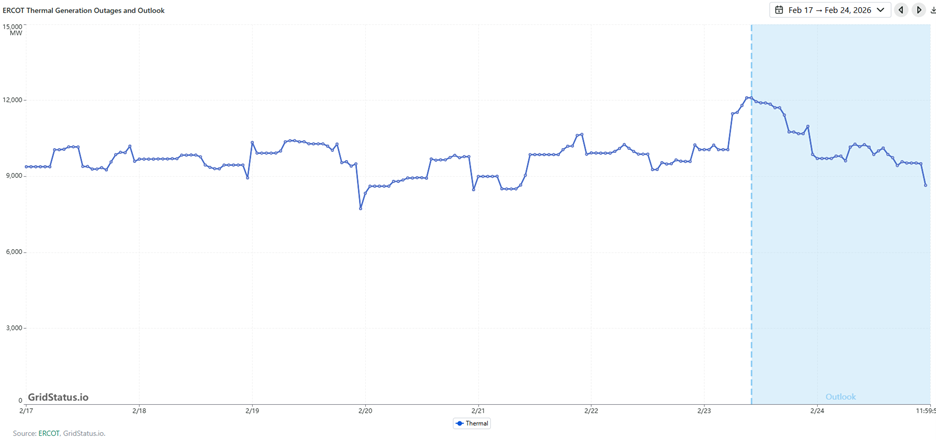

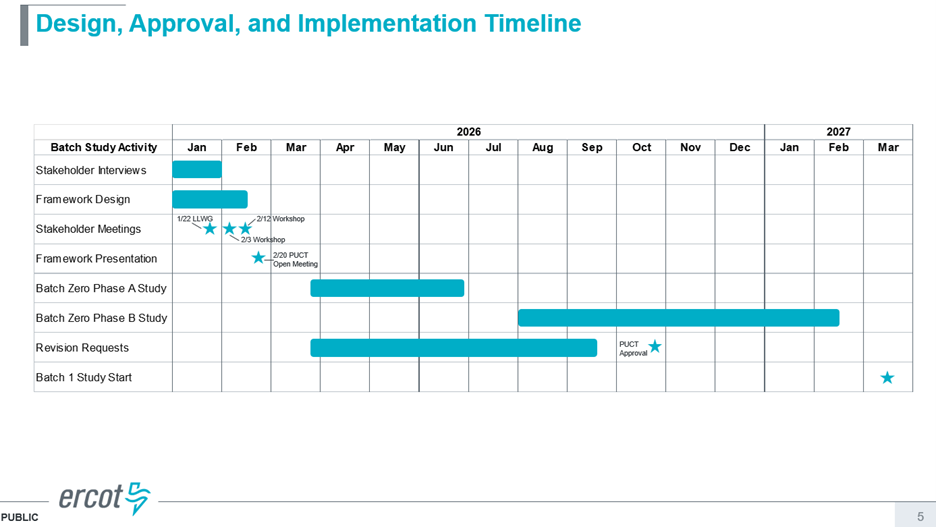

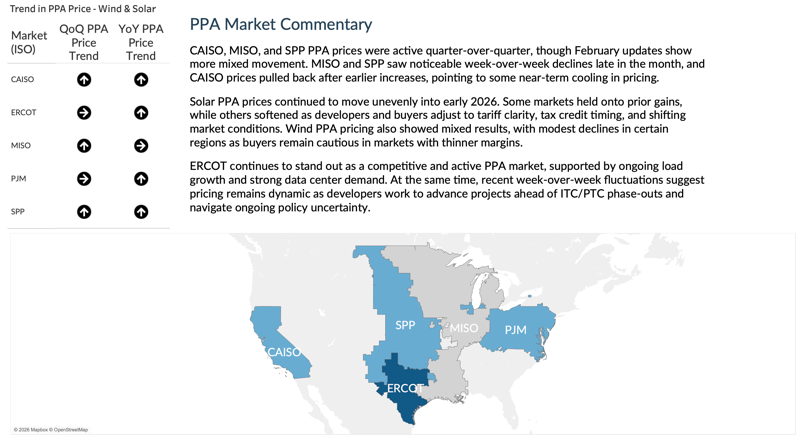

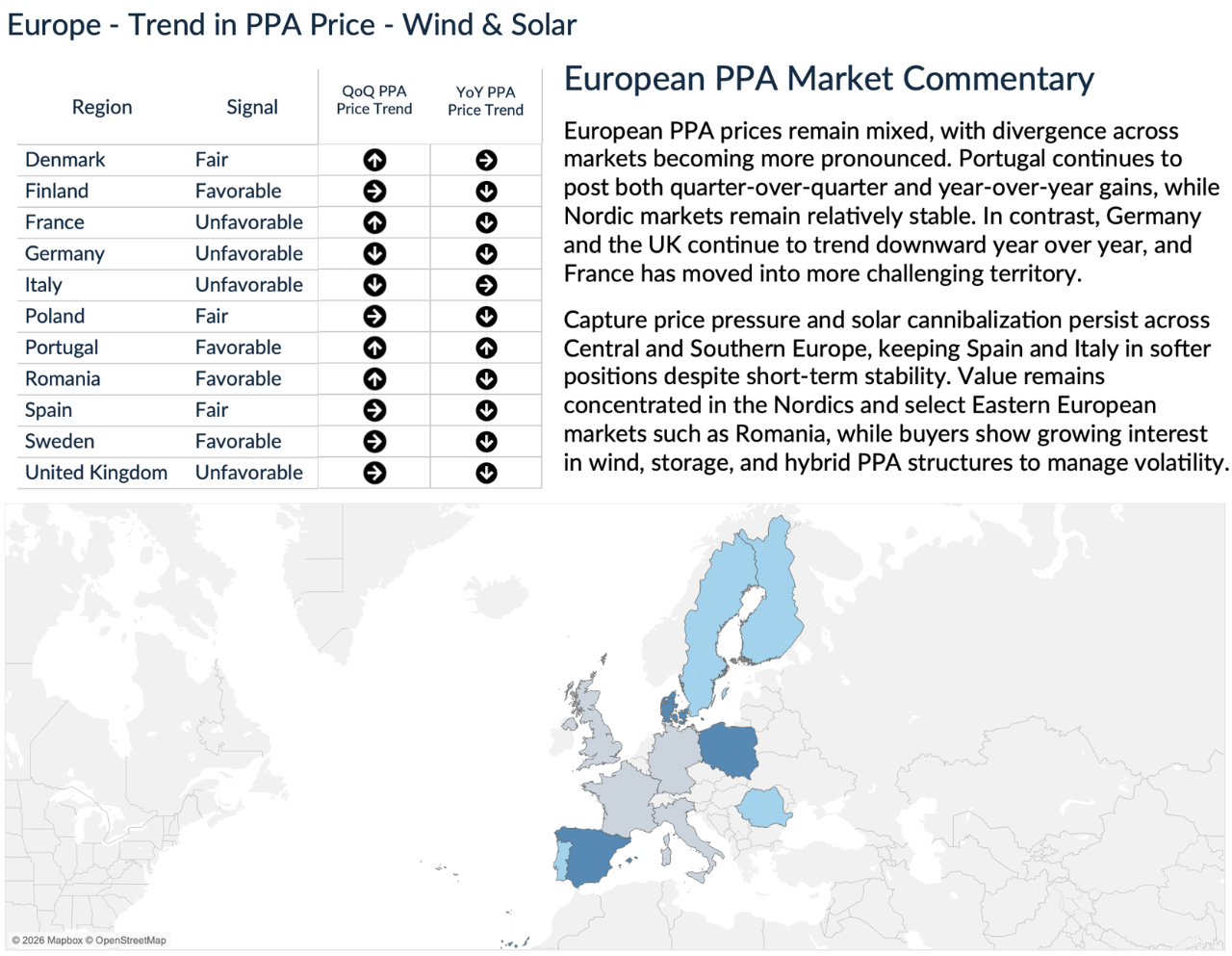

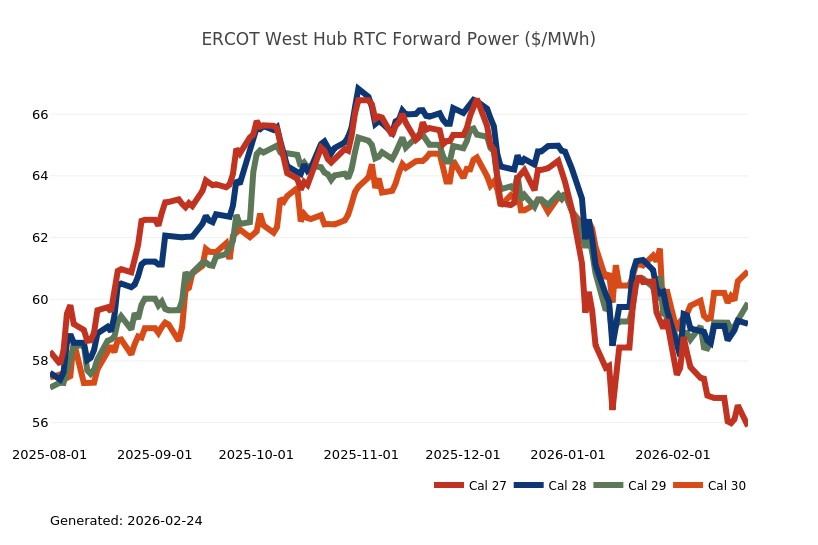

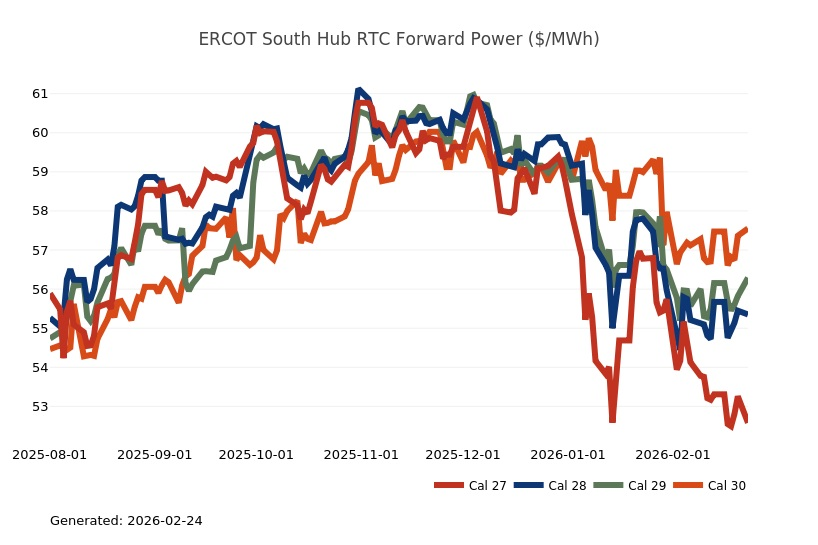

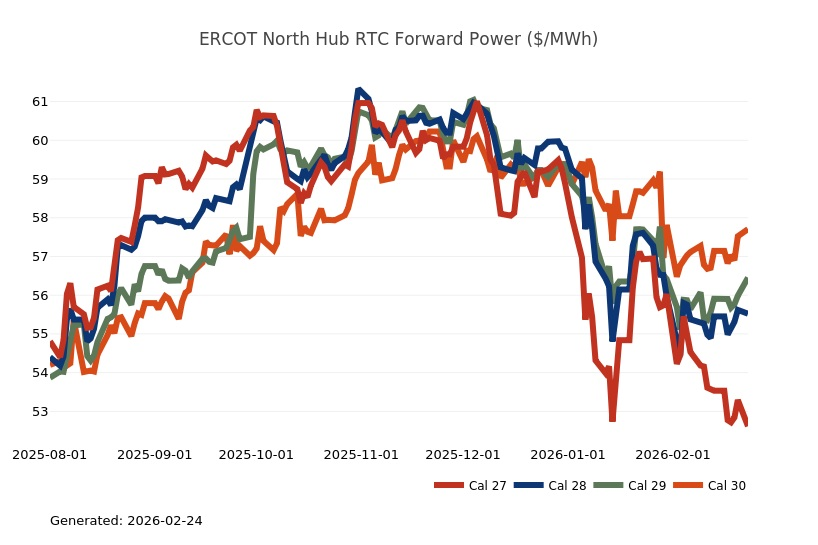

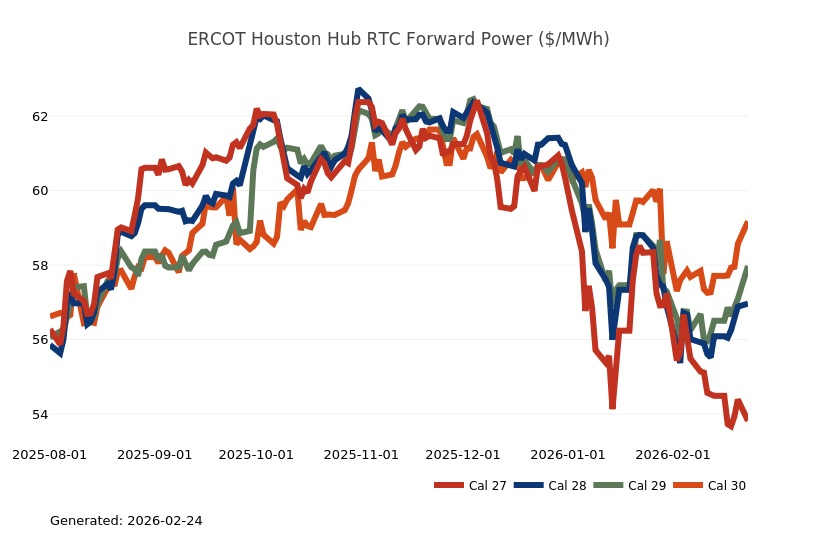

ERCOT Energy Summary

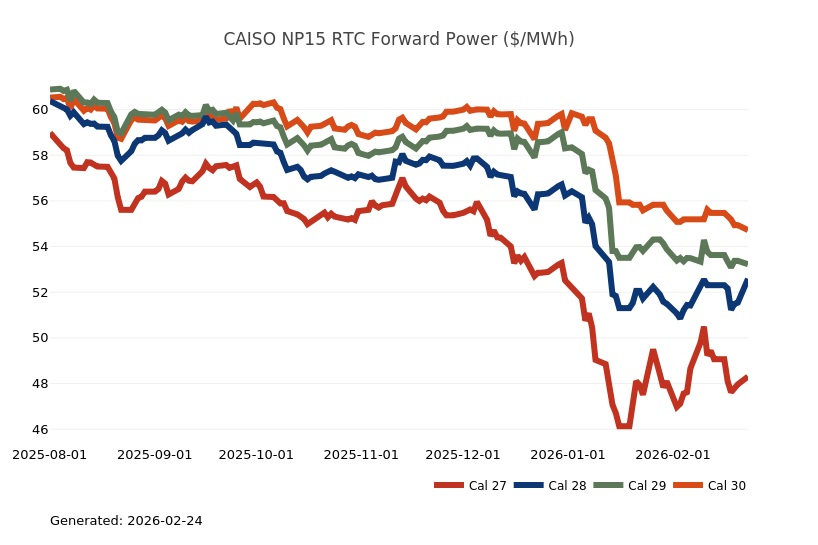

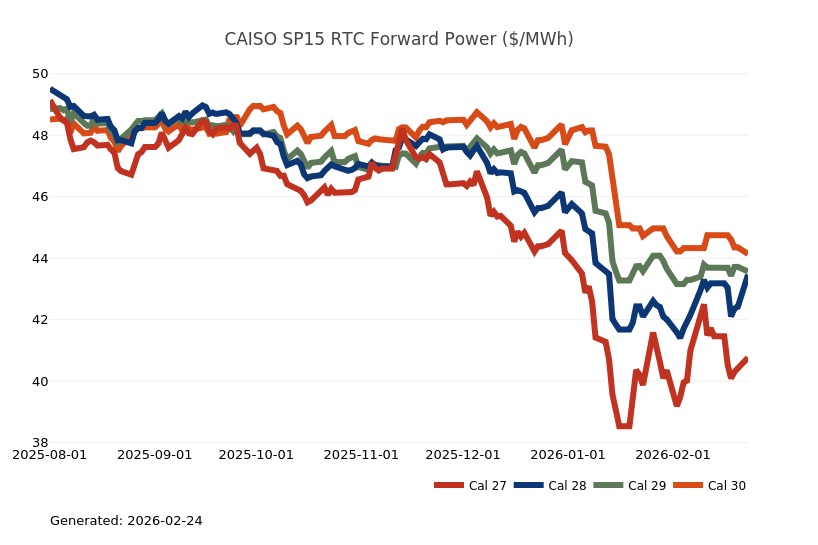

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- At least season pass holders for ski resorts in the West aren’t going to experience a complete bust this year. Dry conditions and minimal snow had been the story across the West despite an extended period of precipitation that arrived during the late December holidays and lingered for the first few days of January. Many areas so far this year have seen less than 50% of their normal rainfall as of our last update two weeks ago. A significant pattern change last week brought the first meaningful and widespread precipitation to much of the West and centered across California. Notably, temperatures were cold enough to support snowfall not just in Washington and Oregon but dropped 5+ feet of revenue generating white stuff on the highest peaks in the Sierra Nevada mountains, likely rescuing the season for many resorts. But it’s looking to be a short-lived respite as warmer trends dominated the Western US forecasts since. More seasonable temperatures will be seen across the Pacific Northwest, a much warmer than normal pattern will lock in elsewhere across the Western U.S., especially for California this week, the LA Basin will see several days top out in the low 80s and will persist into March. This includes record challenging heat across parts of the Desert Southwest later this week with daytime highs in Phoenix looking like they will make it into the low 90s. Longer term, any colder signals look limited for the Western U.S. except for the Pacific Northwest where temperatures will likely remain closer to normal. We expect this forecast will quickly translate to increased in-state hydro generation … and flooding in the Tahoe region.

- Snow water equivalent values for California bumped up to 65% of normal as of this morning’s report (was 52% two weeks ago). Improvements between today and our last report were less across the Pacific Northwest as Washington ticked up to 57% from 50% and Oregon continues to see near record low numbers, 36% of normal, a slight rise from 29% two weeks ago. Streamflow forecasts at the major hydro generating station The Dalles remain slightly below average showing 92% for the April-September period as of Monday’s report.

- Given the colder temperatures over the last week, both PG&E and SoCalGas saw small volumes get drawn from storage. Neither system is in any jeopardy seeing gas withdrawn as we wrap up the last of the core winter months. If anything, operators are thankful to be finding a home for the molecules as PG&E finds itself with about 21% more gas in storage than this same time last year with SoCalGas at about 18%. With the warmer temperatures arriving across the state beginning this past Sunday, loads will diminish and SoCal based solar generation will take off like a rocket crushing demand for thermal generation. This is evident in the city gate prices as PG&E has been a few cents to either side of $2.00 per MMBtu since Friday and SoCalGas has been slowly drifting towards $2.50. Basis prices will remain under pressure as space needs to be cleared for an inflow of molecules this spring. Lower daily gas settlements translate to Day Ahead CAISO settlements that started with the numbers one or two for last week in SP15, values which were consistently about $10 lower than NP15 due to the aforementioned solar output. Curtailments and negative prices during the middays were also prevalent over the weekend. Spring has arrived.

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, February 25 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for information regarding our next Fortunato & Friends webinar featuring Constellation's Chief Economist and a special guest

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.